- Share.Market

- 3 min read

- Published at : 14 Aug 2025 11:10 AM

- Modified at : 14 Aug 2025 11:10 AM

Power Finance Corporation is set for its record date on Monday, August 18, 2025. To be eligible for the upcoming dividend, investors must have bought the shares before the ex-date and hold them at least till the record date.

Power Finance Corporation Ltd. has announced an interim dividend of ₹3.70 per equity share. It has a high dividend yield of 3.80% TTM.

PFC is a Schedule-A Maharatna Central Public Sector Enterprise (CPSE) under the Ministry of Power, and one of India’s largest non-banking financial companies, specializing in financing the power sector. Headquartered in New Delhi with regional offices in Mumbai and Chennai, PFC holds around 20% market share in the sector, provides consultancy and advisory services, and is rated AAA domestically and investment grade internationally.

In Q1 FY26, PFC reported an 11% year-on-year rise in revenue to ₹28,539 crore and a 25% increase in profit after tax to ₹8,981 crore. Performance was supported by stable loan growth, higher net interest income, and improved loan quality, with coverage on high-risk loans rising to 79% from 77% in the previous quarter. Provisions stood at ₹23,531 crore, or 2.07% of the loan book, providing a strong buffer against potential defaults. Subsidiary REC Ltd. saw the resolution of a large stressed asset, TRN Energy Pvt Ltd, under RBI’s 2019 framework, involving a ₹392 crore write-off and a ₹272 crore reversal in expected credit loss.

Over the last three and five years, this stock has given multibagger returns of more than 330% and 445%, respectively.

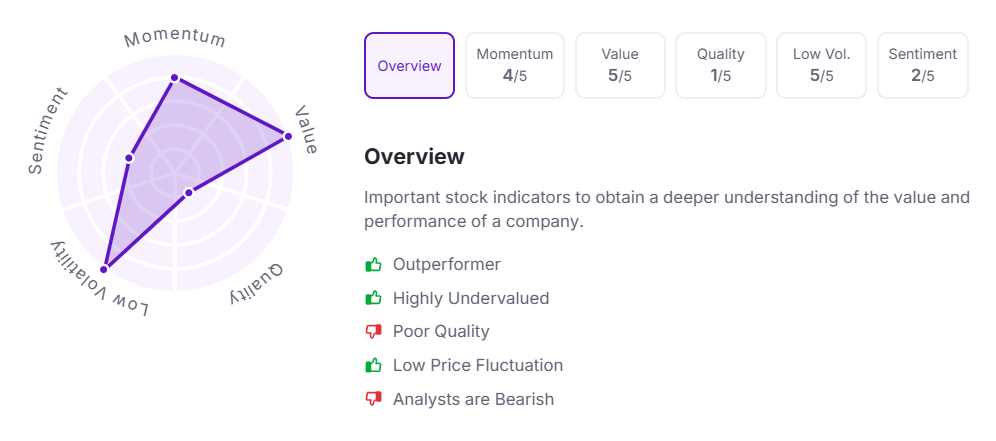

Let’s take a look at its Factor Analysis scores:

Note: The stock price mentioned is as of 11:05 am.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.