- Share.Market

- 5 min read

- Published at : 03 Jul 2025 11:47 AM

- Modified at : 16 Jul 2025 07:30 PM

The shares of Mahindra & Mahindra, Axis Bank, Nestle, and Tech Mahindra are set for their record date on Friday, July 04, 2025. To be eligible for the upcoming dividends, investors must have bought the shares before the ex-date and hold them at least till the record date.

Mahindra & Mahindra Ltd. has announced a dividend of ₹25.30 per equity share.

Mahindra & Mahindra (M&M), one of India’s leading automotive and farm equipment companies, is a flagship of the Mahindra Group with a legacy spanning over seven decades. As of FY25, M&M is India’s No. 1 SUV player with a 22.5% revenue market share, and holds a dominant 43.3% share in the domestic tractor segment. The company has a strong presence across rural and semi-urban markets.

Over the last three years, this stock has given multibagger returns of more than 190%.

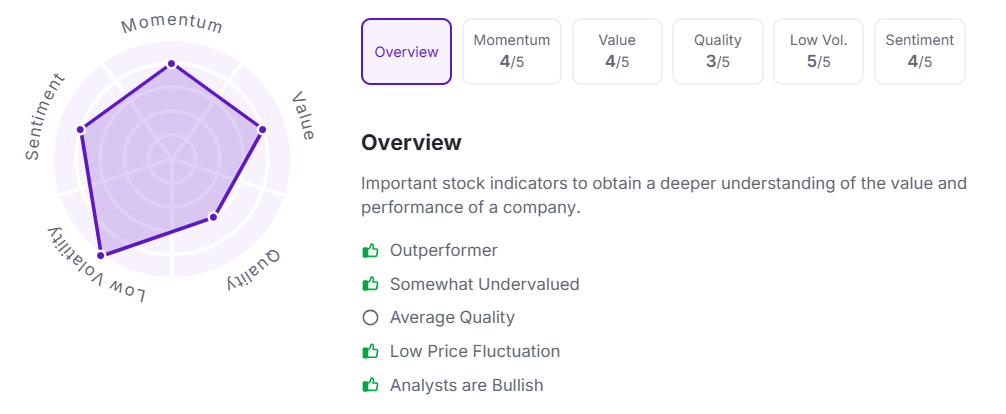

Let’s take a look at its Factor Analysis scores:

Axis Bank Ltd. has announced a final dividend of ₹1 per equity share.

Axis Bank, India’s third-largest private sector bank, now serves ~59 million customers with a balance sheet of ₹16.1 lakh crore. As of March 2025, it operates 5,876 branches and 13,941 ATMs, with nearly half in rural and semi-urban areas. The bank has a strong retail focus, a diversified loan book, and is a leader in digital banking with 14% credit card and 32% UPI market share.

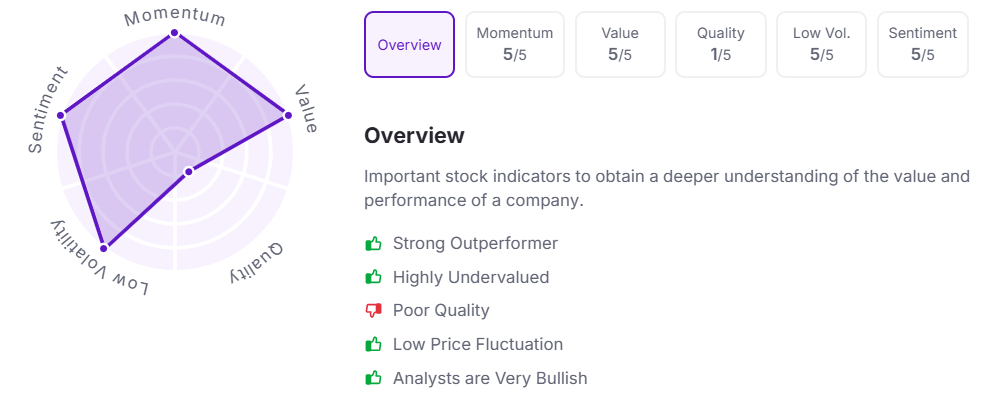

Let’s take a look at its Factor Analysis scores:

Nestle India Ltd. has announced a final dividend of ₹10 per equity share. It has a dividend yield of %.

