- Share.Market

- 3 min read

- Published at : 08 Jul 2025 10:59 AM

- Modified at : 16 Jul 2025 07:12 PM

The shares of MphasiS and Pfizer are set for their record date on Wednesday, July 09, 2025. To be eligible for the upcoming dividends, investors must have bought the shares before the ex-date and hold them at least till the record date.

MphasiS Ltd. has announced a final dividend of ₹57 per equity share. Its current dividend yield is 1.90%.

Mphasis is a leading IT solutions provider that leverages cloud, cognitive, and next-generation digital technologies to modernize and transform global enterprises. From data center modernization to generative AI services, Mphasis is a trusted technology partner across banking, logistics, healthcare, and more. Its focus on innovation, strategic deal wins, and industry recognition underscores its growing relevance in the evolving enterprise tech landscape.

Mphasis reported a strong Q4 FY25 performance, with gross revenue rising 8.9% YoY and 4.5% QoQ to ₹3,717.5 crore, led by broad-based growth and robust deal momentum. Direct revenue grew 10.4% YoY, while net profit rose 13.6% YoY to ₹446.5 crore. For the full year, revenue rose 6.7% YoY to ₹14,220 crore, and net profit grew 9.5% to ₹1,702 crore. Deal wins totaled $1.27 billion in FY25, with $390 million in Q4—85% of which came from next-gen services.

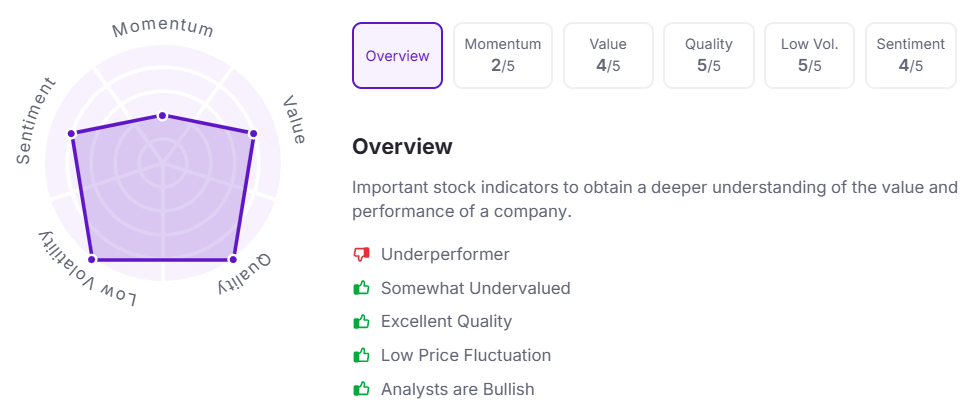

Let’s take a look at its Factor Analysis scores:

Pfizer Ltd. has announced a final dividend of ₹35 and a special dividend of ₹130 per equity share. Its current dividend yield is 0.60%.

Pfizer Inc. is a global biopharmaceutical company focused on discovering, developing, and delivering innovative medicines and vaccines. Through a disciplined capital allocation strategy, it aims to strengthen long-term growth while returning value to shareholders via dividends and maintaining a flexible balance sheet.

Pfizer reported Q1 2025 revenues of $13.7 billion, down 8% YoY, primarily due to a sharp decline in Paxlovid sales. However, the company delivered solid earnings performance, with adjusted net income rising 12% YoY to $5.24 billion and adjusted EPS improving to $0.92. Growth was led by strong performance in certain products.

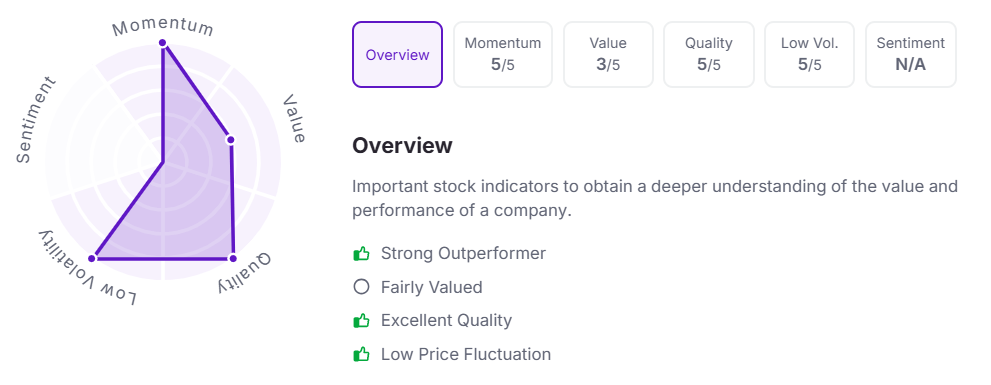

Let’s take a look at its Factor Analysis scores:

Note: The stock prices mentioned are as of 10:55 AM.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.