- Share.Market

- 3 min read

- Published at : 22 Oct 2025 01:43 PM

- Modified at : 15 Nov 2025 10:35 AM

State-owned mining major NMDC Ltd. announced a revision in its iron ore prices effective today, October 22, 2025. The company has fixed the price of Baila Lump (65.5%, 10-40mm) at ₹5,550 per tonne and Baila Fines (64%, -10 mm) at ₹4,750 per tonne, according to an exchange filing.

The new FOR (Free on Rail) prices are inclusive of statutory charges like Royalty, District Mineral Foundation (DMF), and National Mineral Exploration Trust (NMET). However, the prices explicitly exclude other levies, including Cess, Forest Permit Fee, Transit fee, GST, and Environmental Cess.

The price revision follows a period of robust operational performance for the company. For the first half of the current fiscal year (H1 FY2026), NMDC reported a significant surge in production, with cumulative iron ore production reaching 22.20 million tonnes (mt), up from 17.47 mt in the same period of FY2025. Similarly, sales climbed to 22.25 mt, demonstrating strong demand and operational efficiency. This latest pricing move is expected to influence the cost structure for domestic steel manufacturers, who rely heavily on NMDC’s supplies.

About the company

NMDC Limited, a prestigious Navratna Public Sector Enterprise operating under the Ministry of Steel, Government of India, stands as the nation’s single largest producer of iron ore and one of the lowest-cost producers globally. The corporation’s core business involves the highly mechanized mining of iron ore from its major complexes in Chhattisgarh and Karnataka, with an ambitious capacity target of 100 million tonnes (MNT) by FY30. Beyond its dominant position in iron ore, NMDC is also the sole organized producer of diamonds in India, operating the mechanized Panna mine in Madhya Pradesh.

NMDC delivered its best-ever physical performance in the second quarter (Q2) of FY2026, headlined by a spectacular September. Iron ore production surged by 23% and sales volumes climbed by 10% compared to Q2 FY2025. This momentum continued into September 2025, where the company recorded monthly production of 3.75 million tonnes (MT) and sales of 3.88 MT. The consistent volume growth is a direct result of effective asset optimization and strategic market response, strongly positioning the company to meet its annual targets.

Over the last five years, this stock has delivered multibagger returns of more than 165%.

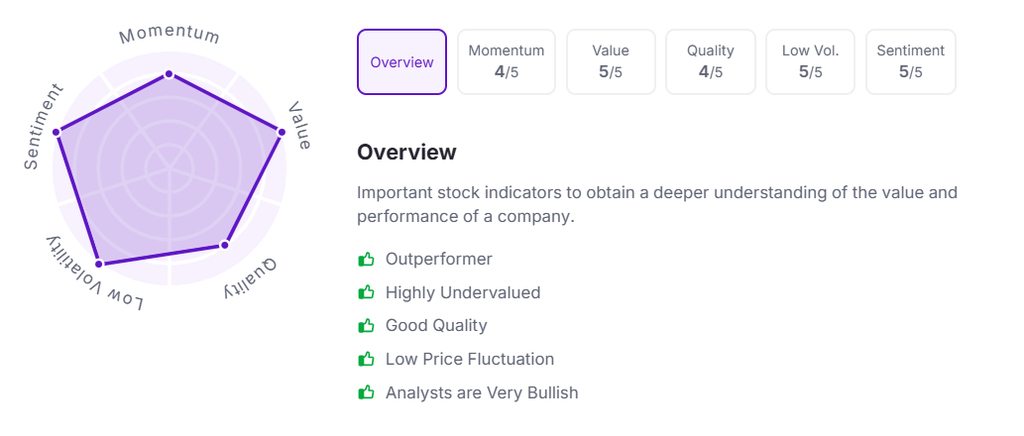

Let’s take a look at its Factor Analysis scores: