- Share.Market

- 4 min read

- Published at : 07 Nov 2025 12:51 PM

- Modified at : 15 Nov 2025 09:54 AM

The shares of Power Grid Corporation of India, Godfrey Phillips India, Ajanta Pharma, and Aurionpro Solutions are set for their record date on Monday, November 10, 2025. To be eligible for the upcoming dividends, investors must have bought the shares before the ex-date and hold them at least till the record date.

The power company has announced an interim dividend of ₹4.5 per equity share. It has a dividend yield of 3.30% TTM.

For the second quarter of Fiscal Year 2026, Power Grid Corporation of India Ltd. reported a Total Income of ₹11,670 crore, reflecting a slight decrease of 1% compared to Q2 FY25. The Profit After Tax (PAT) for the quarter was ₹3,566 crore , a decrease of 6% compared to Q2 FY25.

Over the last five years, this stock has given multibagger returns of more than 260%.

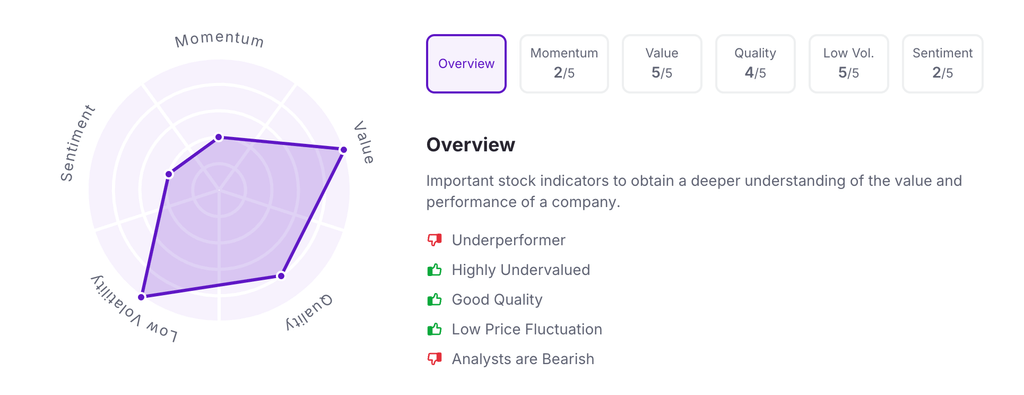

Let’s take a look at its Factor Analysis scores:

The FMCG company has announced an interim dividend of ₹17 per equity share. It has a dividend yield of 1.10% TTM.

For Q2 FY26, Godfrey Phillips India Ltd. reported Total Revenue from Operations of ₹163.22 crores. The company reported Profit After Tax (PAT) from continuing operations of ₹30.50 crores, up 23% from Q2FY25.

Over the last five years, this stock has given multibagger returns of more than 920%.

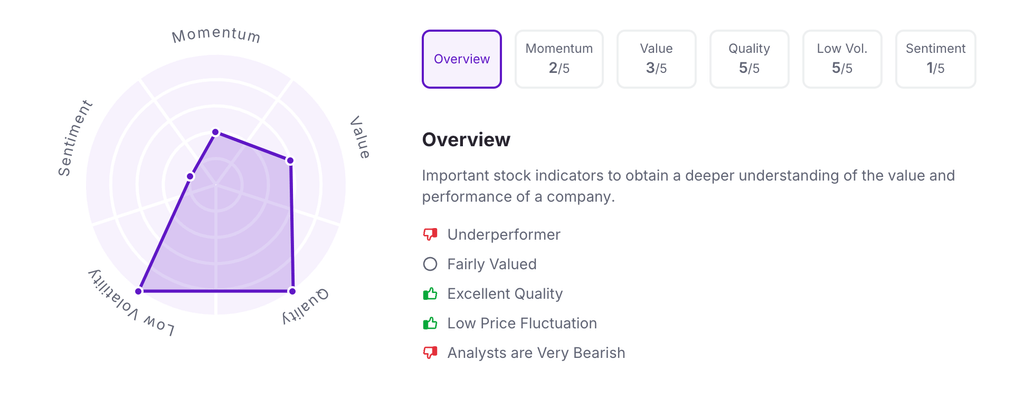

Let’s take a look at its Factor Analysis scores:

The pharma company has announced an interim dividend of ₹28 per equity share.

For the Q2FY26, Ajanta Pharma Ltd. reported Revenue from operations at ₹1,354 crore, up 14%, and Profit after tax at ₹ 260 crore, up 20%.

Over the last five years, this stock has given multibagger returns of more than 135%.

Let’s take a look at its Factor Analysis scores:

The software company has announced an interim dividend of ₹1.00 per equity share. It has a dividend yield of 0.40% TTM.

For Q2 FY26, Aurionpro Solutions Ltd. Revenue of ₹358 crores, marking a strong growth of 29% on a Year-on-Year (YoY) basis, driven by new client wins and market expansion. The company’s financial performance was robust, with Profit After Tax (PAT) standing at ₹56 crores, a growth of 23% on a YoY basis, achieving a PAT margin of 16% for the quarter.

Over the last five years, this stock has given multibagger returns of more than 2,945%.

Let’s take a look at its Factor Analysis scores:

Note: The stock prices mentioned are as of 12:50 pm.