- Share.Market

- 6 min read

- Published at : 10 Jul 2025 11:56 AM

- Modified at : 16 Jul 2025 07:05 PM

The shares of Shriram Finance, IDFC First Bank, UPL, and Apollo Tyres are set for their record date on Friday, July 11, 2025. To be eligible for the upcoming dividends, investors must have bought the shares before the ex-date and hold them at least till the record date.

Shriram Finance Ltd., one of India’s largest retail non-banking financial companies (NBFCs), has announced a dividend of ₹3 per equity share.

Shriram Finance offers a wide suite of lending solutions across commercial vehicles, two-wheelers, cars, gold, home, and personal loans, as well as MSME finance. The company has built a strong presence with 3,220 branches, 79,872 employees, a customer base of over 9.5 million, and Assets Under Management (AUM) exceeding ₹2.63 lakh crore as of March 2025.,

The company reported steady growth in Q4FY25, with total income rising 20.66% and net interest income increasing 13.40% YoY. Profit after tax rose 9.95%, supported by robust retail lending and fee income. For the full year FY25, the company posted a 19.61% rise in total income and a 15.99% increase in net interest income.

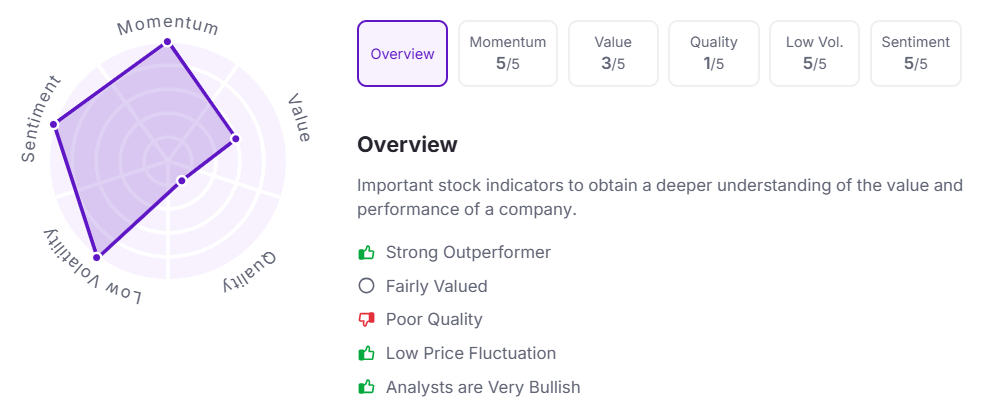

Let’s take a look at its Factor Analysis scores:

IDFC First Bank Ltd. has announced a final dividend of ₹0.25 per equity share.

IDFC First Bank is a new-age private sector bank in India, focused on digital-first, ethical, and inclusive banking. Formed through the merger of IDFC Bank and Capital First, it has built a strong retail franchise across 60,000+ locations with over 35.5 million customers. As of March 2025, the bank operates with ₹2.42 lakh crore in customer deposits and ₹2.41 lakh crore in loans.

IDFC FIRST Bank reported a net profit of ₹1,525 crore for FY25, down 48.4% YoY due to elevated provisions in the microfinance segment. However, core operating profit rose 17.2% to ₹7,069 crore, driven by a 17.3% growth in net interest income. Customer deposits increased 25.2% YoY, with a healthy CASA ratio of 46.9%. Loans and advances grew 20.4%, led by the retail, rural, and MSME portfolios.

Over the last three years, this stock has given multibagger returns of more than 125%.

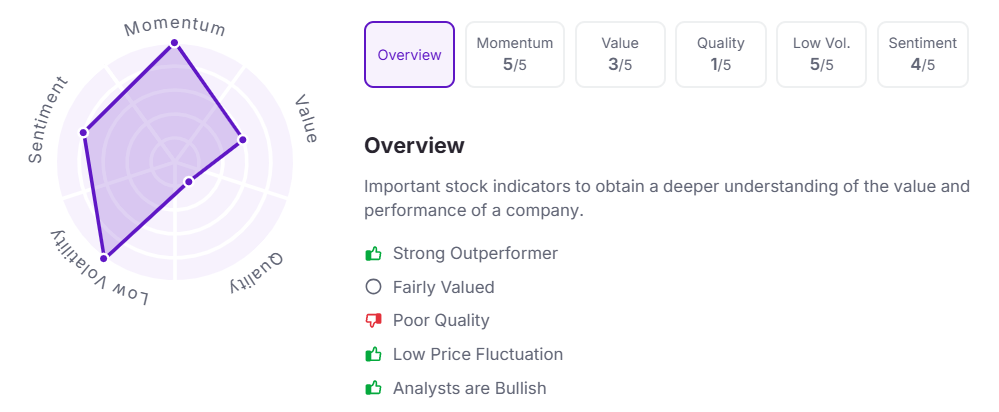

Let’s take a look at its Factor Analysis scores:

UPL Ltd. has announced a final dividend of ₹6 per equity share. It has a dividend yield of 0.20%.

UPL Ltd. is a global agriscience company headquartered in India, offering sustainable agricultural products and solutions across the entire agri-food value chain. With operations in over 140 countries and annual revenue exceeding $5 billion, UPL is one of the world’s leading crop protection and specialty chemical players. UPL’s diversified portfolio, global scale, and innovation-led approach position it as a key enabler of food security and farmer productivity worldwide.

The company delivered a strong turnaround in FY25, posting an 8% revenue growth to ₹466.4 billion and a significant recovery in profitability with net profit of ₹9.0 billion, compared to a loss of ₹12.0 billion in FY24. In Q4 alone, revenue rose 11% YoY, while EBITDA surged 68%.

Let’s take a look at its Factor Analysis scores:

Apollo Tyres Ltd. has announced a final dividend of ₹5 per equity share.

Apollo Tyres Ltd. is a leading global tyre manufacturer headquartered in Gurgaon, India, with a strong presence in over 100 countries. The company operates seven manufacturing units, five in India and two in Europe. Its products are marketed under two flagship brands: Apollo and Vredestein, catering to a wide range of segments including passenger vehicles, commercial trucks, agriculture, two-wheelers, and off-the-road tyres. With a revenue of over US$2.3 billion, it ranks among the world’s top 20 tyre manufacturers.

Over the last three years, this stock has given multibagger returns of more than 130%.

Let’s take a look at its Factor Analysis scores:

Note: The stock prices mentioned are as of 11:55 AM.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.