- Share.Market

- 3 min read

- Published at : 09 Jun 2025 12:31 PM

- Modified at : 16 Jul 2025 08:01 PM

JSW Steel Ltd., India’s leading integrated steel manufacturer, reported a consolidated crude steel production of 22.73 lakh tonnes for May 2025, marking an 8% year-on-year (YoY) increase. The company’s year-to-date (YTD) production growth stood at 13%, reflecting continued momentum across its Indian and overseas operations.

Strong Performance in Indian Operations Despite Maintenance Shutdown

JSW’s Indian operations contributed 21.94 lakh tonnes to May’s production, up 9% YoY. The company reported 80% capacity utilisation for the month, impacted by a planned maintenance shutdown of one of the blast furnaces at its Dolvi facility. The furnace resumed operations on 30th May 2025, and production is expected to normalise in the coming weeks.

U.S. Operations Stable; Capacity Expansion on Track

JSW Steel USA – Ohio reported crude steel production of 0.79 lakh tonnes, slightly lower than last year’s 0.85 lakh tonnes. The total consolidated production for FY26 till May stood at 47.56 lakh tonnes, compared to 42.18 lakh tonnes in the same period last year.

JSW Steel currently has a consolidated crude steel capacity of 35.7 million tonnes per annum (MTPA), including 1.5 MTPA in the U.S. The company is executing its next phase of expansion to take total capacity to 43.4 MTPA over the next three years.

Outlook

With a solid production trajectory, aggressive capacity expansion, and strong focus on sustainability, JSW Steel is positioning itself as a global leader in the steel industry. Backed by operational resilience and technological edge, the company remains well-placed to meet rising domestic and international demand in the years ahead.

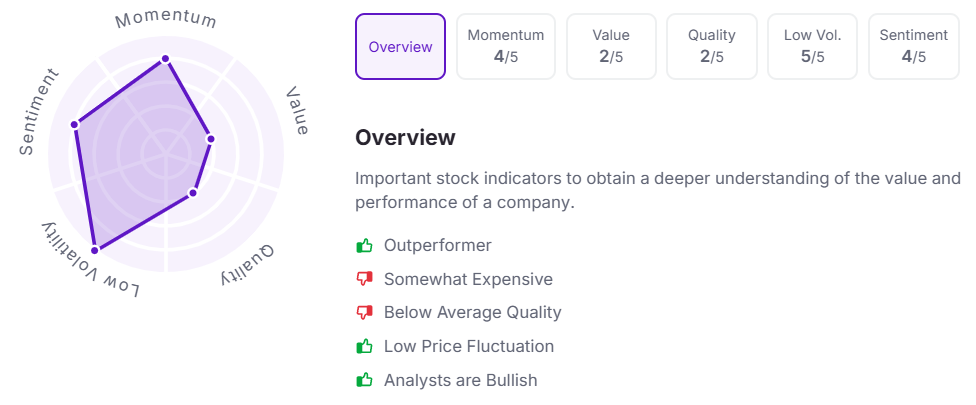

Let’s take a look at its Factor Analysis scores:

Note: The stock price mentioned is as of 12:25 PM.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.