- Share.Market

- 3 min read

- Published at : 28 Jul 2025 03:16 PM

- Modified at : 28 Jul 2025 03:16 PM

Shares of Laurus Labs Ltd. rose as much as 7% reaching an intraday high of ₹901.50, after the company announced a significant land allotment from the Government of Andhra Pradesh and reported a strong set of Q1FY26 results.

Strategic Land Allotment for Laurus Pharma Zone

Laurus Labs informed the exchanges that it has secured 531.77 acres of land in IP Rambilli Phase-II, Anakapalli District, for the establishment of its upcoming Laurus Pharma Zone (LPZ). This project is a major expansion initiative, with a planned investment of ₹5,630 crore over eight years and expected to create employment for 6,350 people across three phases.

The land allotment marks a critical milestone in the company’s infrastructure and manufacturing expansion strategy, giving it the physical and regulatory foundation for scaling its pharma operations across APIs, formulations, and advanced therapies.

Q1FY26 Performance: Growth Led by CDMO and Generics

Laurus Labs reported a 31% year-on-year revenue growth to ₹1,570 crore in Q1FY26. The company’s EBITDA more than doubled to ₹389 crore, supported by strong operating leverage and a favourable product mix.

Revenue growth was led by its CDMO segment, which saw a 103% YoY increase to ₹522 crore, supported by multiple NCE deliveries and expansion of manufacturing assets. The API business was down 4%, while the FDF (Finished Dosage Form) segment posted a 50% growth aided by new contract wins and increased utilization.

Construction of new facilities, including a Gene/ADC plant in Hyderabad and a fermentation facility in Vizag, also commenced during the quarter, reinforcing Laurus Labs’ push into advanced therapies and biomanufacturing capabilities.

Over the last five years, Laurus Labs has given multibagger returns of more than 510%.

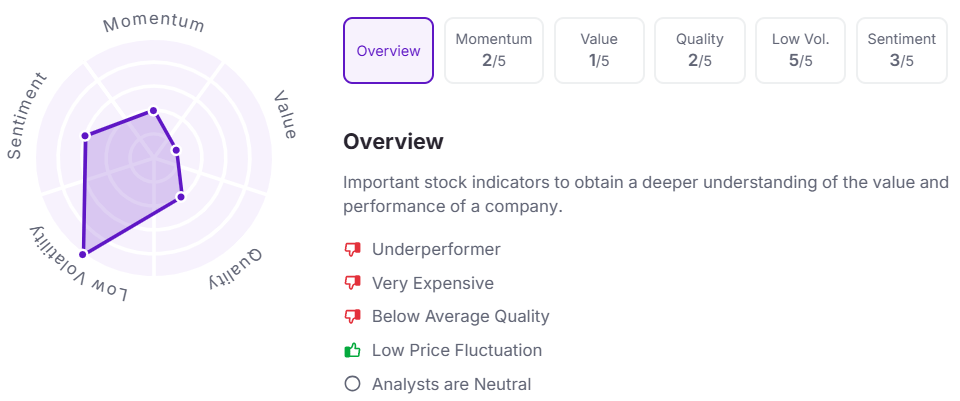

Let’s take a look at its Factor Analysis scores:

Note: The stock price mentioned is as of 3:15 PM.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.