- Share.Market

- 3 min read

- Published at : 13 May 2025 04:25 PM

- Modified at : 16 Jul 2025 09:08 PM

The shares of Mahindra & Mahindra Financial Services and Raymond Limited are in focus for their upcoming rights issue and spin off. Investors who wish to be eligible must have bought the shares before the ex-date and hold them at least till the record date.

Mahindra & Mahindra Financial Services, an NBFC, has announced a Rights Issue in the ratio 1:8, meaning that eligible shareholders will receive 1 share for every 8 shares held.

The record date is set as Wednesday, May 14, 2025, therefore, those investors whose names appear in the list of shareholders of the company as of this date will be eligible for the rights issue. The issue will close on Friday, June 06, 2025. This is the last day shareholders can apply for the rights equity shares.

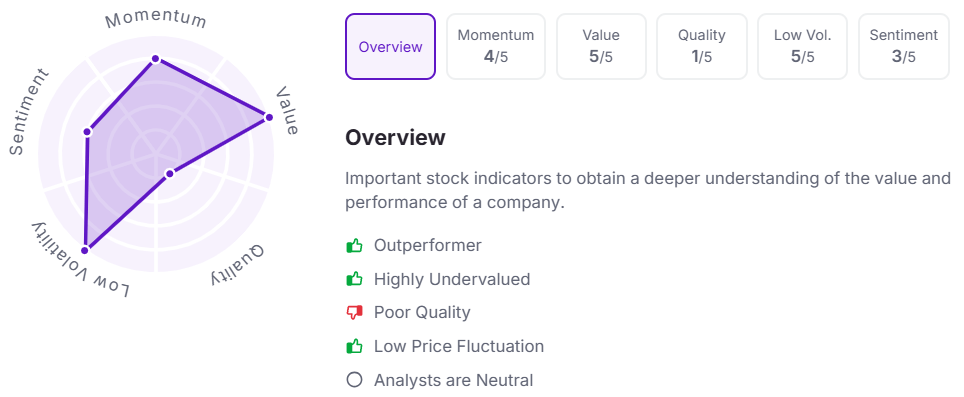

Let’s take a look at its Factor Analysis scores:

Raymond Limited has announced the demerger of its real estate business. The company aims to restructure its real estate business by consolidating it under a single entity, Raymond Realty Limited. The aim is to tap into growth opportunities and attract new investors or strategic partners specifically for the real estate segment.

The company has set May 14, 2025, as the record date for the demerger.

According to the Scheme, eligible shareholders will receive equity shares in Raymond Realty in a 1:1 ratio, meaning one fully paid-up Raymond Realty share for every Raymonds Limited share held.

As per the company, the real estate and remaining businesses have different risk profiles, strategies, and growth potential. Separating them will allow each to operate with focused leadership, make clearer investment decisions, and scale on their own terms. The move is also expected to help attract specialised talent and give existing shareholders more flexibility in managing their investments.

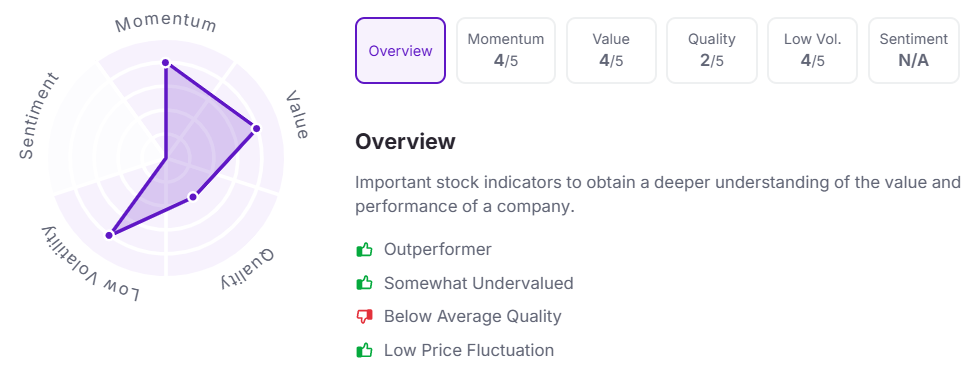

Raymond Limited has given multibagger returns of over 100% in the last three years. Let’s take a look at its Factor Analysis scores:

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.