- Share.Market

- 6 min read

- Published at : 03 Sep 2025 01:21 PM

- Modified at : 03 Sep 2025 01:21 PM

The shares of NTPC, ONGC, Oil India, and Kalyan Jeweller are set for their record date on Thursday, August 04, 2025. To be eligible for the upcoming dividends, investors must have bought the shares before the ex-date and hold them at least till the record date.

NTPC Ltd. has announced a dividend of ₹3.35 per equity share. It has a dividend yield of 1.50% TTM.

NTPC Ltd., India’s largest integrated power producer with an installed capacity of over 83 GW, has been a cornerstone of the nation’s energy growth for nearly five decades. In Q1 FY26, the company reported standalone income of ₹43,333 crore, down from ₹45,053 crore in Q1 FY25, while profit after tax rose 6% to ₹4,775 crore. On a consolidated basis, NTPC posted income of ₹47,821 crore against ₹48,982 crore last year, with profit after tax increasing 11% year-on-year to ₹6,108 crore.

Over the last three and five years, this stock has given multibagger returns of more than 105% and 235%, respectively.

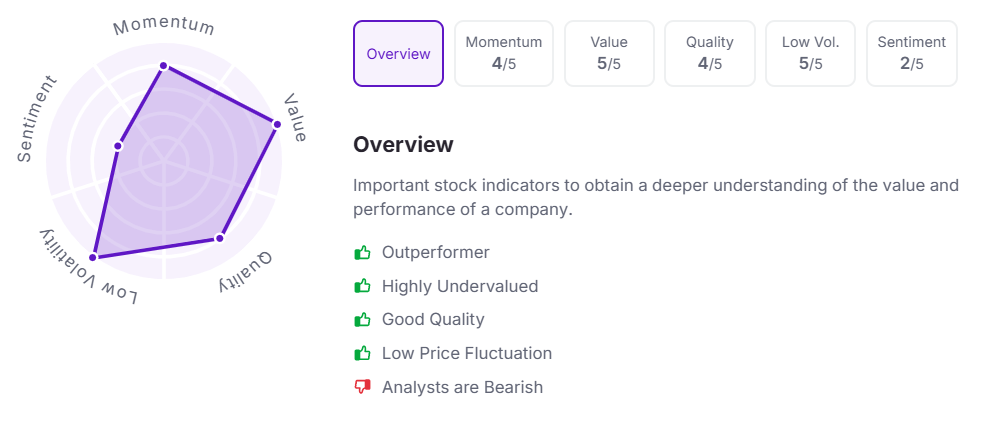

Let’s take a look at its Factor Analysis scores:

Oil And Natural Gas Corporation Ltd. has announced a final dividend of ₹1.25 per equity share. It has a dividend yield of 4.59% TTM.

ONGC, India’s largest crude oil and natural gas company, plays a vital role in ensuring the nation’s energy security by contributing over 70% of the country’s domestic production.

In Q1 FY26, the company reported consolidated net profit of ₹11,554 crore, up 18.2% year-on-year, while standalone profit stood at ₹8,024 crore against ₹8,938 crore a year earlier. Consolidated gross revenue came in at ₹1,63,108 crore compared to ₹1,68,968 crore in Q1 FY25, with crude oil production rising 1.2% and new well gas revenues crossing ₹1,700 crore.

Over the last five years, this stock has given multibagger returns of more than 195%.

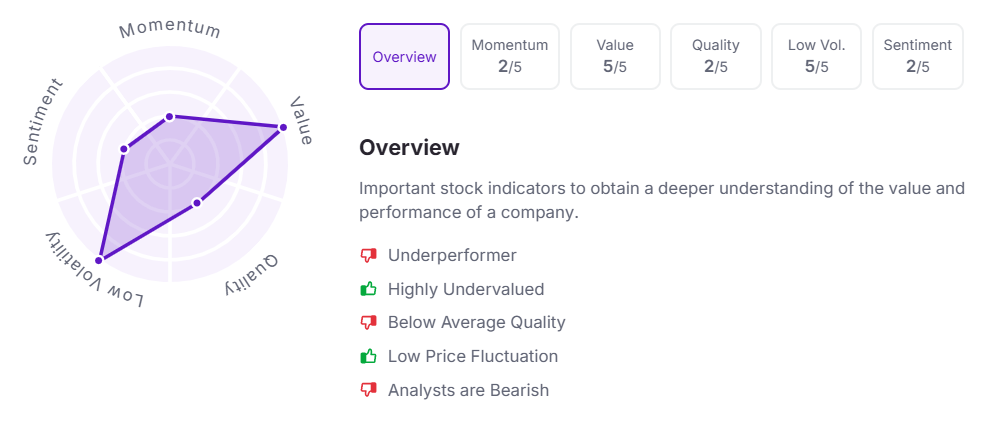

Let’s take a look at its Factor Analysis scores:

Oil India Ltd.has announced a final dividend of ₹1.50 per equity share. It has a dividend yield of 2.40%.

