- Share.Market

- 4 min read

- Published at : 20 Nov 2025 10:09 AM

- Modified at : 20 Nov 2025 12:18 PM

The shares of Oil India, Info Edge (India), MRF, Indian Railway Catering and Tourism Corporation, and Gabriel India are set for their record date on Friday, November 21, 2025. To be eligible for the upcoming dividends, investors must have bought the shares before the ex-date and hold them at least till the record date.

The oil company has announced an interim dividend of ₹3.50 per equity share. It has a dividend yield of 2.00% TTM.

For the second quarter of Fiscal Year 2026, Oil India Ltd. reported a turnover of ₹9,175 crore , reflecting an increase of 12.77% compared to Q2 FY25. The Profit After Tax (PAT) for the quarter was ₹1643.81 crore , a decrease of 20.6% compared to Q2 FY25.

Over the last five years, this stock has given multibagger returns of more than 610%.

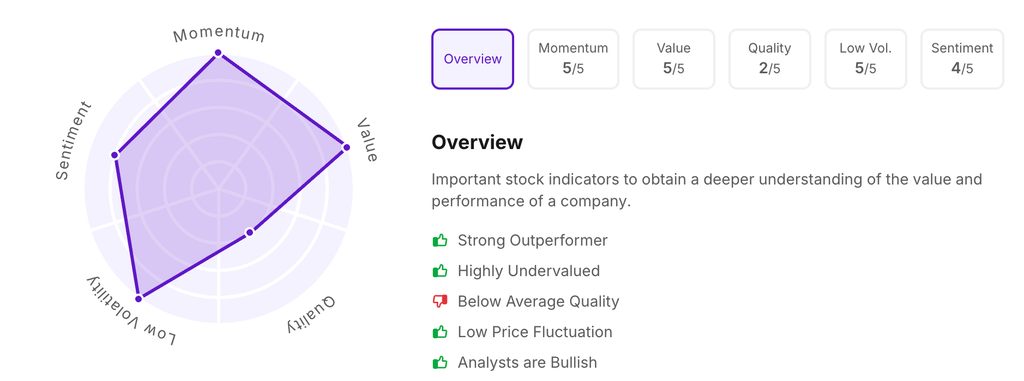

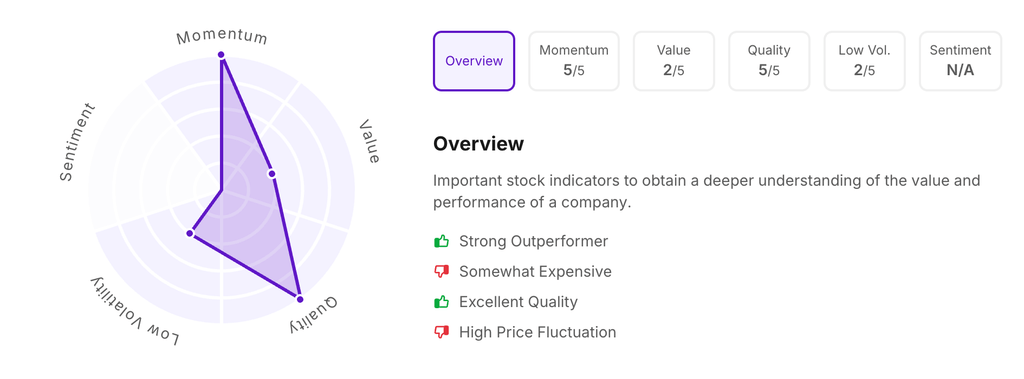

Let’s take a look at its Factor Analysis scores:

India’s premier online classifieds company has announced an interim dividend of ₹2.40 per equity share. It has a dividend yield of 0.30% TTM.

For Q2 FY26, Info Edge (India) Ltd. reported Revenue from Operations of ₹805.45 crores, up 14.93%. The company reported Profit After Tax (PAT) from continuing operations of ₹347.49 crores, up 310% from Q2FY25.

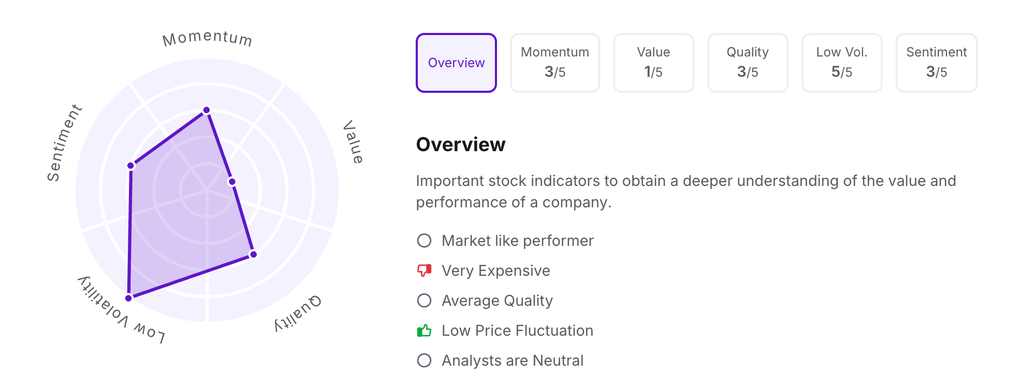

Let’s take a look at its Factor Analysis scores:

