- Share.Market

- 3 min read

- Published at : 14 Oct 2025 03:09 PM

- Modified at : 15 Nov 2025 11:14 AM

The shares of SKF India and Tata Consultancy Services are in focus for their upcoming spin off and dividend. Investors who wish to be eligible must have bought the shares before the ex-date and hold them at least till the record date.

SKF India Limited has announced the demerger of its Industrial Business unit. This restructuring is done under a Scheme of Arrangement between SKF India Limited (the Demerged Company) and a newly formed subsidiary, SKF India (Industrial) Limited (the Resulting Company).

The company has set October 15, 2025, as the Record Date for the demerger.

According to the Scheme, eligible shareholders will receive new shares in the Industrial business on a 1:1 ratio. This means shareholders will get one fully paid-up equity share of SKF India (Industrial) Limited for every one share they hold in the existing SKF India Limited.

The core restructuring action is the transfer of the Industrial Business (which includes rolling bearing, seals, mechatronics, and lubrication systems for railways, defence, wind energy, etc.) into the new entity, SKF India (Industrial) Limited. The existing SKF India Limited will retain the Automotive Business. Both entities will become independent, publicly listed companies, as the new shares of SKF India (Industrial) Limited are also proposed to be listed on BSE and NSE.

The company states the demerger provides several advantages:

- It allows independent and focused management for both the Automotive and Industrial businesses.

- It permits each business to tailor capital allocation and pursue different growth strategies.

- It will attract different sets of specialized investors.

- It de-risks both businesses from each other’s cycles and helps unlock shareholder value.

Over the last five years, this stock has delivered multibagger returns of more than 235%.

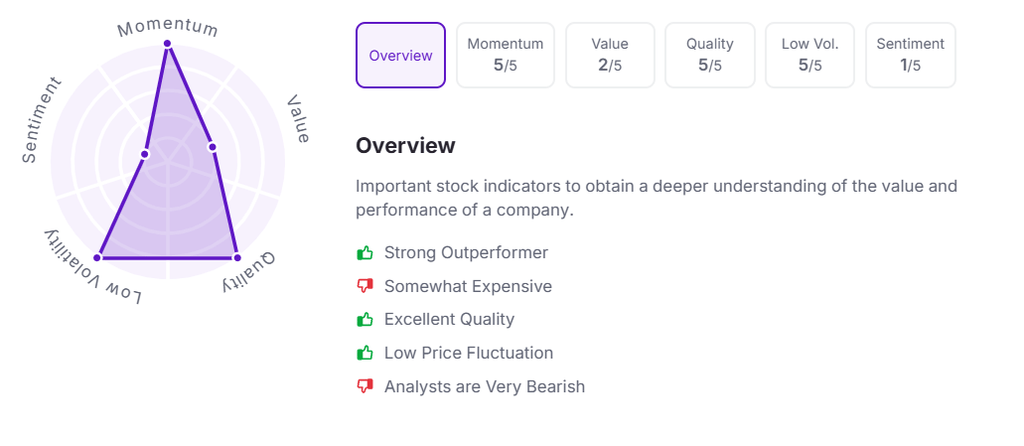

Let’s take a look at its Factor Analysis scores:

Tata Consultancy Services Ltd. has announced a final dividend of ₹11 per equity share. It has a current dividend yield of 4.20% TTM.

Tata Consultancy Services (TCS) is a global leader in digital transformation and technology, serving major organizations worldwide since 1968. The company has a proven history of scaling new technologies, from mainframes to Artificial Intelligence, and generated consolidated revenues of US $30 billion in the fiscal year ending March 31, 2025.

TCS delivered strong Q2FY26 results with broad-based growth, successfully increasing its international revenue sequentially. The company secured major deals, including a seven-year, $647 million contract with Scandinavian insurer Tryg, and expanded a multi-year partnership with a global healthcare company.

This success aligns with TCS’s goal to become the world’s largest AI-led technology services company, backed by commitments like establishing a new AI infrastructure entity, planning a massive 1 GW AI datacenter in India, and acquiring Salesforce specialist ListEngage. Key wins with clients like Weatherford International and European retailer Kesko demonstrate a clear focus on modern digital and AI solutions.

Let’s take a look at its Factor Analysis scores:

Note: The stock prices mentioned are as of 3:05 pm.