- Share.Market

- 3 min read

- Published at : 04 Aug 2025 01:56 PM

- Modified at : 04 Aug 2025 01:57 PM

Shares of Sarda Energy & Minerals Ltd. soared as much as 20%, reaching an intraday high of ₹527.15, following the company’s announcement of a robust Q1 FY26 performance, marked by strong revenue and earnings growth.

The Raipur-headquartered miner and integrated steel producer reported a 76% year-on-year rise in consolidated revenue to ₹1,633 crores, while profit after tax more than doubled to ₹437 crores, up 120% from ₹198 crores a year ago. Sequentially, net profit jumped over fourfold.

What stood out in the results was the energy segment, which now contributes 47% of the company’s consolidated revenue and a staggering 67% of EBITDA. The segment delivered ₹800 crores in revenue and ₹467 crores in EBITDA in Q1.

Independent power production (IPP), which became part of the company in August 2024, saw thermal generation touch 1,182 million units, up 13% QoQ. Captive thermal power generation rose 15% YoY to 355 million units, while hydropower output surged 37% YoY to 120 million units, aided by seasonal tailwinds.

Iron ore pellet production rose 9% year-on-year to 230,000 tonnes, with sponge iron and billet output up 4% and 17% respectively. Wire rod production surged 54% to 42,000 tonnes, while ferro alloys and HB wire output grew 9% each.

On the sales front, iron ore pellet and wire rod volumes rose 9% and 80% YoY, respectively, the latter benefiting from improved dispatches. Billet sales more than doubled to 11,000 tonnes, while ferro alloys and HB wire saw modest growth of 5% each.

The power segment also delivered solid numbers. Captive thermal sales increased 36%, IPP volumes rose 13% sequentially, and hydropower sales jumped 38% YoY, aided by seasonal tailwinds.

The company attributed the sharp improvement in profitability to improved contribution from the energy vertical, operating leverage across metals, and volume uptick in higher-margin product categories.

The Board of Directors has declared a final dividend of ₹1.50 per equity share, with August 22, 2025, set as the record date to determine shareholder eligibility.

With a combined operational power capacity of 928 MW (761.5 MW thermal and 167 MW hydro), integrated mining assets in Chhattisgarh, and a diversified steel and alloys portfolio, Sarda Energy is well-positioned to benefit from India’s industrial and infrastructure-led growth cycle. The ramp-up of the IPP business and stable demand for long steel and ferro alloys are expected to support earnings momentum in the coming quarters.

Over the last three and five years, this stock has given multibagger returns of more than 489% and 2,970%, respectively.

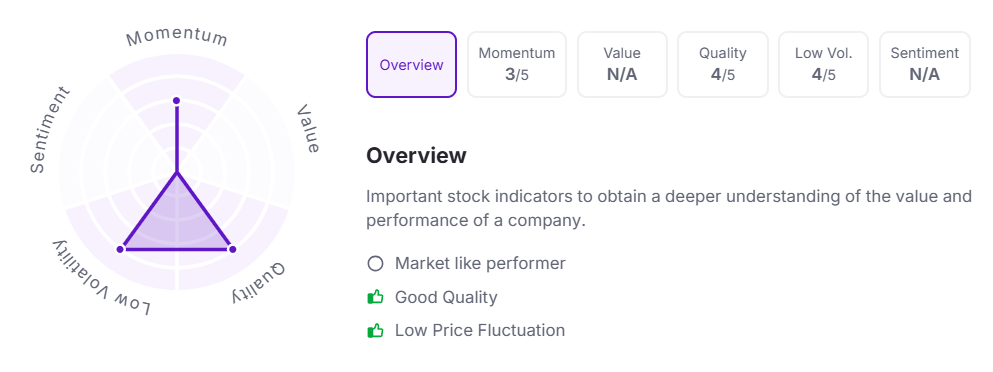

Let’s take a look at its Factor Analysis scores:

Note: The stock price mentioned is as of 1:55 pm.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.