India’s largest tyre maker has announced an interim dividend of ₹3.00 per equity share. It has a dividend yield of 0.20% TTM.

For the Q2FY26, MRF Ltd. reported total income at ₹7,487 crore, up 7%, and Profit after tax at ₹526 crore, up 11.68%.

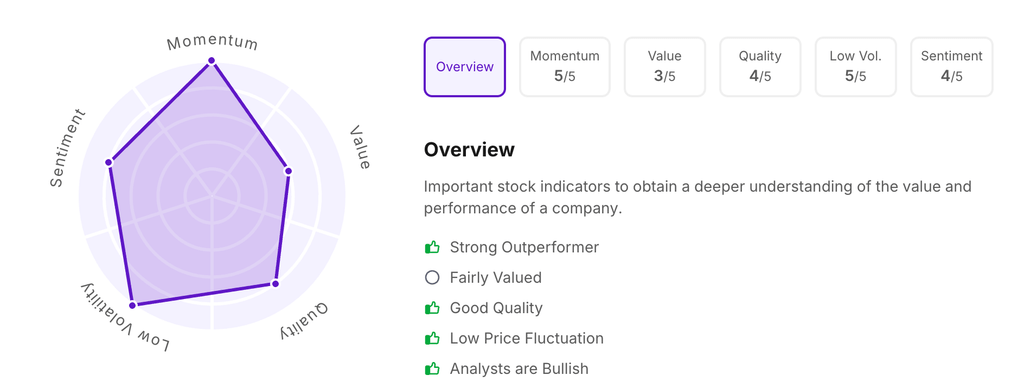

Let’s take a look at its Factor Analysis scores:

The PSU under the Ministry of Railways has announced an interim dividend of ₹5.00 per equity share. It has a dividend yield of 0.60% TTM.

For Q2 FY26, Indian Railway Catering & Tourism Corporation Ltd. reported Revenue of ₹1,145.99 crores, marking a growth of 7.71% on a Year-on-Year (YoY) basis, and Profit after tax at ₹342.02 crore, up 11.1%.

Over the last five years, this stock has given multibagger returns of more than 155%.

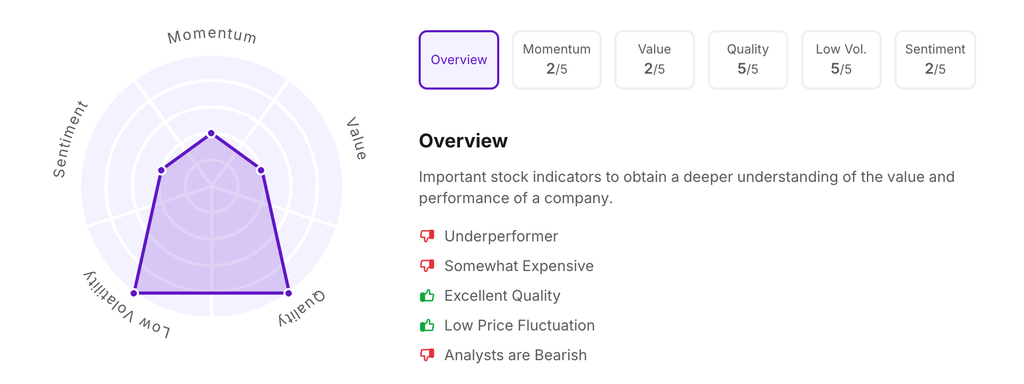

Let’s take a look at its Factor Analysis scores:

The auto components company has announced an interim dividend of ₹1.90 per equity share. It has a dividend yield of 0.30% TTM.

For Q2 FY26, Gabriel India Ltd. reported Revenue of ₹1,180.3 crores, marking a growth of 14.92% on a Year-on-Year (YoY) basis, and Profit after Tax at ₹69 crore, up 9.7%.

Over the last five years, this stock has given multibagger returns of more than 915%.

Let’s take a look at its Factor Analysis scores:

Note: The stock prices mentioned are as of 10:00 am.