- Share.Market

- 3 min read

- Published at : 23 Sep 2025 10:54 AM

- Modified at : 23 Sep 2025 11:23 AM

Shares of KEC International Ltd. surged up to 8%, reaching an intraday high of ₹937.80 apiece.

Post market hours on Monday, September 22, the company said it secured a major new order worth ₹3,243 crore in its international Transmission & Distribution (T&D) business. This new contract, which includes its largest ever EPC order to date, is expected to significantly boost the company’s growth trajectory and has led to a surge in its stock price.

This substantial order intake is primarily composed of two key projects:

- A major contract for 400 kV Transmission lines in the United Arab Emirates (UAE).

- The supply of towers, hardware, and poles in the Americas.

The order from the UAE not only strengthens KEC International’s footprint in the Middle East but also substantially expands its international T&D order book. With this latest win, the company’s year-to-date (YTD) order intake has now reached an impressive ~₹11,700 crore, positioning it well for future growth.

About the Company

KEC International is a global infrastructure Engineering, Procurement, and Construction (EPC) major with a diverse presence in various sectors, including Power Transmission & Distribution, Civil, Transportation, Renewables, Oil & Gas Pipelines, and Cables.

For Q1FY26, the company’s consolidated revenue increased by 11% year-over-year (YoY) to ₹5,023 crore. EBITDA saw substantial growth, rising by 19% YoY to ₹350 crore, with the EBITDA margin expanding by 50 basis points to 7.0%. Both Profit Before Tax (PBT) and Profit After Tax (PAT) saw stellar growth of over 40%, reaching ₹159 crore and ₹125 crore, respectively.

Over the last three and five years, this stock has delivered multibagger returns of more than 105% and 195%, respectively.

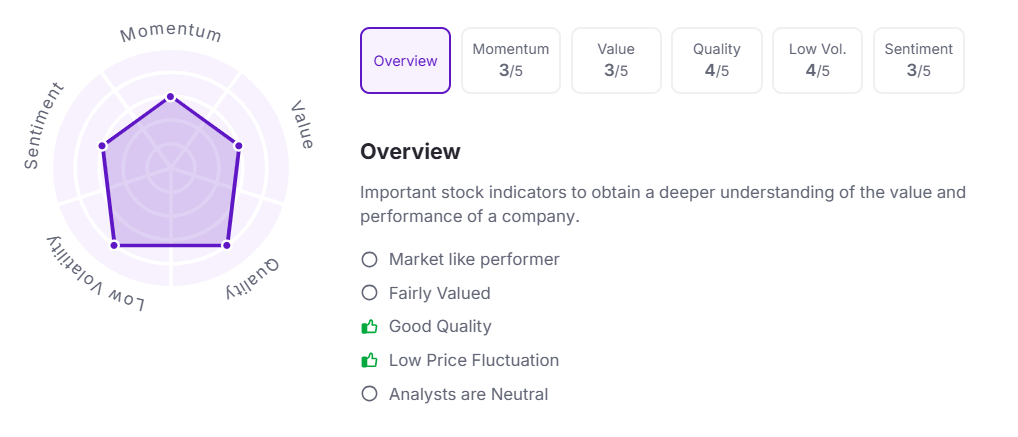

Let’s take a look at its Factor Analysis scores:

Note: The stock prices mentioned are as of 10:50 am.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.