- Share.Market

- 2 min read

- Published at : 06 Nov 2025 06:53 PM

- Modified at : 15 Nov 2025 09:56 AM

Redington Ltd., a leading technology solutions distributor, has announced its strongest-ever consolidated financial performance for the quarter ended September 30, 2025 (Q2 FY26).

Post the announcement, shares of Redington surged over 15%, reaching an intraday high of ₹293.30 apiece.

Consolidated global revenues for the quarter stood at ₹29,118 crore, marking a 17% increase year-on-year. This growth was broad-based across all operating regions, supported by enhanced go-to-market alignment, brand collaborations, and an expanded solutions portfolio.

Profit After Tax (PAT) for the quarter surged by 32% year-on-year to ₹388 crore, compared to ₹293 crore in the same quarter last year.

Growth momentum remained broad-based across key geographies. Both the India and UAE businesses registered a strong 23% year-on-year growth. Saudi Arabia (KSA) also contributed to the upward trend with a 10% growth, while the Africa region maintained its positive trajectory.

The Software Solutions Group delivered exceptional performance, growing 48% year-on-year. This acceleration was strongly supported by momentum in cloud, software, and cybersecurity services.

The Mobility Solutions Group grew by 18% year-on-year. This growth was primarily fueled by higher demand in the premium market segment, new product introductions, and robust execution of the Direct to Retail model.

The Enterprise Solutions Group (ESG) grew 11% year-on-year, primarily led by higher demand for personal computers (PC) in India as the penetration of AI PCs began to accelerate. The Technology Solutions Group (TSG) recorded 9% growth, largely driven by stronger demand from the enterprise segment.

Over the last five years, this stock has delivered multibagger returns more than 390%.

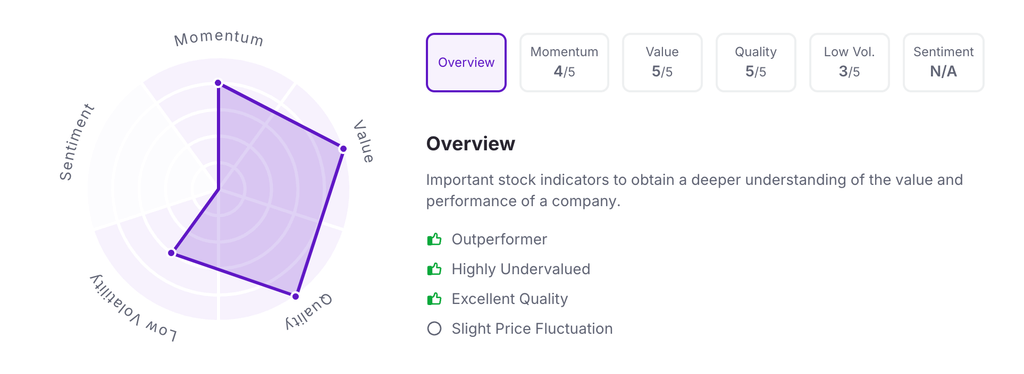

Let’s take a look at its Factor Analysis scores:

Note: The stock price mentioned is as of 3:30 pm.