- Share.Market

- 6 min read

- Published at : 18 Sep 2025 11:50 AM

- Modified at : 18 Sep 2025 11:51 AM

The shares of Mazagon Dock, Bharat Dynamics, NALCO, and NLC India are set for their record date on Friday, September 19, 2025. To be eligible for the upcoming dividends, investors must have bought the shares before the ex-date and hold them at least till the record date.

Mazagon Dock Shipbuilders Ltd. has announced a final dividend of ₹2.71 per equity share. It has a current dividend yield of 0.70% TTM.

Mazagon Dock Shipbuilders is a premier Indian shipbuilding yard with a history dating back to 1774. A government-owned company since 1960, it specializes in building warships and submarines for the Indian Navy and Coast Guard, as well as various other vessels for domestic and international clients.

Mazagon Dock reported a strong performance for Q1FY26. Revenue from operations was ₹2,626 crore, and total income reached ₹2,915 crore. The company saw a significant improvement in profitability, with an EBITDA of ₹591 crore and a profit after tax (PAT) of ₹452 crore.

Over the last three and five years, this stock has given multibagger returns of more than 1,300% and 4,065%, respectively.

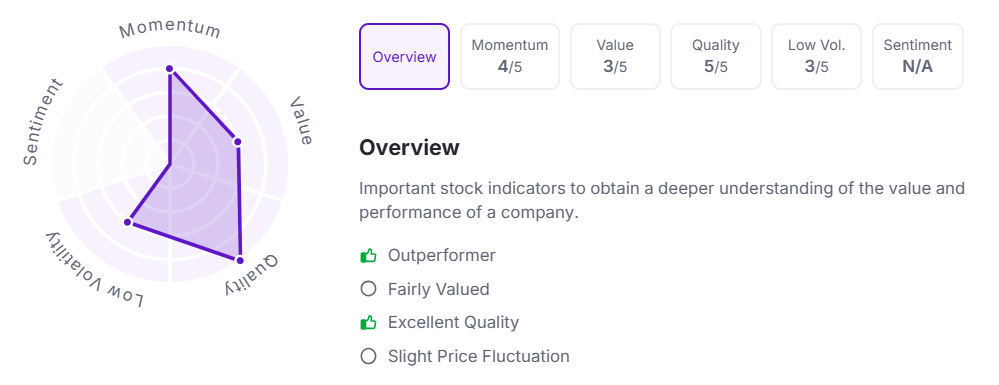

Let’s take a look at its Factor Analysis scores:

Bharat Dynamics Ltd. has announced a final dividend of ₹0.65 per equity share. It has a current dividend yield of 0.30% TTM.

Bharat Dynamics is a public sector undertaking under the Ministry of Defence, established in 1970. The company serves as the manufacturing base for guided missile systems and allied defense equipment for the Indian Armed Forces.

Bharat Dynamics Limited reported a total income of ₹33,479.14 lakh for the quarter ended June 30, 2025. This marks a notable increase from ₹27,154.95 lakh in the same quarter of the previous year. The company’s profit after tax (PAT) for the quarter was ₹2,216.46 lakh, showing strong growth compared to ₹721.63 lakh in Q1FY25. This performance highlights BDL’s increasing revenue and improved profitability.

Over the last three and five years, this stock has given multibagger returns of more than 250% and 930%, respectively.

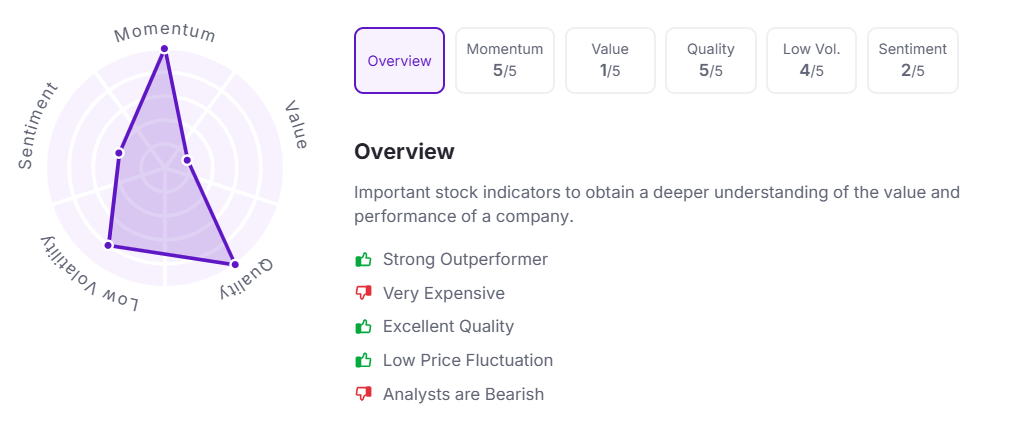

Let’s take a look at its Factor Analysis scores:

