- Share.Market

- 3 min read

- Published at : 26 May 2025 05:16 PM

- Modified at : 16 Jul 2025 07:48 PM

The shares of L&T Finance and Trident are set for their record date on Tuesday, May 27, 2025. To be eligible for the upcoming dividends, investors must have bought the shares before the ex-date and hold them at least till the record date.

L&T Finance Ltd

L&T Finance Ltd., one of India’s leading NBFCs, has announced a final dividend of ₹2.75 per equity share. Its current dividend yield is 1.40%.

The company had previously announced a final dividend of ₹2.50 per equity share on June 18, 2024.

L&T Finance has a legacy spanning over three decades. The company serves over 2.6 crore customers through a widespread distribution network of 13,000+ partner touchpoints and employs nearly 35,000 people. Known for its strong corporate governance and digital innovation, the company is rated ‘AAA’ by all four major rating agencies and has consistently maintained top-tier ESG ratings.

L&T Finance closed FY25 with its highest-ever annual PAT of ₹2,644 crore, up 14% year-on-year. Retail disbursements grew 11% YoY to ₹60,040 crore, with strong traction in home loans, LAP, and farmer finance. The retail loan book expanded 19% YoY, now making up 97% of the consolidated book.

Over the last three years, this stock has given multibagger returns of more than 140%.

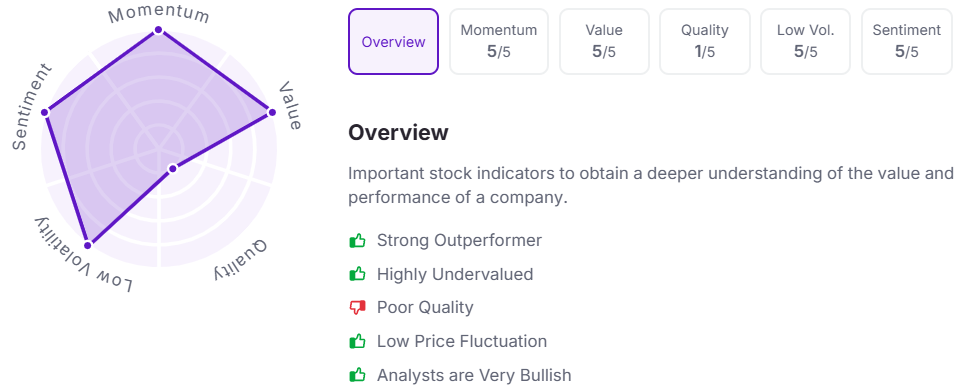

Let’s take a look at its Factor Analysis scores:

Trident Ltd

Trident Ltd., a leading Indian FMCG company, has announced a third interim dividend of ₹2 per equity share. Its current dividend yield is 1.30%.

Trident Group began as a single yarn manufacturing unit in Punjab and has since grown into one of the world’s largest integrated home textile manufacturers. The company has diversified into towels, bed linen, paper, chemicals, and energy. With operations spanning over 100 countries, Trident has built a reputation as a trusted global brand in lifestyle and wellness, while staying rooted in sustainability and inclusive growth.

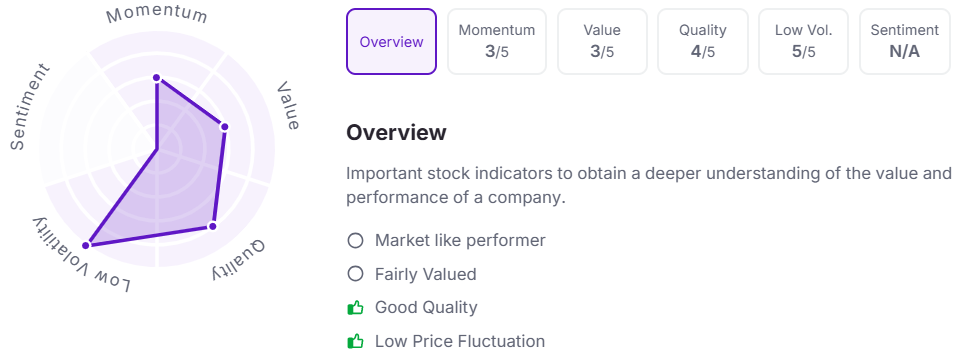

Let’s take a look at its Factor Analysis scores:

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.