- Share.Market

- 3 min read

- Published at : 08 Aug 2025 02:47 PM

- Modified at : 08 Aug 2025 02:47 PM

Shares of Kalpataru Projects International Ltd. surged up to 7%, reaching an intraday high of ₹1,209.00, after the company reported a strong set of results for Q1 FY26, marked by double-digit growth across all key financial metrics and improved operational efficiency.

Kalpataru Projects reported consolidated revenue of ₹6,171 crore, marking a 35% year-on-year growth, driven by healthy execution across its diversified portfolio of infrastructure and engineering projects. This is the company’s highest-ever first-quarter revenue.

Profit After Tax (PAT) for the quarter jumped 154% year-on-year to ₹214 crore, with PAT margin improving to 3.5% from 1.8% in Q1 FY25. The surge was attributed to operating leverage, disciplined execution, and better business mix.

Profit Before Tax (PBT) stood at ₹290 crore, a 112% increase over the same period last year. The PBT margin expanded by 170 basis points to 4.7%, highlighting efficiency gains across project verticals.

EBITDA rose 39% YoY to ₹525 crore, with EBITDA margin stable at 8.5%. Improved contribution from higher-margin segments and steady cost controls supported the performance.

On a standalone basis, revenue grew 35% to ₹5,040 crore, while PAT increased 72% to ₹201 crore. Standalone PBT margin expanded 100 bps to 5.4%, indicating consistent profitability improvement at the operating company level.

KPIL reported a 26% YoY reduction in consolidated net debt to ₹2,765 crore, while net working capital days improved by 12 days to 91 days. This reflects stronger cash flow management and project execution discipline.

The company’s consolidated order book stood at ₹65,475 crore as of June 30, 2025, up 14% YoY. So far in FY26, KPIL has secured fresh orders worth ₹9,899 crore, including ₹456 crore in the Buildings & Factories (B&F) segment in Q2.

KPIL continues to execute projects across 30+ countries, with a global presence in 75 countries. The company operates in power transmission and distribution, buildings and factories, water supply, oil & gas, railways, and urban infrastructure, maintaining a leadership position in multiple verticals.

Over the last three and five years, this stock has given multibagger returns of more than 215% and 415%, respectively.

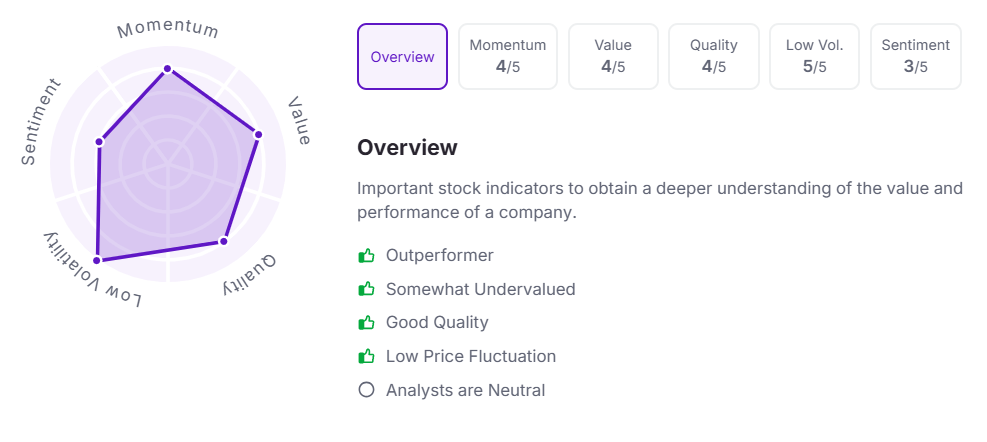

Let’s take a look at its Factor Analysis scores:

Note: The stock price mentioned is as of 2:46 pm.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.