- Share.Market

- 3 min read

- Published at : 02 Jun 2025 03:22 PM

- Modified at : 16 Jul 2025 07:54 PM

The shares of Larsen & Toubro and Nuvama Wealth Management are set for their record date on Tuesday, June 03, 2025. To be eligible for the upcoming dividends, investors must have bought the shares before the ex-date and hold them at least till the record date.

Larsen & Toubro Ltd

Larsen & Toubro Ltd. has announced a dividend of ₹34 per equity share. Its current dividend yield is 0.80%.

Larsen & Toubro (L&T) is a diversified Indian multinational operating in EPC projects, hi-tech manufacturing, and services across more than 50 countries. With a legacy of over 80 years, the company has maintained leadership across key sectors by combining engineering excellence with a strong customer focus.

L&T delivered a robust performance in FY25, with order inflows rising 18% YoY, and consolidated revenue growing 16% YoY to ₹2.56 lakh crores. Profit after tax was up 15% from the previous year. The company’s order book reached a record ₹5.79 lakh crore, up 22% YoY.

Over the last three years, this stock has given multibagger returns of more than 120%.

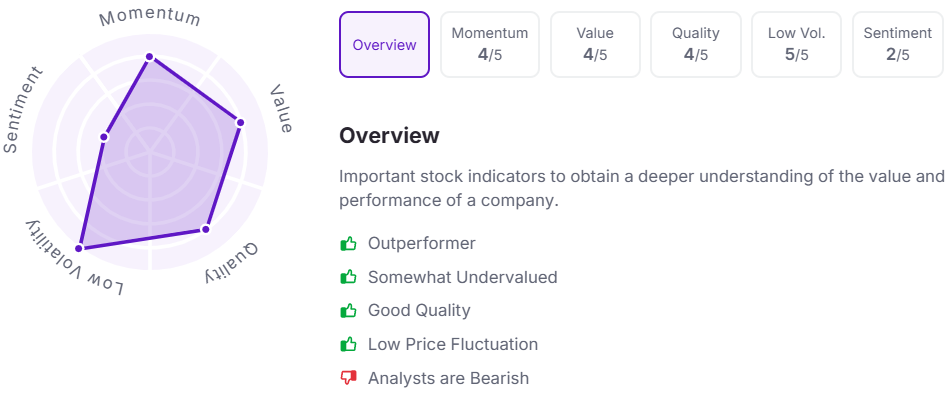

Let’s take a look at its Factor Analysis scores:

Nuvama Wealth Management Ltd

Nuvama Wealth Management Ltd. has announced an interim dividend of ₹69 per equity share. Its current dividend yield is 2.00%.

Nuvama Wealth Management is a diversified financial services platform offering wealth management, asset management, and capital markets solutions. With a digital-first approach and strong domain expertise, the company serves high-net-worth individuals, retail investors, and institutions across India.

Nuvama reported a strong FY25 performance, with revenue rising 32% YoY to ₹4,159 crores and net profit rising 58% to ₹985 crores. Growth was broad-based across wealth, asset management, and broking segments, driven by rising client engagement, digital scale, and improved operating leverage.

Over the last three years, this stock has given multibagger returns of more than 155%.

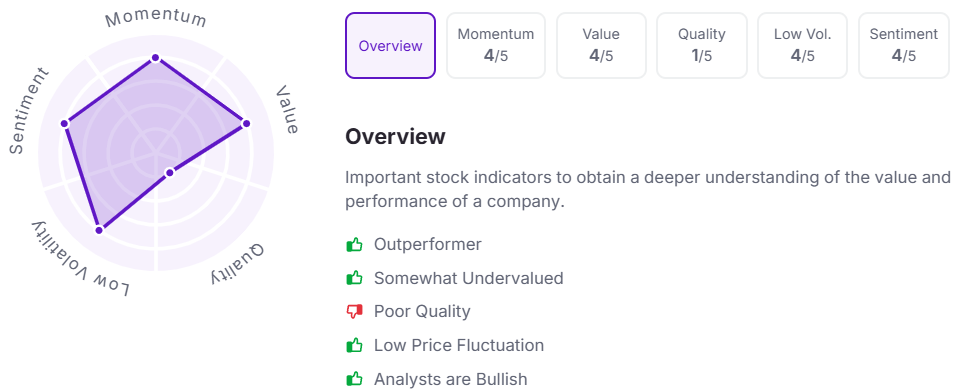

Let’s take a look at its Factor Analysis scores:

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.