- Share.Market

- 6 min read

- Published at : 13 Aug 2025 12:13 PM

- Modified at : 13 Aug 2025 12:13 PM

The shares of Reliance Industries, Bharat Electronics, REC, Hindustan Petroleum Corporation, and NHPC are set for their record date on Thursday, August 14, 2025. To be eligible for the upcoming dividends, investors must have bought the shares before the ex-date and hold them at least till the record date.

Reliance Industries Ltd. has announced a final dividend of ₹5.5 per equity share. It has a dividend yield of 0.40% TTM.

Reliance Industries Limited, a Fortune 500 company and India’s largest private sector corporation, operates across energy, petrochemicals, retail, digital services, and media. For Q1 FY26, the company reported a 6% year-on-year rise in consolidated gross revenue to ₹2,73,252 crore, while EBITDA surged 35.7% to a record ₹58,024 crore, aided by strong growth in Jio Platforms and Reliance Retail, as well as improved margins in the oil-to-chemicals segment. Net profit jumped 76.5% to ₹30,783 crore, marking its highest-ever quarterly earnings.

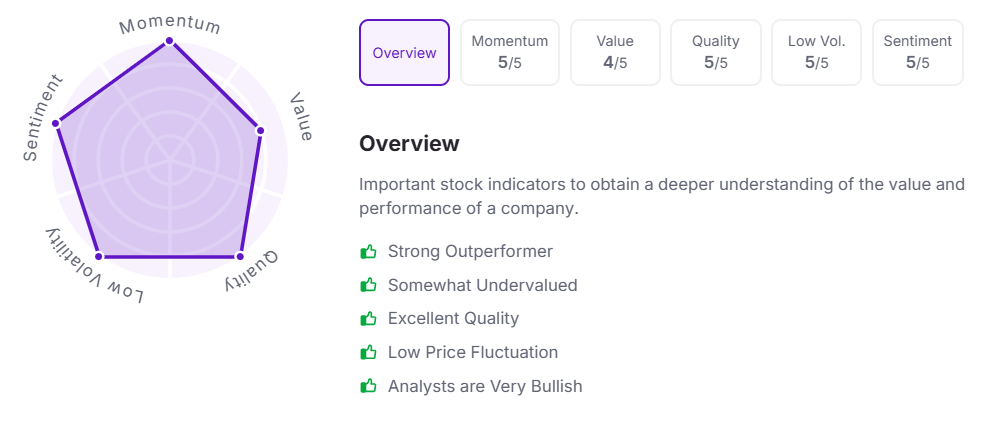

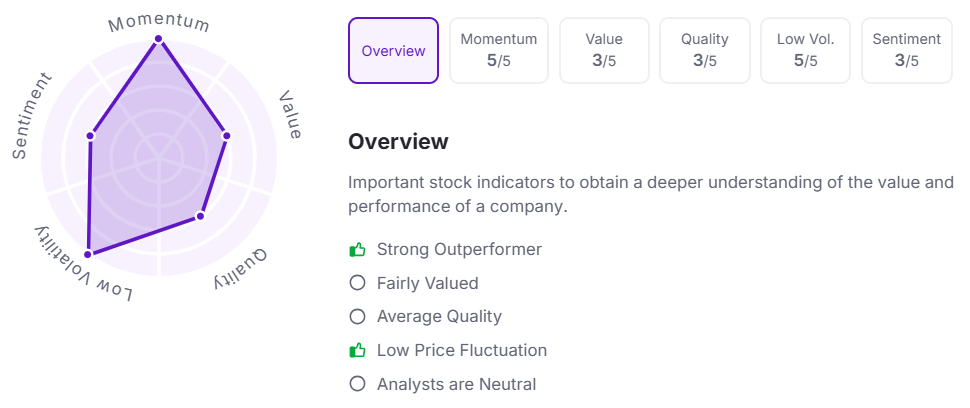

Let’s take a look at its Factor Analysis scores:

Bharat Electronics Ltd. has announced a final dividend of ₹0.90 per equity share. It has a dividend yield of 0.60% TTM.

Bharat Electronics Limited, a Navratna PSU under the Ministry of Defence, designs and manufactures advanced electronic products and systems for the armed forces, alongside diversified solutions in areas like homeland security, space electronics, renewable energy, and smart infrastructure. In Q1 FY26, the company posted a 5.19% year-on-year increase in revenue from operations to ₹4,416.83 crore, while PAT grew 24.87% to ₹969.13 crore and the order book as of July 1, 2025, stood at ₹74,859 crore.

Over the last three and five years, this stock has given multibagger returns of more than 295% and 940%, respectively.

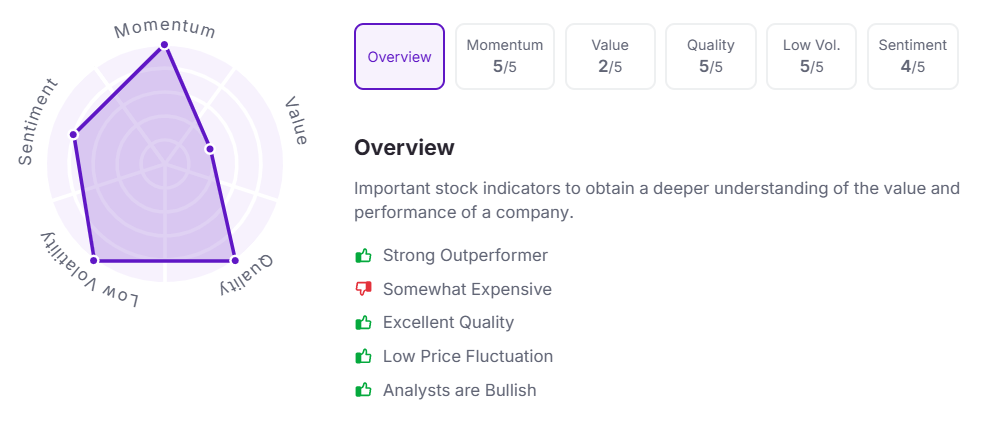

Let’s take a look at its Factor Analysis scores:

REC Ltd. has announced a final dividend of ₹2.60 per equity share. It has a high dividend yield of 4.30% TTM.

