- Share.Market

- 3 min read

- Published at : 25 Jun 2025 06:12 PM

- Modified at : 16 Jul 2025 08:00 PM

Reliance Defence Limited, a subsidiary promoted by Reliance Infrastructure Ltd., has secured a landmark export order worth ₹600 crore from Rheinmetall Waffe Munition GmbH, one of Germany’s top defence and ammunition manufacturers. This deal is among the largest ammunition export orders to date by an Indian private defence player and reflects the growing momentum of India’s indigenous defence capabilities on the global stage.

This development comes shortly after the two companies announced a strategic partnership aimed at co-developing advanced defence technologies. The collaboration is a major endorsement of India’s ‘Aatmanirbhar Bharat’ and ‘Make in India’ missions and positions Reliance Defence as a key player in the international defence supply chain, particularly in the European market, where demand for high-tech munitions is rising.

The deal also strengthens plans for the Dhirubhai Ambani Defence City (DADC), a major greenfield facility under development in Ratnagiri, Maharashtra. The site will manufacture explosives, small arms, and ammunition at scale, creating a new hub for innovation and export-driven growth in India’s defence sector.

Rheinmetall AG, which operates across 171 global locations and reported revenues of €9.8 billion in 2024, is a leader in armoured systems, air defence, and next-gen ammunition technologies. The ₹600 crore order affirms its faith in the capabilities of India’s growing private defence sector.

Over the last three years, Reliance Infrastructure has given multibagger returns of more than 345%.

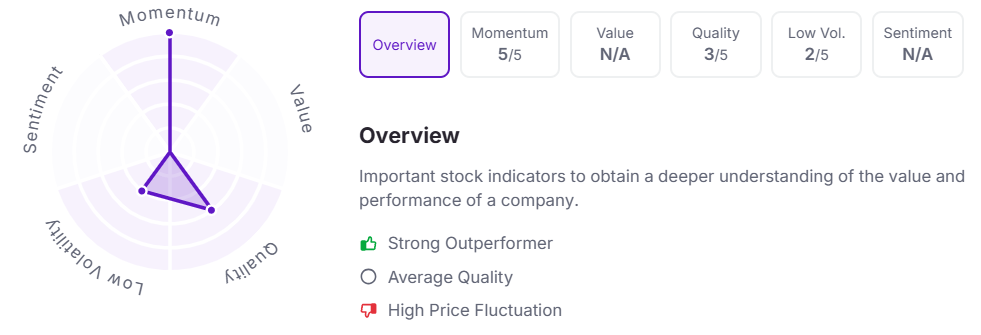

Let’s take a look at its Factor Analysis scores:

Note: The stock price mentioned is as of 3:30 PM.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.