- Share.Market

- 4 min read

- Published at : 25 Sep 2025 12:40 PM

- Modified at : 15 Nov 2025 11:54 AM

The board of Nazara Technologies Ltd. has approved a 1:2 stock split and a 1:1 bonus issue, key corporate actions aimed at increasing the stock’s liquidity and promoting broader retail investor participation.

The record date for these corporate actions is Friday, September 26, 2025. To be eligible, investors must have bought the shares before the ex-date and hold them at least till the record date.

Stock Split and Bonus Issue Details

The stock split involves the sub-division of 1 existing equity share with a face value of ₹4 into 2 new equity shares, each with a face value of ₹2. Nazara has fixed Friday, September 26, 2025, as the Record Date to determine the eligibility of shareholders for these sub-divided shares.

Following this, the company has announced a bonus issue in the ratio of 1:1. This means that eligible shareholders, after the split adjustment, will receive one bonus equity share for every share they own as on the Record Date.

While a stock split does not fundamentally change the company’s valuation or a shareholder’s total holding value, this reduction in the per-share price might act as a significant catalyst. Such actions are often perceived by the market as a sign of management’s confidence in the company’s continued growth trajectory and ability to sustain strong performance.

About the Company

Nazara Technologies is India’s only publicly listed gaming company, focused on building a global gaming platform with a strong portfolio of intellectual property (IP), publishing, and operating capabilities across India, North America, and other markets. Its key businesses span various gaming genres and services, including Curve Games, Animal Jam, Fusebox Games, Kiddopia, and Sportskeeda, in addition to a digital ad tech business, Datawrkz.

Nazara reported a substantial performance boost in Q1FY26, with revenues doubling year-over-year to ₹498.8 crore and EBITDA increasing by 90% to ₹47.4 crore. Net profit (PAT) saw an even sharper rise of 118% to ₹51.3 crore, driven by strong results from its core IP-led gaming businesses like Fusebox, Animal Jam, and Curve Games.

Over the last five years, this stock has delivered multibagger returns of more than 100%.

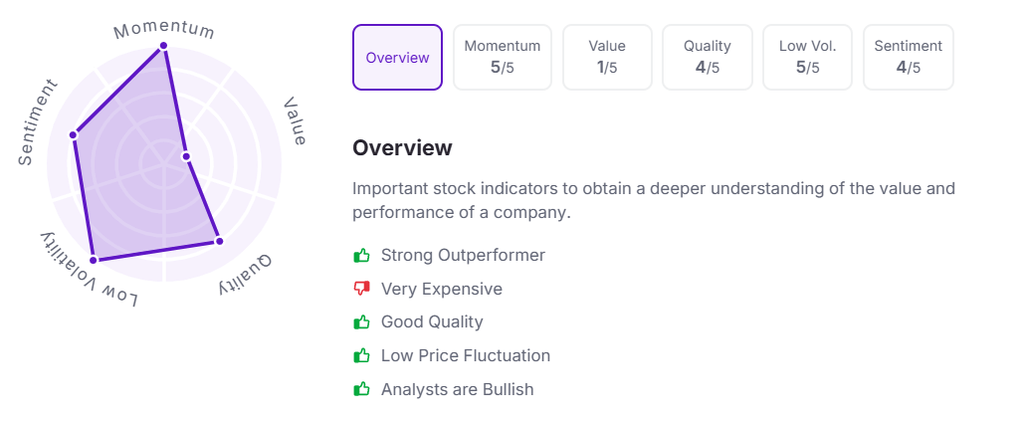

Let’s take a look at its Factor Analysis scores:

Note: The stock price mentioned is as of 12:35 pm.

Disclaimer and Disclosure

Investments in the securities market are subject to market risks, read all the related documents carefully before investing. Registration granted by SEBI, enlistment as Research Analyst with Exchange and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. Kindly refer to https://share.market/ for more details.Investments in WealthBaskets are subject to the Terms of Service. All investors are advised to conduct their own independent research into investment strategies before making an investment decision. PPWB acts as a distributor of mutual funds and it is not an exchange traded product. PPWB acts as a distributor of mutual funds and WealthBaskets and it is not an exchange traded product. Disputes with respect to the distribution activity of Mutual Funds and WealthBaskets will not have access to Exchange investor redressal or Arbitration mechanism. The securities are quoted as an example and not as a recommendation. This is for informational purposes and should not be considered as recommendations.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887 and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226. Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA. CIN: U65990KA2021PTC146954