- Share.Market

- 6 min read

- Published at : 28 Aug 2025 12:23 PM

- Modified at : 28 Aug 2025 12:23 PM

The shares of NBCC (India), Premier Energies, Bikaji Foods International, Whirlpool of India, and Zee Entertainment Enterprises are set for their record date on Friday, August 29, 2025. To be eligible for the upcoming dividends, investors must have bought the shares before the ex-date and hold them at least till the record date.

NBCC (India) Ltd. has announced a final dividend of ₹0.14 per equity share. It has a dividend yield of 1.10% TTM.

NBCC (India) Ltd., a Navratna CPSE under the Government of India, is a leading player in the construction sector with operations spanning project management consultancy, engineering procurement & construction, and real estate development, along with a strong global footprint.

In Q1, the company reported consolidated total income of ₹1,713 crore, up 1.73% YoY, and profit after tax of ₹114 crore, marking a robust 31.69% increase. EBITDA margin improved to 5.88%, while new business worth ₹2,412 crore was secured during the quarter.

Over the last three and five years, this stock has given multibagger returns of more than 345% and 430%, respectively.

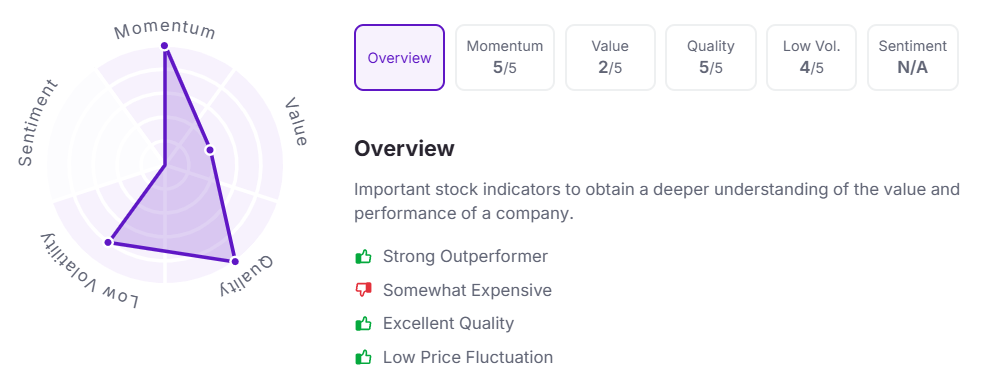

Let’s take a look at its Factor Analysis scores:

Premier Energies Ltd. has announced a final dividend of ₹0.50 per equity share. It has a dividend yield of 0.10% TTM.

Premier Energies is a leading Indian manufacturer of solar cells and modules with over three decades of proven manufacturing expertise, a near-monopoly in solar cell exports from India, and strong credentials as one of the first domestic producers of TOPCon cells. It is ALMM, DCR, and BIS compliant, widely trusted by top IPPs and EPC contractors, and operates one of India’s largest integrated cell-module facilities.

In the latest quarter, revenue from operations stood at ₹18,207 million, up 9.9% YoY, while profit after tax came in at ₹3,078 million, rising 53% YoY.

Bikaji Foods International Ltd. has announced a final dividend of ₹1 per equity share.

Bikaji Foods International Ltd., India’s third-largest ethnic snacks maker and a fast-growing player in the organized snacks market, continued its growth momentum in Q1FY26. Revenue rose 14.2% YoY to ₹6,527 million with 7.5% volume growth, while EBITDA stood at ₹963 million, up 5.1% YoY with a margin of 14.8%. PAT grew 1.3% YoY to ₹585 million, supported by strong performance in ethnic snacks and healthy demand across categories.

Over the last three years, this stock has given multibagger returns of more than 165%.

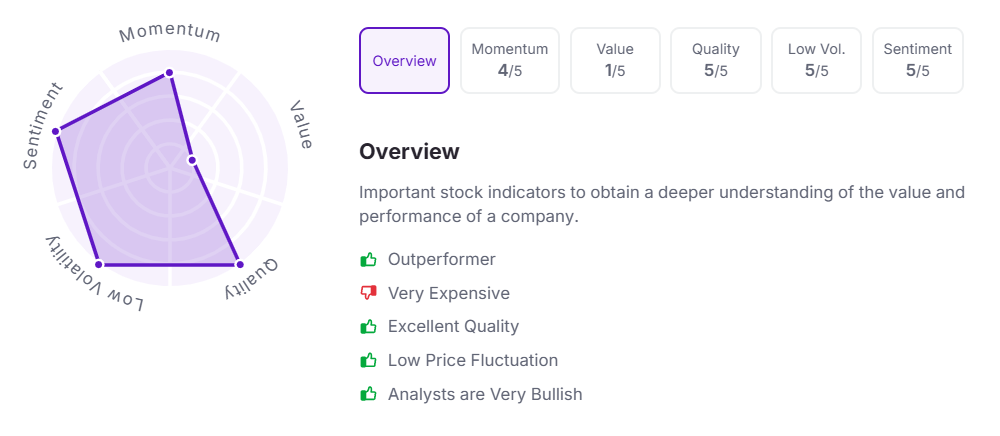

Let’s take a look at its Factor Analysis scores:

Whirlpool of India Ltd. has announced a final dividend of ₹5 per equity share.