National Aluminium Company Ltd. has announced a final dividend of ₹2.50 per equity share. It has a current dividend yield of 4.70% TTM.

National Aluminium Company is a “Navratna” company and one of India’s largest bauxite, alumina, aluminum, and power complexes. The company operates a captive bauxite mine, an alumina refinery, an aluminum smelter, and a captive power plant, all located in Odisha. The Indian government holds a majority stake of 51.28% in the company.

NALCO reported a strong financial performance for Q1FY26. The company’s revenue from operations saw a significant increase of 33.3% compared to the same period in the previous year, rising to ₹3,807 crore. This growth translated to a remarkable surge in profitability. The profit after tax (PAT) for the quarter was ₹1,064 crore, a substantial increase of 77% over the ₹601 crore PAT reported in Q1FY25.

Over the last three and five years, this stock has given multibagger returns of more than 175% and 515%, respectively.

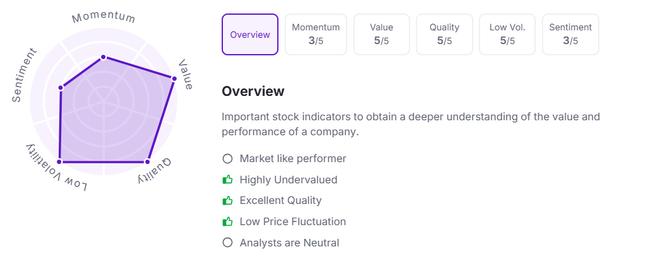

Let’s take a look at its Factor Analysis scores:

NLC India Ltd. has announced a final dividend of ₹1.50 per equity share. It has a current dividend yield of 0.60% TTM.

NLC India is a Navratna public sector company engaged in lignite mining and power generation. Established in 1956, the company has diversified into renewable energy and coal mining. With a strong focus on sustainable development, NLCIL integrates environmental protection into its corporate objectives and maintains a commitment to community welfare.

NLCIL reported a strong performance for Q1FY26. The company’s revenue from operations was ₹3,825.61 crore, showing a 13.25% growth compared to ₹3,378.17 crore in Q1FY25. The company’s profitability also saw a significant boost, with a Profit After Tax (PAT) of ₹839.21 crore, which is a 48.09% increase from ₹566.69 crore in Q1FY25.

Over the last three and five years, this stock has given multibagger returns of more than 245% and 385%, respectively.

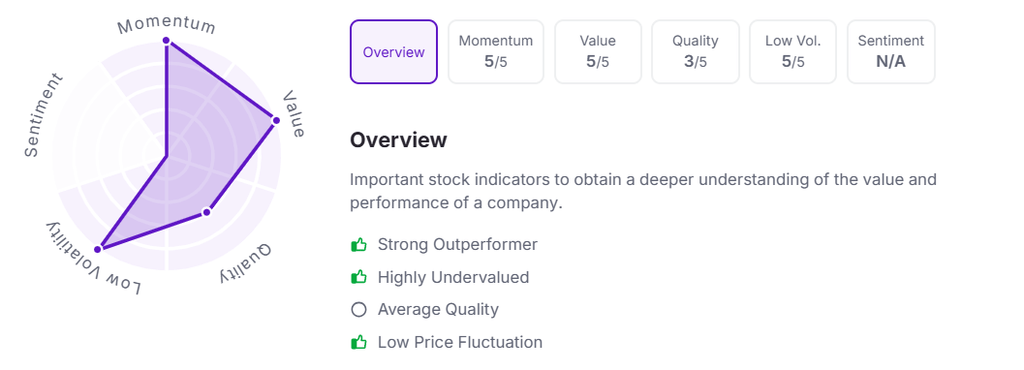

Let’s take a look at its Factor Analysis scores:

Note: The stock prices mentioned are as of 11:48 am.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.