- Share.Market

- 3 min read

- Published at : 18 Sep 2025 12:06 PM

- Modified at : 18 Sep 2025 12:06 PM

Shares of Poonawalla Fincorp Ltd. surged over 12%, hitting a new 52-week high of ₹513.35 apiece.

The rally was triggered by the company’s announcement of a major capital infusion from its promoter, Rising Sun Holdings Private Limited.

The board has approved the preferential allotment of 3.31 crore equity shares at an issue price of ₹452.51 per share, raising a total of nearly ₹1,500 crore. This strategic move not only substantially bolsters the company’s financial position but also signals strong, long-term confidence from the promoter in Poonawalla Fincorp’s future. The capital raise is expected to enhance the company’s ability to drive its growth trajectory and strengthen its competitive standing in the NBFC landscape.

Further signaling a robust growth strategy, the company’s board also approved a significant increase in its fund-raising limit through Non-Convertible Debt Securities. The new limit has been doubled from ₹10,000 crore to ₹20,000 crore for the financial year 2025-26. This dual capital-raising approach is expected to provide the company with the necessary financial flexibility to pursue its ambitious objectives. The strong market reaction, marked by a sharp rise in trading volumes, underscores the positive investor sentiment surrounding these strategic announcements.

About Poonawalla Fincorp

Poonawalla Fincorp is a non-deposit taking, systemically important NBFC, focused on providing consumer and MSME finance across India. The company offers a diversified product suite including loans against property, personal loans, and pre-owned car finance.

The company reported robust results for Q1FY26, with its Assets Under Management (AUM) growing by 53% year-on-year to ₹41,273 crore.

Over the last 5 years, this stock has delivered multibagger returns of more than 1,225%.

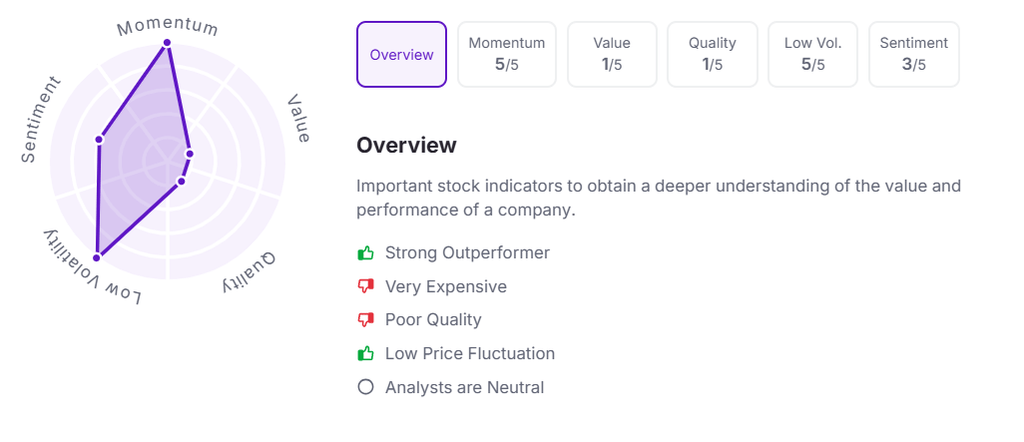

Let’s take a look at its Factor Analysis scores:

Note: The stock prices mentioned are as of 12:05 pm.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.