Oil India Limited (OIL), a Maharatna CPSE with a legacy of over six decades in the oil and gas sector, operates across the full energy value chain spanning upstream, midstream, and downstream, with a strong presence in both domestic and global markets.

In Q1 FY26, the company reported a consolidated PAT of ₹2,046 crore, largely stable compared to ₹2,016 crore in Q1 FY25, while standalone PAT declined to ₹813 crore from ₹1,467 crore due to weaker crude price realisations. Consolidated EPS stood at ₹11.66 per share versus ₹11.59 last year, with oil and gas production maintained at 1.680 MMTOE and its subsidiary NRL sustaining crude throughput at 799 TMT.

Over the last three and five years, this stock has given multibagger returns of more than 215% and 520%, respectively.

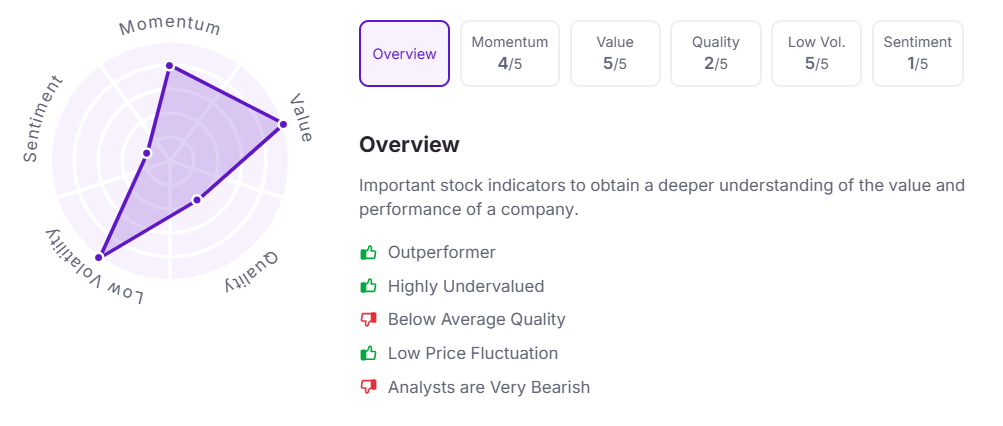

Let’s take a look at its Factor Analysis scores:

Kalyan Jewellers India Ltd. has announced a final dividend of ₹1.50 per equity share.

Kalyan Jewellers India Limited, headquartered in Thrissur, is one of the largest jewellery retailers in India with over three decades of presence and a strong international footprint across the Middle East and the US.

In Q1 FY26, the company reported consolidated revenue of ₹7,268 crore, up 31% from last year, with consolidated PAT rising 49% to ₹264 crore. Standalone India operations posted revenue of ₹6,142 crore and PAT of ₹256 crore, both growing over 30% and 55% respectively, while international operations recorded revenue of ₹1,070 crore. Its lifestyle jewellery platform Candere reported revenue of ₹66 crore with a net loss of ₹10 crore.

Over the last three and five years, this stock has given multibagger returns of more than 500% and 485%, respectively.

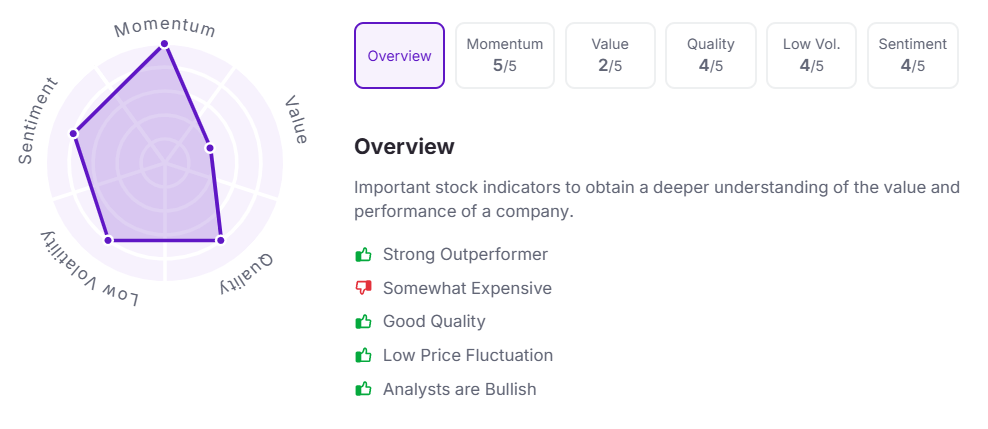

Let’s take a look at its Factor Analysis scores:

Note: The stock prices mentioned are as of 1:15 pm.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.