- Share.Market

- 3 min read

- Published at : 30 Jul 2025 02:13 PM

- Modified at : 30 Jul 2025 05:23 PM

Shares of The New India Assurance Company Ltd. surged up to 16%, reaching an intraday high of ₹202.50, after the company reported a strong Q1FY26 performance.

NIACL’s gross written premium (GWP) rose 13.1% year-on-year to ₹13,334 crore, supported by healthy growth in Fire, Engineering, and Health portfolios. The company reported a profit after tax of ₹391 crore, a sharp 80% increase.

What stood out this quarter was NIACL’s strong domestic performance. The domestic gross direct premium grew over 15%, significantly outpacing the industry’s domestic growth rate of 8.84%, as per General Insurance Council data. This helped NIACL increase its domestic market share from 14.65% to 15.51%, solidifying its leadership position, especially in the Health and Fire segments where it holds shares of 18.9% and 16.5%, respectively.

Operational efficiency improved notably. Operating expenses fell to 7.86% of net written premium, down from 11.65% last year, reflecting disciplined cost management and better operating leverage.

Looking ahead, NIACL plans to focus on innovative product launches for the retail and MSME segments, with an emphasis on non-motor portfolios where margins are better. The company is also investing in parametric insurance, and is part of a state-level initiative to deepen insurance penetration in Gujarat.

Digitally, NIACL is expanding its reach with multilingual WhatsApp services, AI-enabled chatbots, and a revamped website and customer portal. These upgrades are designed to improve service delivery, streamline claims, and attract younger, tech-savvy customers.

With over 100 years of legacy, NIACL’s Q1 performance marks a clear shift toward a more focused, efficient, and retail-driven strategy. Backed by strong investment income and growing market presence, the insurer is laying the groundwork for sustained, profitable growth — a direction the market is clearly applauding.

Over the last three years, this stock has given multibagger returns of more than 135%.

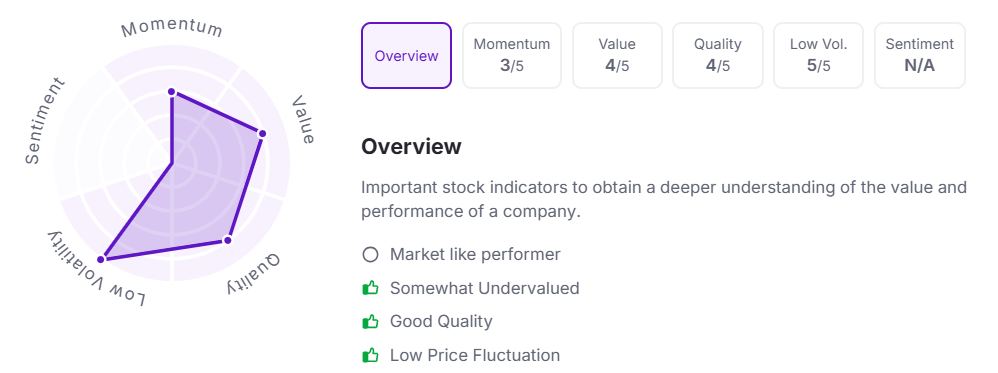

Let’s take a look at its Factor Analysis scores:

Note: The stock price mentioned is as of 2:10 PM.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.