- Share.Market

- 3 min read

- Published at : 08 Aug 2025 07:54 PM

- Modified at : 08 Aug 2025 07:54 PM

Shares of PG Electroplast Ltd. fell 20% after the company announced its Q1FY26 results, reaching an intraday low of ₹567.35 apiece.

PG Electroplast Ltd. (PGEL), a key player in India’s Electronic Manufacturing Services (EMS) and plastic molding space, reported a 21.5% year-on-year drop in net profit for Q1FY26. The company’s bottom line declined to ₹66.71 crore despite a 13.9% rise in revenue, reflecting margin pressure and seasonal headwinds.

The early onset of the monsoon dampened demand for summer products like Room ACs and Coolers, leading to a softer-than-usual start to the year. Cooler sales declined 3.9% YoY, while Room ACs grew 15.1% and Washing Machines surged 36.1%. Still, overall momentum in the company’s core product business was affected.

PGEL’s consolidated Q1 revenue stood at ₹1,503.85 crore, up from ₹1,320.22 crore a year ago. EBITDA came in at ₹139.42 crore, a 3.6% increase from ₹134.54 crore in Q1FY25. However, profit declined due to operational challenges.

The product segment contributed ₹1,159 crore — about 77% of PGEL’s total revenue — growing 16.7% YoY. The electronics business, which includes the recently transitioned TV segment, now structured as a 50:50 JV under Goodworth Electronics, made up 4.3% of total revenue.

Goodworth Electronics posted strong performance, with revenue rising to ₹147.53 crore from ₹75.47 crore last year. EBITDA improved to ₹4.27 crore from ₹0.69 crore YoY, highlighting a positive turnaround.

PGEL is executing a capex plan of ₹700–750 crore in FY26. Key initiatives include:

- A new washing machine campus in Greater Noida

- A refrigerator campus in South India

- A plastic component and cooler facility in Rajasthan

- Expanded Room AC capacity in West India (Supa)

These investments support upcoming growth in core categories like Washing Machines, Room ACs, and Coolers.

The company maintained confidence in its long-term growth trajectory. Management expects:

- PGEL Consolidated Revenue: ₹5,700–5,800 crore (17%–19% YoY growth)

- Net Profit: ₹300–310 crore (3%–7% YoY growth)

- Goodworth Electronics Revenue: ₹850 crore

- Total Group Revenue: ₹6,550–6,650 crore (21%–23% YoY growth)

The Product business is projected to grow 17%–21% to ₹4,140–4,280 crore, with Electronics at ₹450 crore (+29% YoY).

While Q1 reflected short-term demand disruption, the management reiterated its confidence in India’s underpenetrated consumer durables market. The company is banking on product innovation, efficient expansion, and deeper client relationships to sustain growth.

Over the last three and five years, this stock has given multibagger returns of more than 535% and 11,550%, respectively.

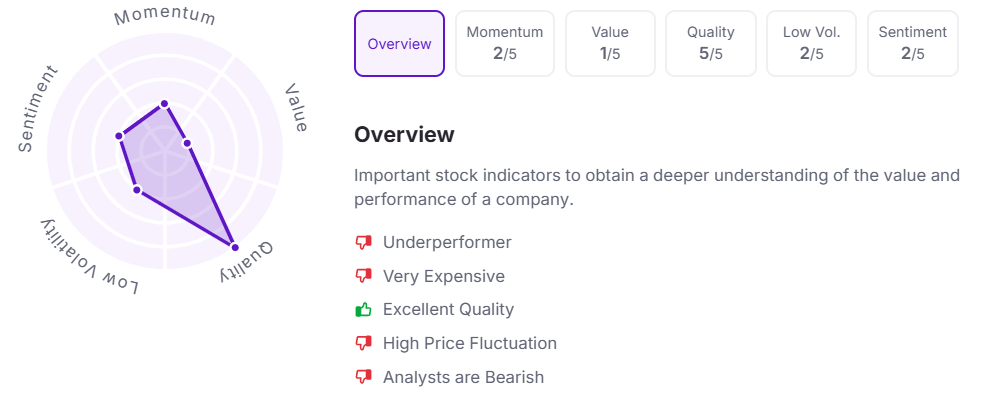

Let’s take a look at its Factor Analysis scores:

Note: The stock price mentioned is as of 3:30 pm.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.