- Share.Market

- 3 min read

- Published at : 05 Sep 2025 01:44 PM

- Modified at : 05 Sep 2025 01:44 PM

Sterlite Technologies Ltd (STL) announced the launch of the world’s slimmest Intermittent Bonded Ribbon (IBR) cable designed for data center operators, hyperscalers, and telecom service providers.

Post the announcement, shares of Sterlite Technologies Ltd. surged over 9%, reaching an intraday high of ₹117.59 apiece.

According to the company, the new Celesta IBR cable packs 864 fibers in a diameter of just 11.7 mm, optimized for jetting in a 14 mm inner diameter duct. The cable achieved a record jetting performance of over 1,500 meters (around 4,700 ft) in under 20 minutes. It employs STL’s bend-insensitive HD G.657.A2 200-micron fiber along with industry-standard sheathing, enabling high-density packing and superior installation performance.

The innovation is targeted at hyperscalers that require ultra-high-capacity, low-latency, and scalable network infrastructure to support large-scale data flows across distributed cloud and data center ecosystems. By maximizing fiber count in limited duct space and reducing installation time, the cable offers a reliable solution for demanding high-growth, high-bandwidth applications.

STL said its IBR cable portfolio now spans from 12F to an industry-leading 6912F. Over the last five years, the company has delivered more than 10 million fkm to customers in Europe and the US.

Commenting on the launch, Dr. Badri Gomatam, CTO of STL, said the Celesta IBR cable reflects the company’s commitment to advanced engineering and customer-focused innovation. “By delivering industry-leading fibre density and bend performance in a remarkably slim design, we’re empowering hyperscalers and data centres to scale up efficiently and sustainably—laying the foundation for next-generation digital infrastructure,” he said.

STL, with 10 manufacturing facilities across North America, Europe, and Asia, said it is uniquely positioned to meet diverse global connectivity needs at scale.

About Sterlite Technologies

Sterlite Technologies Limited (STL) is a global provider of optical and digital solutions, building advanced 5G, FTTx, rural broadband, enterprise, and data centre networks. Backed by over 700 patents and strong R&D, STL serves customers across the US, Europe, and India while driving sustainability through initiatives like India’s first green hydrogen-based fibre manufacturing facility. In Q1 FY26, the company reported revenue of ₹1,019 crore, up ~17% year-on-year, and EBITDA of ₹140 crore, nearly doubling from last year, with an order intake of ₹1,529 crore and a robust open order book of ₹4,888 crore.

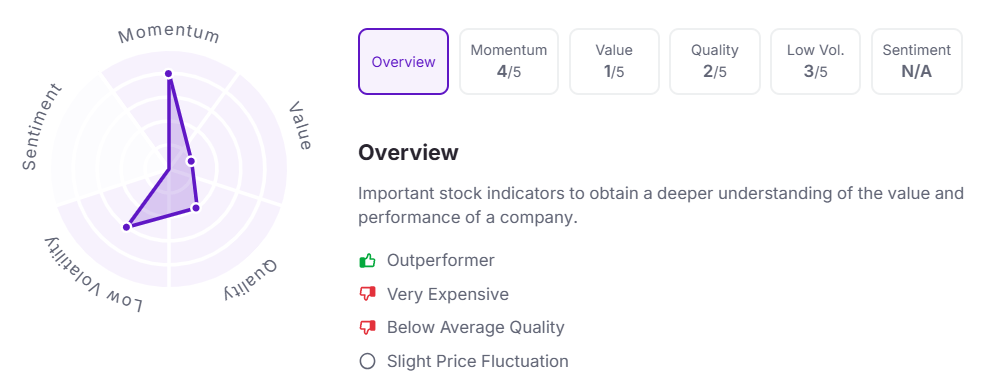

Let’s take a look at its Factor Analysis scores:

Note: The stock price mentioned is as of 1:15 pm.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.