- Share.Market

- 3 min read

- Published at : 08 Aug 2025 01:00 PM

- Modified at : 08 Aug 2025 01:00 PM

Shares of Kalyan Jewellers India Ltd. fell as much as 9%, even after the company reported a strong set of earnings for the quarter ended June 30, 2025 (Q1 FY26).

The company reported a 31% year-on-year (YoY) growth in consolidated revenue to ₹7,268 crores in Q1 FY26, compared to ₹5,528 crores in the same quarter last year. This growth was supported by steady demand across both domestic and international markets, despite ongoing volatility in gold prices.

Consolidated Profit After Tax (PAT) for the quarter stood at ₹264 crores, a 49% increase from ₹178 crores in Q1 FY25. The company attributed the earnings growth to better operating efficiency and a favourable sales mix, even as it operated in a high gold price environment.

Standalone revenue from India, which forms the bulk of Kalyan’s business, was ₹6,142 crores, up 31% YoY. Standalone PAT came in at ₹256 crores, representing a 55% increase compared to the same period last year. The company continues to benefit from its widespread retail presence and regional brand strength.

The Middle East operations contributed ₹1,026 crores in revenue, growing 27% YoY. Net profit from the region stood at ₹22 crores, up 18%. The company said demand trends in the region remained healthy, and the performance reflects resilience despite macroeconomic challenges.

Kalyan’s digital-first lifestyle jewellery platform Candere posted ₹66 crores in revenue but remained in the red with a net loss of ₹10 crores for the quarter. The business continues to face profitability pressures amid growing competition in the online jewellery segment.

Commenting on the results, Ramesh Kalyanaraman, Executive Director of Kalyan Jewellers, said the company has started Q2 on a positive note and is preparing for the upcoming festive season with new collections and marketing campaigns. He noted that despite gold price volatility, consumer demand has remained robust.

As of June 30, 2025, Kalyan Jewellers operates 406 showrooms across India, the Middle East, and the United States, covering a retail area of over 1 million square feet. The company has a three-decade presence in the Indian market and is among the country’s largest jewellery retailers, known for its mix of traditional and modern designs.

Over the last three years, this stock has given multibagger returns of more than 660%.

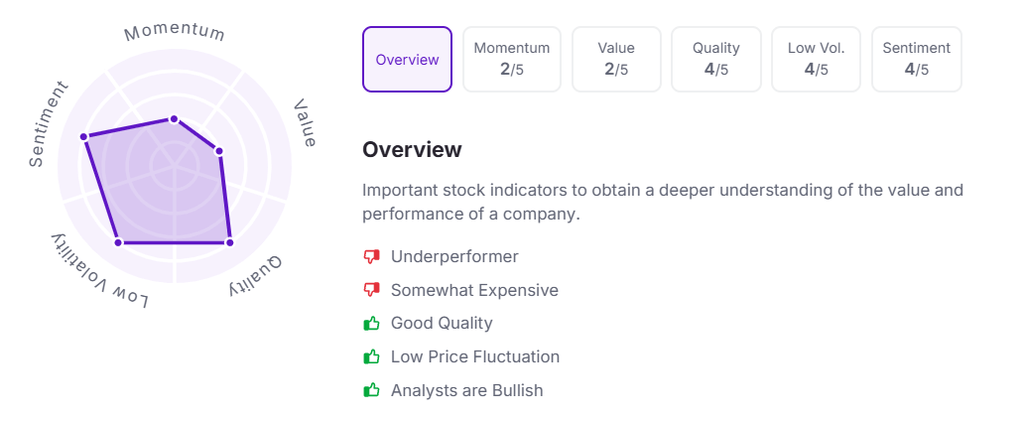

Let’s take a look at its Factor Analysis scores:

Note: The stock price mentioned is as of 12:58 pm.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.