- Share.Market

- 3 min read

- Published at : 19 May 2025 03:29 PM

- Modified at : 16 Jul 2025 07:38 PM

In a major push for regional clean energy cooperation, Reliance Power Limited has signed a commercial term sheet for a long-term power purchase agreement (PPA) with Green Digital Private Limited (GDL), a company owned by Druk Holding and Investments Limited (DHI), the investment arm of the Royal Government of Bhutan.

Post the announcement, Reliance Power surged, reaching an intraday high of ₹46.73 apiece.

Under the agreement, Reliance Power and DHI will jointly develop Bhutan’s largest solar power project, with a planned capacity of 500 megawatts (MW). The greenfield project, to be executed under a 50:50 joint venture structure, will be developed at a capital outlay of up to ₹2,000 crore. This represents the single largest private sector foreign direct investment (FDI) in Bhutan’s solar energy sector to date.

The project is being undertaken under the Build-Own-Operate (BOO) model and will be implemented in phased tranches over the next 24 months. It is expected to significantly enhance Bhutan’s solar power capacity, currently dominated by hydropower, and diversify its renewable energy mix while also contributing to greater regional grid integration across South Asia.

Reliance Power has already initiated the Engineering, Procurement, and Construction (EPC) bidding process in line with international competitive standards, aiming to ensure technical robustness and cost efficiency. The company is also engaging with leading financial institutions to raise sustainable, long-term project financing tailored to optimize the capital structure and improve financial viability.

The initiative builds on a broader partnership formalized in October 2024 between Reliance Enterprises (jointly promoted by Reliance Power and Reliance Infrastructure) and DHI. In addition to the solar project, the collaboration includes the execution of the 770 MW Chamkharchhu-I hydroelectric project, a run-of-the-river plant aligned with Bhutan’s national energy strategy and structured under a long-term concession model.

This latest development further strengthens Reliance Power’s growing clean energy portfolio, which currently includes 2.5 GWp of solar capacity and over 2.5 GWh of battery energy storage systems (BESS), making it India’s largest integrated Solar + BESS platform.

With the Bhutan project, Reliance Power deepens its presence in the South Asian renewable energy space, while contributing to sustainable energy security and economic integration in the region.

Over the last three years, Reliance Power has given multibagger returns of more than 250%.

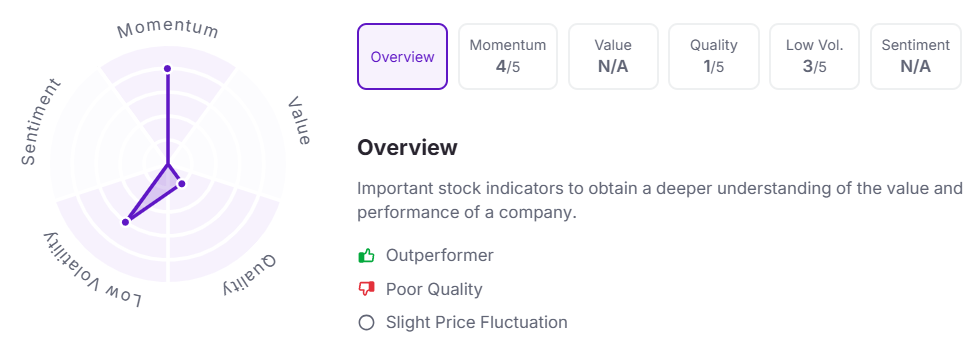

Let’s take a look at its Factor Analysis scores:

Note: The stock price mentioned is as of 3:30 PM.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.