- Share.Market

- 2 min read

- Published at : 24 Oct 2025 06:42 PM

- Modified at : 15 Nov 2025 10:22 AM

SBI Cards and Payment Services Ltd. announced its financial results for the quarter ended September 30, 2025 (Q2 FY26). The company delivered solid growth in both revenue and profit, driven by robust expansion in customer spending and its card base.

Total Revenue for the quarter increased by 13% year-on-year (YoY) at ₹5,136 crore (versus ₹4,556 crore in Q2 FY25). Interest Income increased by 9% YoY, reaching ₹2,490 crore. Fees and Commission Income saw a higher increase, rising 16% YoY at ₹2,471 crore.

Finance Costs declined by 4% YoY at ₹760 crore, primarily attributed to a lower cost of borrowings for the company. Total Operating Cost increased by 24% YoY at ₹2,484 crore from ₹2,011 crore in Q2 FY25.

Profit After Tax (PAT) for Q2 FY26 grew 10% YoY at ₹445 crore (versus ₹404 crore in Q2 FY25).

SBI Card is a non-banking financial company (NBFC) that offers an extensive portfolio of credit cards. The company holds a strong position in the industry, ranking #2 for Cards-in-force (19.0% market share) and #3 for Spends (17.0% market share). The robust 31% YoY growth in customer spending, which reached ₹107,063 crore, was a key operational driver for the 13% increase in total revenue.

Cards-in-force grew 10% YoY at 2.15 crore as of September 30, 2025. Spends grew by 31% YoY at ₹107,063 crore.

New Accounts Volume added during the quarter was 936 thousand (936K), compared to 904 thousand new accounts in the corresponding period last year.

Financially, the company managed to reduce its Finance Costs by 4% due to a lower cost of borrowings, which helped boost the final profit number. However, the rise in Total Operating Costs (up 24%) and increased Impairment Losses and Bad Debts Expenses (up 7%) indicate higher spending on operations and managing credit risk. Overall, the company’s strong Capital Adequacy Ratio of 22.5% ensures it remains well-capitalized relative to RBI norms.

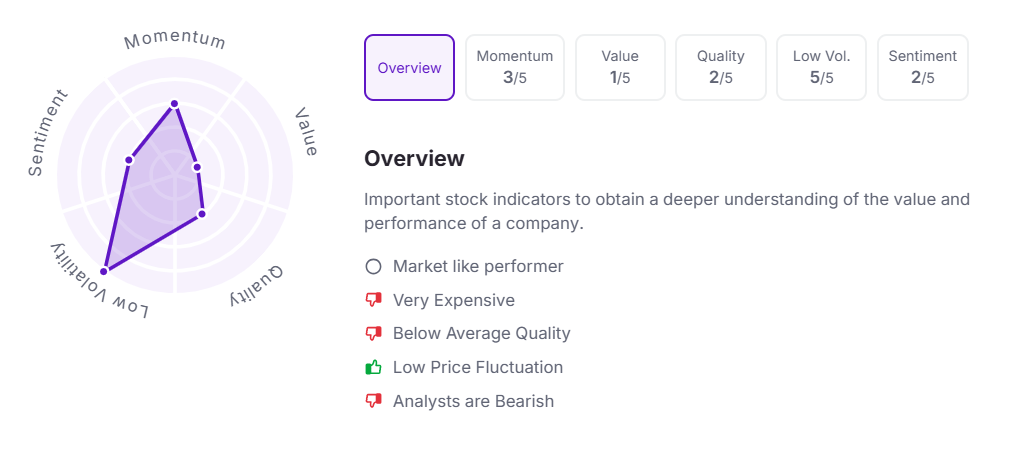

Let’s take a look at its Factor Analysis scores:

Note: The stock price mentioned is as of 3:30 pm.