REC Limited, a Maharatna NBFC under the Ministry of Power, finances infrastructure projects across the power and non-power sectors, including generation, transmission, renewable energy, electric mobility, and transport infrastructure. In Q1 FY26, the company reported a 29% year-on-year rise in net profit to ₹4,451 crore, with total income up 13% to ₹14,734 crore and net interest income growing 17% to ₹5,247 crore. The loan book expanded 10% to a record ₹5.85 lakh crore, and net worth reached an all-time high of ₹79,688 crore.

Over the last three and five years, this stock has given multibagger returns of more than 275% and 370%, respectively.

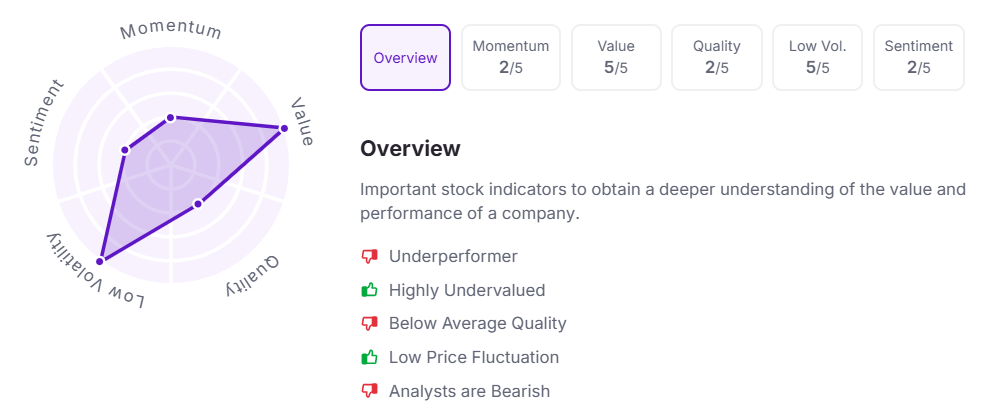

Let’s take a look at its Factor Analysis scores:

Hindustan Petroleum Corporation Ltd. has announced a final dividend of ₹10.50 per equity share.

Hindustan Petroleum Corporation Limited (HPCL), a leading oil refining and marketing company in India, operates an extensive network of refineries, retail outlets, LPG distributorships, and energy infrastructure across the country. In Q1 FY26, the company delivered a 1128% year-on-year surge in profit after tax to ₹4,371 crore, supported by record refinery throughput of 6.66 MMT, robust sales volumes, and operational efficiencies. HPCL also achieved its highest-ever quarterly sales in petrol, CNG, and LPG.

Over the last three and five years, this stock has given multibagger returns of more than 145% and 185%, respectively.

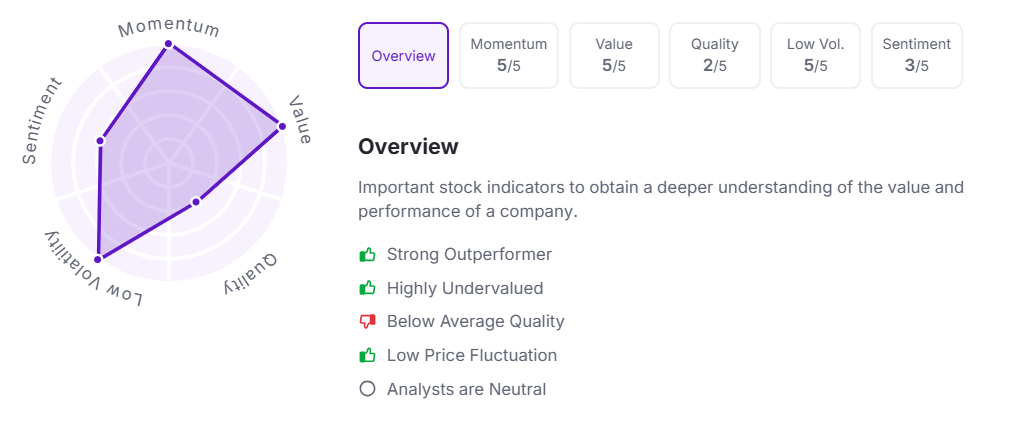

Let’s take a look at its Factor Analysis scores:

NHPC Ltd. has announced a final dividend of ₹0.51 per equity share. It has a dividend yield of 1.70% TTM.

NHPC Limited, India’s largest hydropower development organization, specializes in end-to-end execution of hydro projects and has expanded into solar and wind power generation. Incorporated in 1975, the company operates 8247.18 MW of installed capacity of hydro, solar and wind energy, accounting for over 16% of the nation’s total hydro capacity.

Over the last three and five years, this stock has given multibagger returns of more than 145% and 310%, respectively.

Let’s take a look at its Factor Analysis scores:

Note: The stock prices mentioned are as of 12:12 pm.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.