- Share.Market

- 3 min read

- Published at : 13 Aug 2025 02:28 PM

- Modified at : 13 Aug 2025 02:28 PM

Shares of NMDC Steel Ltd. jumped as much as 19% in intraday trade on Wednesday, a day after the company reported a turnaround in its June quarter (Q1 FY26) results, posting a profit for the first time since listing. The stock hit an intraday high of ₹42.70.

For the quarter ended June 30, 2025, NMDC Steel reported a net profit of ₹25.56 crore, compared to a net loss of ₹547.25 crore in the same period last year. This marks a significant improvement in the company’s bottom line performance.

Revenue from operations rose 66.36% year-on-year to ₹3,365.22 crore, up from ₹2,022.91 crore in Q1 FY25. The strong growth in revenue was driven by higher prices and improved capacity utilisation.

The company reported EBITDA of ₹408 crore, compared to a loss of ₹401 crore in the year-ago period.

The company attributed its improved performance to an increase in product prices and a ramp-up in production capacities, which led to higher operating leverage, meaning fixed costs were spread over a greater output, improving profitability.

As of the end of the June quarter, the Government of India-owned NMDC Limited held a 60.79% promoter stake in NMDC Steel. The Life Insurance Corporation of India (LIC) owned a 14% stake, while Foreign Portfolio Investors (FPIs) held over 4%. Retail shareholders, defined as those holding shares worth up to ₹2 lakh each, accounted for a 10.5% stake, spread across 7.69 lakh investors.

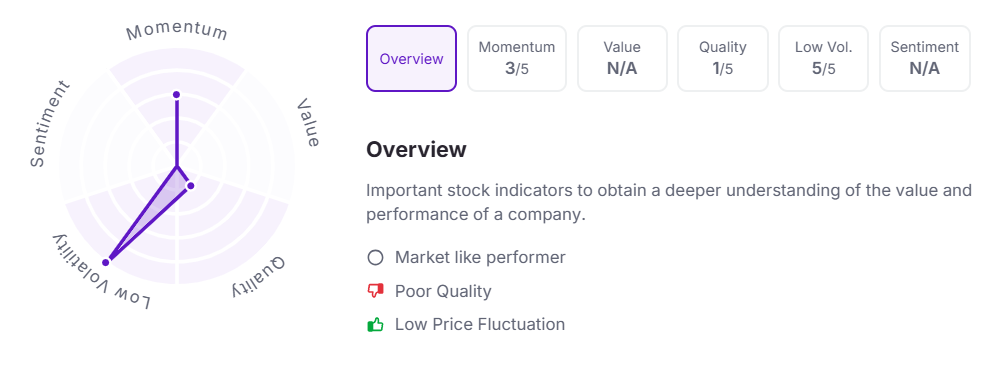

Let’s take a look at its Factor Analysis scores:

Note: The stock price mentioned is as of 2:26 pm.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.