Whirlpool of India Ltd., a leading home appliances manufacturer, reported Q1FY26 revenue of ₹2,432 crore, down 2.6% YoY due to weak summer demand and early monsoon impacting industry volumes. Despite this, the company improved profitability through market share gains in refrigerators and washers, cost control under its P4G program, and productivity measures. Consolidated EBITDA stood at ₹211.1 crore, flat YoY, while PBT rose 0.3% to ₹196.4 crore and PAT increased 0.6% to ₹146.1 crore.

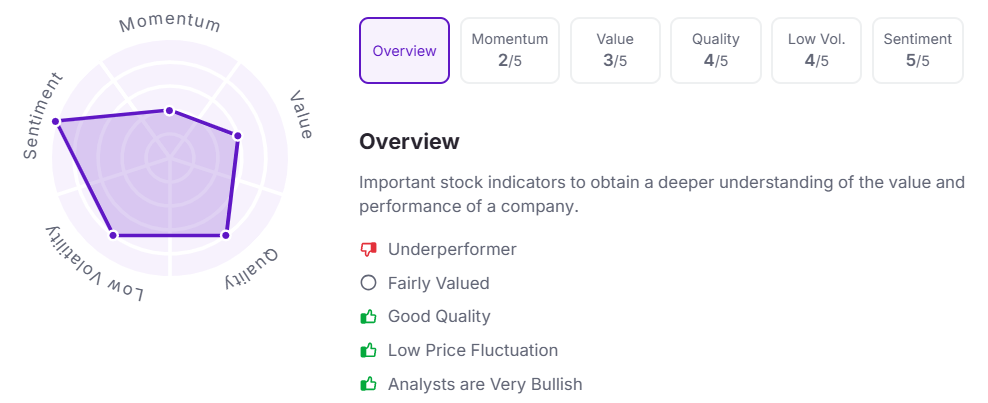

Let’s take a look at its Factor Analysis scores:

Zee Entertainment Enterprises Ltd. has announced a final dividend of ₹2.43 per equity share. It has a dividend yield of 0.80% TTM.

Zee Entertainment Enterprises Ltd., India’s biggest homegrown entertainment network with 30+ years of content creation expertise, operates as a 360° entertainment company across TV, digital, music, films, and syndication.

In FY25, the company delivered resilient financials with EBITDA margin improving to 14.4% (up 390 bps YoY), cash and cash equivalents more than doubling to ₹24.1 billion, and ZEE5’s EBITDA loss reducing 50% to ₹5.5 billion.

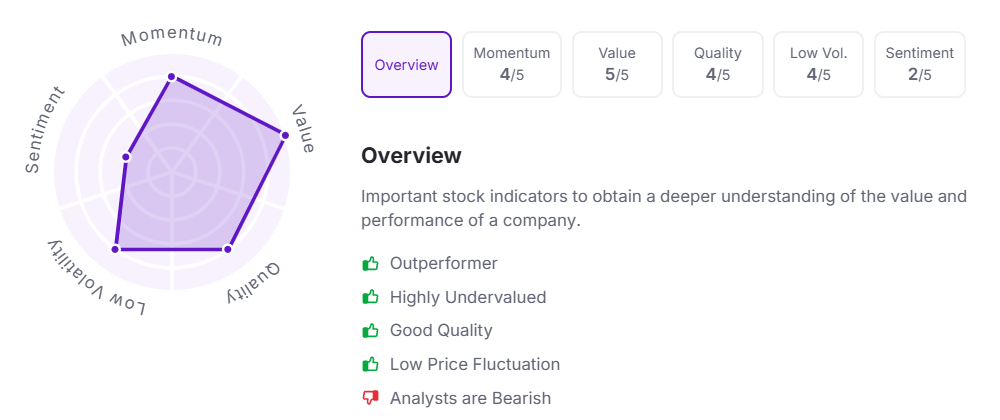

Let’s take a look at its Factor Analysis scores:

Note: The stock prices mentioned are as of 12:20 pm.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.