- Share.Market

- 3 min read

- Published at : 13 Aug 2025 03:28 PM

- Modified at : 13 Aug 2025 03:28 PM

Shares of Premier Explosives Ltd. were locked in an upper circuit at 20%, reaching an intraday high of ₹512.30, after the company posted strong results for the June quarter (Q1 FY26), driven by a sharp rise in its defence and space business.

Premier Explosives Ltd is a leading manufacturer of high-energy materials for the defence, aerospace, and mining sectors.

The company’s revenue from operations rose 72% year-on-year to ₹1,421.5 million, supported by a sharp increase in defence and space services revenue.

Revenue from defence and space services jumped 87% YoY to ₹1,229 million, contributing 86% of total revenue, while commercial explosives revenue grew 12% YoY to ₹192 million. The company operates in a single reportable segment —high energy materials— primarily catering to the defence, aerospace, and mining sectors. This focus, combined with rising demand in defence and space, underpinned the revenue momentum.

EBITDA stood at ₹208.8 million, up 35% YoY, with an EBITDA margin of 14.7% compared to 18.7% a year earlier. Profit before tax more than doubled to ₹227.7 million from ₹106.2 million in the same quarter last year.

Profit after tax surged 110% YoY to ₹153.2 million, with the PAT margin improving to 10.8% from 8.8%. Cash profit rose 81% to ₹182.4 million.

The quarter also included an exceptional expense of ₹400 lakh as ex-gratia compensation to employees affected by an accident at the company’s manufacturing facility.

The company’s order book remained robust at ₹9,885 million as of June 30, 2025, equivalent to about 2.4 times its FY25 revenue, indicating strong revenue visibility for the coming quarters.

Over the last three and five years, this stock has given multibagger returns of more than 630% and 1,810%, respectively.

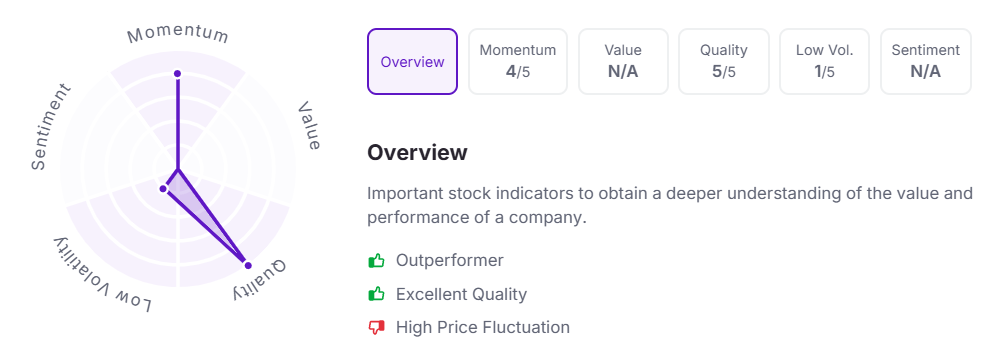

Let’s take a look at its Factor Analysis scores:

Note: The stock price mentioned is as of 3:25 pm.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.