- Share.Market

- 3 min read

- Published at : 11 Sep 2025 12:42 PM

- Modified at : 11 Sep 2025 12:49 PM

Shares of Jupiter Wagons Ltd. surged up to 7%, reaching an intraday high of ₹345.00 apiece, post the announcement that its material subsidiary, Jupiter Tatravagonka Railwheel Factory Private Limited, has received a Letter of Acceptance (LOA) from the Ministry of Railways, Railway Board.

The contract pertains to the supply of 9,000 LHB axles for FIAT-IR bogies, with a total order value of around ₹113 crore. This strengthens Jupiter Wagons’ position as a strategic supplier to the Indian Railways, coming shortly after its previous win for the supply of 5,376 wheelsets for Vande Bharat trains, valued at ₹215 crore.

The company highlighted that this development reflects the government’s increasing reliance on domestic players for critical rail components as part of India’s railway modernisation drive. The order will be executed by Jupiter Tatravagonka Railwheel Factory, which has emerged as a key partner in the axle and wheel segment.

About the Company

Jupiter Wagons Group is one of India’s most integrated railway engineering companies, engaged in manufacturing railway wagons, high-speed bogies, alloy steel castings, and components for passenger coaches, alongside a growing presence in commercial vehicle load bodies, ISO containers, and refrigerated containers. Through its subsidiary, Jupiter Electric Mobility Pvt. Ltd., the group has also forayed into commercial EVs, further diversifying its portfolio.

For Q1FY26, Jupiter Wagons reported consolidated revenue of ₹459.3 crore, down 47.8% YoY due to a shortage of wheelset supplies from Indian Railways. EBITDA fell 56.2% YoY to ₹59.8 crore in the same period last year. Profit after tax declined 66.2% to ₹31.1 crore.

Over the last three and five years, this stock has delivered multibagger returns of more than 315% and 1,990%, respectively.

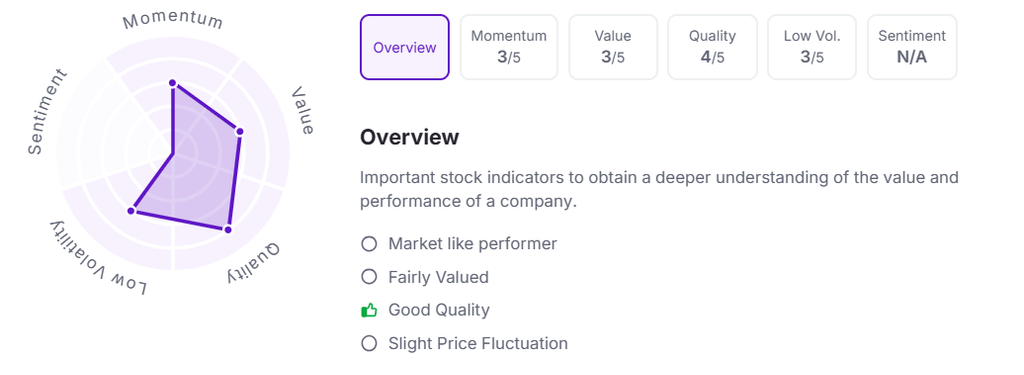

Let’s take a look at its Factor Analysis scores:

Note: The stock price mentioned is as of 12:38 pm.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.