- Share.Market

- 3 min read

- Published at : 04 Jun 2025 03:30 PM

- Modified at : 16 Jul 2025 08:01 PM

KEC International Ltd., a global EPC major and part of the RPG Group, has announced the win of new orders worth ₹2,211 crore across its Transmission & Distribution (T&D), Oil & Gas Pipelines, and Cables businesses. With this, the year-to-date (YTD) order intake crosses ₹4,200 crore, a ~40% growth compared to the same period last year.

Major International Wins Bolster T&D Book

The largest share of the new orders comes from the T&D business, where KEC has secured high-voltage transmission line projects in the Middle East and the Americas. This includes:

- Design, supply, and installation of 380 kV overhead transmission lines in Saudi Arabia, one of the largest and most active markets for grid infrastructure in the region.

- A major tower supply order secured by its subsidiary SAE Towers in Mexico, further strengthening KEC’s footprint in the North American T&D market.

These wins reinforce the company’s strategic focus on the MENA region and the Americas, both of which are seeing increased investments in energy infrastructure.

Second Oil & Gas Order in Africa

In the Oil & Gas Pipelines segment, KEC has bagged its second international order for terminal station works in Africa, in addition to an ongoing pipeline laying project. This win underlines the growing traction of KEC in non-traditional EPC segments beyond T&D and Civil.

Cables Business Secures Fresh Supply Orders

KEC also announced multiple new orders for the supply of various types of cables to customers across India and overseas markets. This segment continues to deliver stable performance, supporting the core EPC operations and reinforcing KEC’s role as a vertically integrated infrastructure player.

As the flagship company of RPG Enterprises, a diversified Indian conglomerate with a turnover of USD 5.2 billion, KEC is a key player in shaping global infrastructure growth.

With robust international traction and a diversified order pipeline, KEC International is well-positioned to capitalize on infrastructure investment cycles across geographies in FY26.

Over the last three years, this stock has given multibagger returns of more than 125%

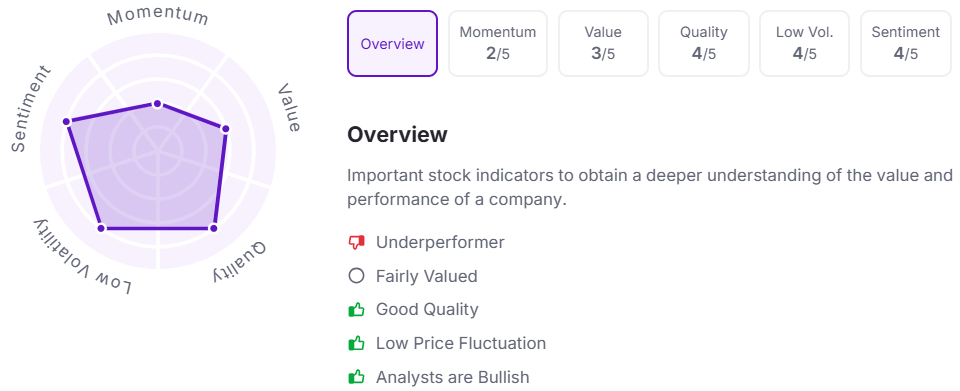

Let’s take a look at its Factor Analysis scores:

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.