- Share.Market

- 3 min read

- Published at : 21 Jul 2025 05:23 PM

- Modified at : 21 Jul 2025 05:23 PM

Shares of Mastek Ltd. surged, reaching an intraday high of ₹2,818.00 after the company announced its Q1FY26 results.

Mastek Limited reported a steady financial performance for the first quarter of FY26, driven by sustained demand across digital engineering and AI services. Consolidated revenue rose 12.5% year-on-year to ₹914.7 crore for the quarter ended June 30, 2025.

Net profit grew 28.7% year-on-year to ₹92.1 crore, supported by operational efficiency and higher-margin engagements. On a sequential basis, PAT rose 13.5% compared to the previous quarter.

Operating EBITDA stood at ₹137.3 crore, marking a 10.8% year-on-year increase.

Mastek’s 12-month order backlog reached ₹2,347.9 crore, reflecting 8.3% growth in rupee terms over the previous year. The company added 12 new clients during the quarter, taking its total active client base to 323.

The quarter saw strong deal activity, with Mastek closing over 10 new AI-led contracts across generative and agentic AI solutions. Key wins included engagements in healthcare, government services, education, and financial sectors, particularly in the UK and Europe.

Management stated that while the US business faced challenges in some accounts, the overall pipeline and order backlog remain healthy. Oracle-led engagements in healthcare and commercial sectors continued to contribute to growth.

Mastek’s total employee count stood at 4,824 as of June 30, 2025, down from 5,058 in the previous quarter. Attrition for the last twelve months stood at 19.5%.

Looking ahead, Mastek said it remains focused on expanding its AI-driven offerings and strengthening client relationships to support sustainable, profitable growth.

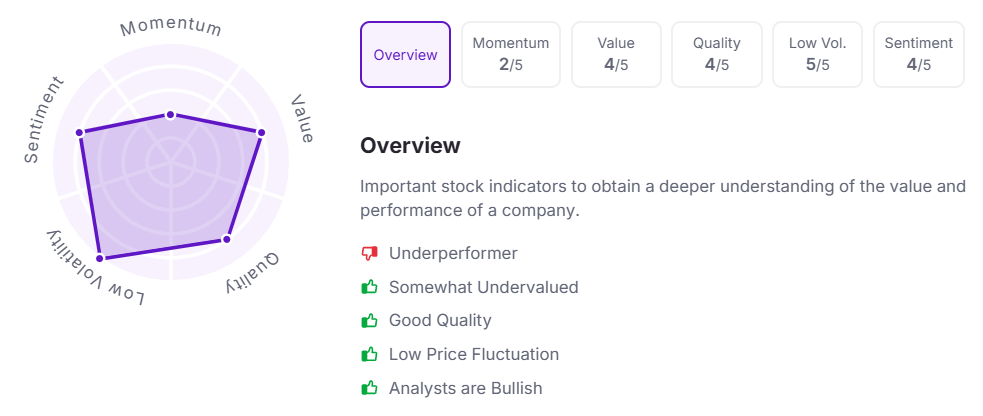

Let’s take a look at its Factor Analysis scores:

Note: The stock price mentioned is as of 3:30 PM.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.