- Share.Market

- 3 min read

- Published at : 20 Jun 2025 01:58 PM

- Modified at : 16 Jul 2025 07:39 PM

Revolt Motors, India’s leading electric motorcycle manufacturer and a wholly owned subsidiary of RattanIndia Enterprises Ltd., marked a major production milestone on Thursday with the rollout of its 50,000th electric motorcycle from its Manesar facility in Haryana. The landmark unit reflects both the growing momentum of India’s EV transition and Revolt’s rapid scale-up in a competitive two-wheeler market.

Backed by RattanIndia Enterprises, a Fortune 500 India-listed company with interests across tech-led sectors, Revolt has emerged as the fastest-growing player in the electric motorcycle segment. It operates a network of over 200 dealerships and maintains an annual production capacity of 1.8 lakh units. With operations extending to Nepal and Sri Lanka, the company is also building out its international footprint.

Revolt’s key models feature lithium-ion battery systems, regenerative braking, AI-driven riding modes, and smart connectivity, tailored for Indian riding conditions. The company has also maintained a focus on manufacturing quality, with its Manesar facility playing a central role in maintaining production precision and performance standards.

Revolt plans to double its production capacity to over 3 lakh units by 2026, expand its dealership network to 400 locations, and enter new geographies across South Asia and the Middle East. The company is also developing new models to address evolving consumer demand across urban and semi-urban markets.

With the rising adoption of electric two-wheelers in India driven by policy incentives, improving infrastructure, and consumer awareness, Revolt’s milestone underscores its position at the forefront of India’s shift to clean mobility.

RattanIndia has given multibagger returns of more than 285% and 610% over the last three and five years, respectively.

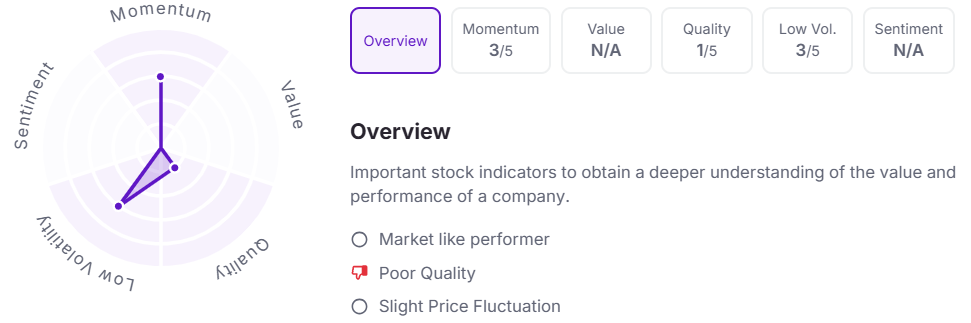

Let’s take a look at its Factor Analysis scores:

Note: The stock price mentioned is as of 1:55 PM.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.