Nestlé India is a leading FMCG player with a 112-year legacy and a reach of over 5.2 million outlets. In FY25, it posted its highest-ever domestic sales, led by strong growth in beverages, confectionery, and out-of-home segments. With 9 factories and a 10th coming up in Odisha, the company continues to focus on innovation, rural expansion, and sustainability, while e-commerce now contributes 8.5% of domestic sales.

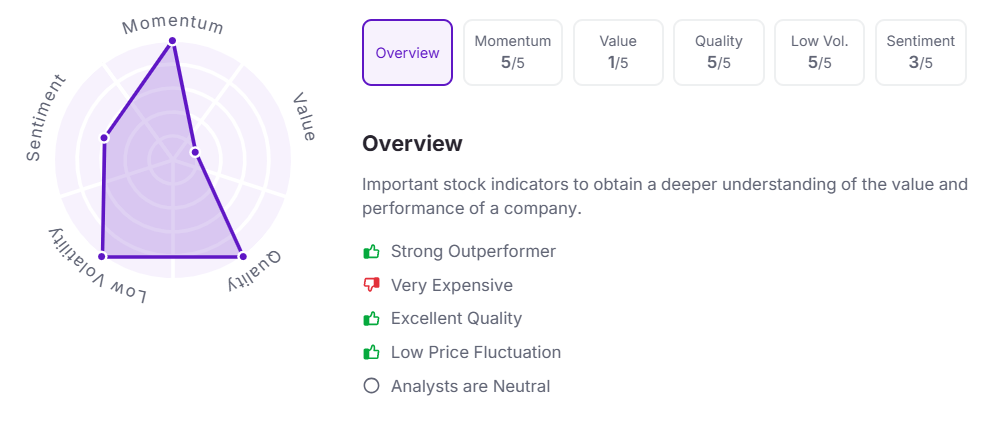

Let’s take a look at its Factor Analysis scores:

Tech Mahindra Ltd. has announced a final dividend of ₹30 per equity share. Its current dividend yield is 0.90% TTM.

Tech Mahindra is a global technology and consulting company and part of the Mahindra Group, operating in over 90 countries with 150,000+ professionals serving 1,100+ clients. In FY25, it reported revenue of ₹52,988 crore and PAT of ₹4,252 crore, up 80% YoY, with EBIT margin expanding 360 bps. Backed by strong deal wins, AI-led innovations, and deep domain expertise, Tech Mahindra continues to scale digital transformation across industries, while maintaining a strong focus on sustainability and global partnerships.

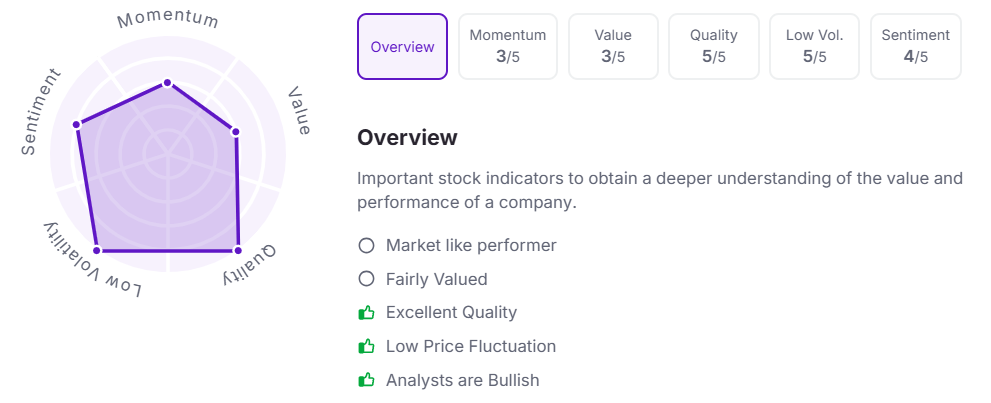

Let’s take a look at its Factor Analysis scores:

Note: The stock prices mentioned are as of 11:45 AM.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.