- Share.Market

- 3 min read

- Published at : 16 Sep 2025 12:35 PM

- Modified at : 16 Sep 2025 12:47 PM

Larsen & Toubro Ltd.’s Heavy Civil Infrastructure (HCI) business vertical has secured a significant order from Nuclear Power Corporation of India Ltd (NPCIL) for the Kudankulam Nuclear Power Project (KKNPP – 5 & 6) in Tamil Nadu. The project, valued between ₹1,000 to ₹2,500 crore, marks a key win for the company.

The scope of work is extensive, covering the complete mechanical package for the nuclear power plant. This includes the crucial installation of the nuclear reactor and turbine systems, along with their generators and condensers.

The project also involves the installation of essential support systems like seawater systems, polar and trestle cranes, and other related equipment. Additionally, L&T’s responsibilities extend to the installation of all associated piping, structural steelwork, anti-corrosion coating, and insulation, as well as full-scale testing across various buildings and structures on the site.

Post the announcement, shares of L&T gained up to 2%, reaching an intraday high of ₹3,654.90 apiece.

About the Company

Larsen & Toubro is a leading Indian multinational conglomerate with a strong presence in EPC Projects, Hi-Tech Manufacturing, and various services across multiple geographies. The company has a diverse business portfolio and an extensive international reach, operating in over 50 countries globally.

For the quarter ended June 30, 2025, the company reported robust growth across all key parameters. It achieved a 30% year-over-year growth in consolidated Profit After Tax (PAT) to ₹3,617 crore. Revenue also saw a significant increase, growing by 16% to ₹63,679 crore. Furthermore, the company secured its highest ever Q1 order inflow, totaling ₹94,453 crore, a 33% increase from the previous year.

Over the last five years, this stock has given multibagger returns of more than 300%.

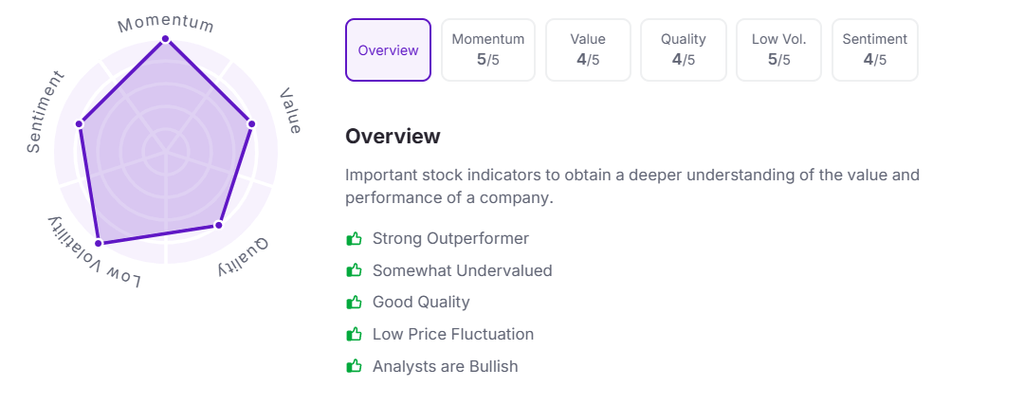

Let’s take a look at its Factor Analysis scores:

Note: The stock prices mentioned are as of 12:34 pm.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.