- Share.Market

- 3 min read

- Published at : 16 Jun 2025 10:52 AM

- Modified at : 04 Dec 2025 07:34 AM

Spicejet Ltd. has reported a sharp financial turnaround, posting its highest-ever quarterly profit in Q4 FY25 and its first full-year profit in seven years. The airline’s performance underscores the early success of its restructuring and fleet revival strategy amid a challenging aviation landscape.

The airline posted a net profit of ₹319 crore in Q4 FY25, a nearly 12x jump from ₹26 crore in the previous quarter (Q3 FY25). This marks SpiceJet’s second consecutive profitable quarter.

Full-year FY25 net profit stood at ₹48 crore, reversing a loss of ₹404 crore in FY24. This is the first time the airline has reported an annual profit since FY18.

The airline reported a passenger load factor of 88.1% for Q4 FY25, reflecting strong travel demand. The full-year PLF stood at 87.7%, only marginally lower than FY24’s 88.8%.

Passenger Load Factor (PLF) shows how full flights are; the higher the number, the more seats are being sold, which boosts revenue without adding costs.

The promoter group completed a ₹500 crore equity infusion in FY25, including a final tranche of ₹294.09 crore in the fourth quarter. The capital injection reflects renewed promoter confidence and has helped strengthen liquidity during the fleet revival phase.

During the quarter, the airline launched 24 new domestic flights and added three new destinations, Tuticorin, Porbandar, and Dehradun, under its Summer 2025 schedule.

The airline also resumed international operations in FY26, adding Kathmandu as its first new international destination this year. Special Haj charter operations were launched from Srinagar, Guwahati, Gaya, and Kolkata.

To address challenges related to grounded aircraft, the company partnered with global players like StandardAero Inc. and Carlyle Aviation to fast-track engine overhauls and restore capacity. Several engines have now returned from overhaul, and a gradual ramp-up in operations is expected in the coming months.

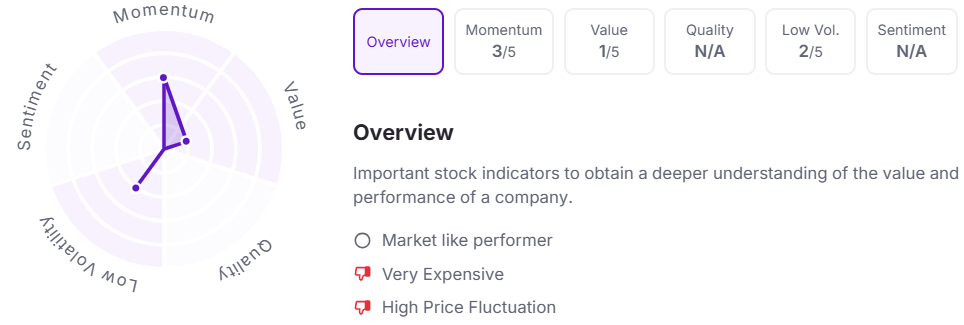

Let’s take a look at its Factor Analysis scores:

Note: The stock price mentioned is as of 10:30 AM.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.