- Share.Market

- 3 min read

- Published at : 20 May 2025 06:41 PM

- Modified at : 16 Jul 2025 07:40 PM

Torrent Pharmaceuticals reported a consolidated net profit of ₹498 crores for the quarter ended March 31, 2025, up 11% year-on-year. The growth came on the back of strong domestic performance, even as international markets posted mixed trends.

Revenue for the quarter rose 7% YoY to ₹2,959 crores. For the full year FY25, consolidated revenue rose 7% to ₹11,516 crores. Net profit grew 15% to ₹1,911 crores.

The Board of Directors recommended a final dividend of ₹6 per share, subject to shareholder approval. It also proposed raising up to ₹5,000 crores via QIP or other equity instruments. Additionally, Aman Mehta has been appointed as Managing Director effective August 1, 2025, pending shareholder approval.

India Business Drives Growth

Domestic revenues stood at ₹1,545 crores in Q4, growing 12% YoY, led by outperformance in focus therapies. According to AIOCD data, the Indian pharmaceutical market grew 8% during the quarter, while Torrent’s chronic portfolio grew 14%. The company has 21 brands in the top 500, with 14 brands exceeding ₹100 crores in annual sales. For the full year, India revenues reached ₹6,393 crores, up 13% YoY.

International Performance Mixed

US revenues rose 15% YoY to ₹302 crores in Q4 FY25 and ₹1,100 crores for the full year, up 2%. Brazil revenues declined 6% to ₹351 crores in Q4 due to currency depreciation; however, constant currency sales grew 5%. FY25 Brazil revenue stood at ₹1,100 crores, down 2% YoY.

Germany revenue increased 2% to ₹286 crores in Q4. For FY25, revenue grew 6% to ₹1,139 crores.

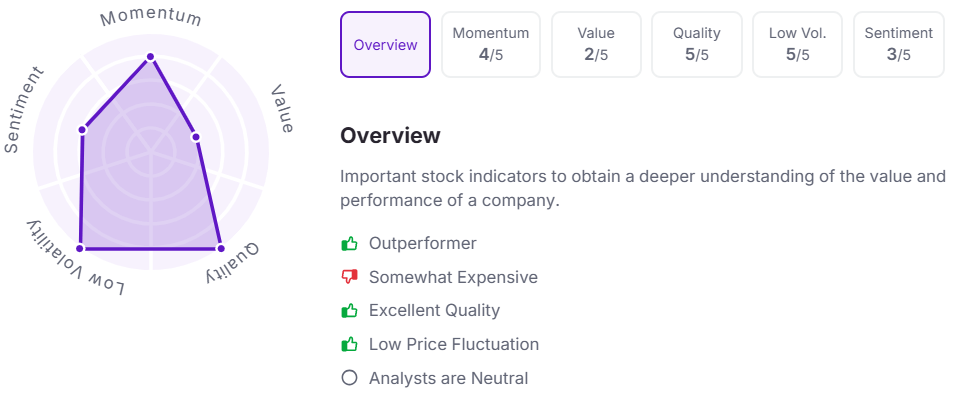

Over the last three years, Torrent Pharmaceuticals has given multibagger returns of 150%. Let’s take a look at its Factor Analysis scores:

Note: The stock price mentioned is as of 3:30 PM.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.