- Share.Market

- 4 min read

- Published at : 02 Sep 2025 11:58 AM

- Modified at : 02 Sep 2025 12:57 PM

The shares of Patanjali Foods, Prestige Estates Projects, and Concord Biotech are set for their record date on Wednesday, September 03, 2025. To be eligible for the upcoming dividends, investors must have bought the shares before the ex-date and hold them at least till the record date.

Patanjali Foods Ltd. has announced a final dividend of ₹2 per equity share. It has a dividend yield of 0.40% TTM.

Patanjali Foods Limited, incorporated in 1986, is among India’s leading FMCG companies with a diversified presence across edible oils, foods, home and personal care, and wind power generation, operating through well-known brands such as Patanjali, Ruchi Gold, Nutrela, and Dant Kanti.

In Q1FY26, the company reported revenue from operations of ₹8,899.70 crore, up from ₹7,177.17 crore in the same period last year, with gross profit rising 23.81% YoY to ₹1,259.19 crore. PAT stood at ₹180.39 crore with a margin of 2.02%, while the edible oils segment drove growth with sales of ₹6,685.86 crore, up 25.34% YoY, supported by strong performance in branded oils.

Over the last five years, this stock has delivered multibagger returns of more than 197%.

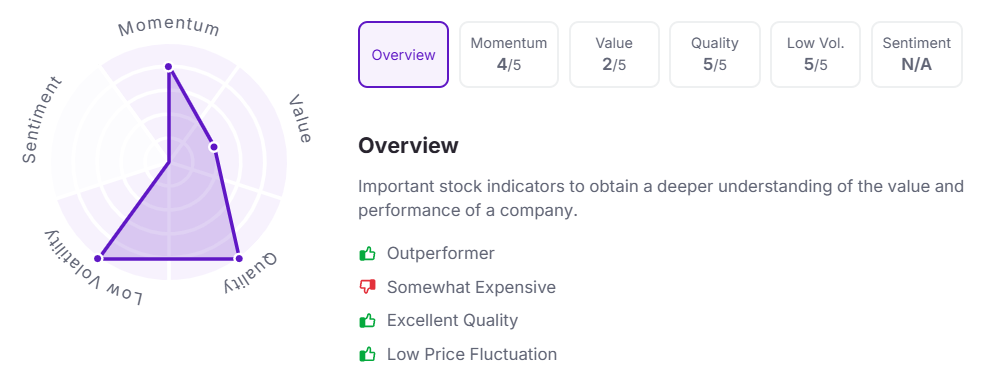

Let’s take a look at its Factor Analysis scores:

Prestige Estates Projects Ltd. has announced a dividend of ₹1.8 per equity share. It has a dividend yield of 0.10% TTM.

Prestige Estates Projects Limited is one of India’s leading real estate developers with a nearly four-decade legacy and a diversified portfolio across residential, commercial, retail, hospitality, and integrated townships in major cities.

In Q1 FY26, the company posted its best-ever quarterly performance, reporting record sales of ₹121,264 million, up 300% year-on-year, driven by strong launches, its debut in NCR, disciplined collections, and maiden completions in Mumbai.

Over the last three and five years, this stock has given multibagger returns of more than 230% and 510%, respectively.

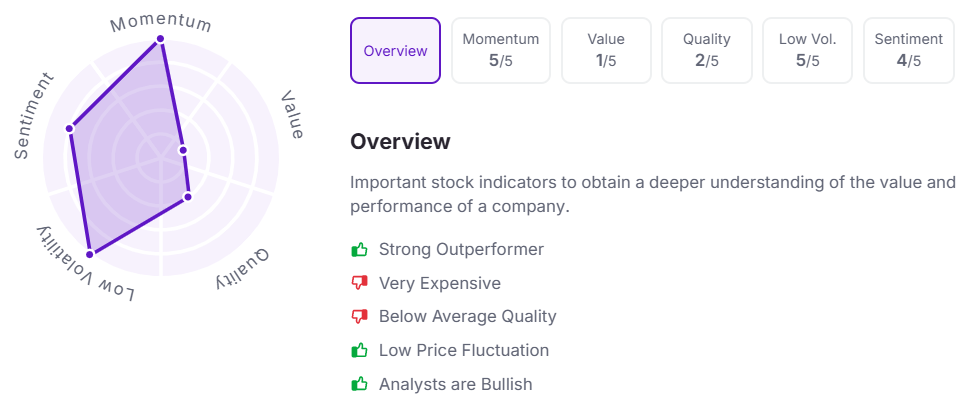

Let’s take a look at its Factor Analysis scores:

Concord Biotech Ltd. has announced a final dividend of ₹10.70 per equity share.

Concord Biotech Limited is an R&D-driven biopharmaceutical company specializing in fermentation-based and semi-synthetic Active Pharmaceutical Ingredients (APIs) and finished formulations, with a presence in over 70 countries and strong manufacturing infrastructure across Gujarat.

In Q1FY26, the company reported revenue of ₹204 crore, down 5% year-on-year due to customer procurement lumpiness following an exceptionally strong previous quarter. EBITDA came in at ₹61.4 crore with margins impacted by commercialization costs of the new injectable facility at Valthera, though underlying margins excluding these costs remained steady at 37%. PAT stood at ₹44.1 crore compared to ₹59.6 crore in Q1FY25. During the quarter, Concord advanced its strategic growth agenda with the acquisition of a 75% stake in Stellon Biotech in the US.

Since listing, this stock has delivered multibagger returns of more than 125%.

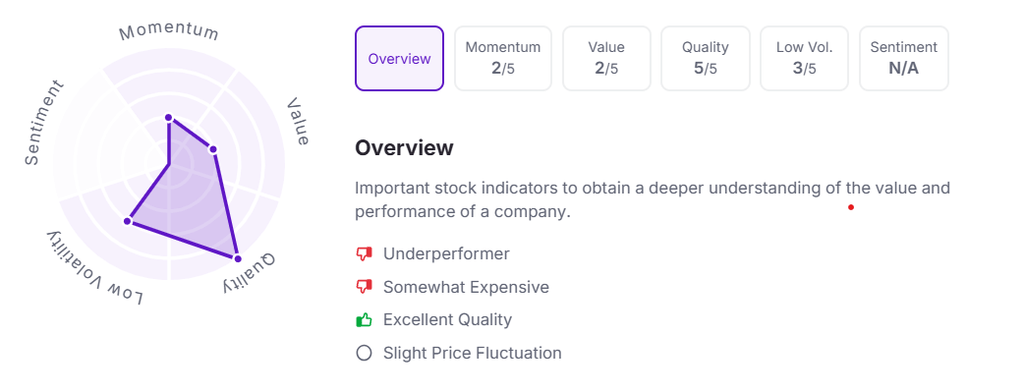

Let’s take a look at its Factor Analysis scores:

Note: The stock prices mentioned are as of 11:55 am.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.