- Share.Market

- 2 min read

- Published at : 10 Oct 2025 02:43 PM

- Modified at : 15 Nov 2025 11:23 AM

JSW Steel Ltd. reported its highest-ever quarterly Consolidated Crude Steel Production of 7.90 million tonnes for the second quarter of the financial year 2026 (Q2 FY26). This record output represents a significant increase, rising 17% year-on-year (YoY) and 9% quarter-on-quarter (QoQ). The growth was primarily driven by the strength of the company’s domestic facilities.

The strong performance was supported by high efficiency across its domestic network, with capacity utilisation at Indian Operations standing at an impressive 92% for the quarter. A key driver of the overall production jump was the full commissioning of integrated capacity at a wholly-owned subsidiary. JVML commissioned its second converter on August 30, 2025, which made the overall Indian crude steel capacity of 34.2 million tonnes per annum (MTPA) fully operational. The new 5 MTPA operations at JVML ramped up effectively, achieving 88% capacity utilisation in September 2025.

The company is simultaneously working to secure future production capabilities through strategic upgrades. Toward the end of September 2025, JSW Steel initiated a planned 150-day shutdown of Blast Furnace 3 at Vijayanagar to upgrade its hot metal capacity. This is an investment in future output, aiming to boost the capacity from 3 MTPA to 4.5 MTPA. For the first half of the financial year (H1 FY26), the consolidated production reached 15.16 million tonnes, reflecting a robust 16% YoY increase, underscoring the company’s sustained growth momentum.

Over the last five years this stock has delivered mutlibagger returns of more than 295%.

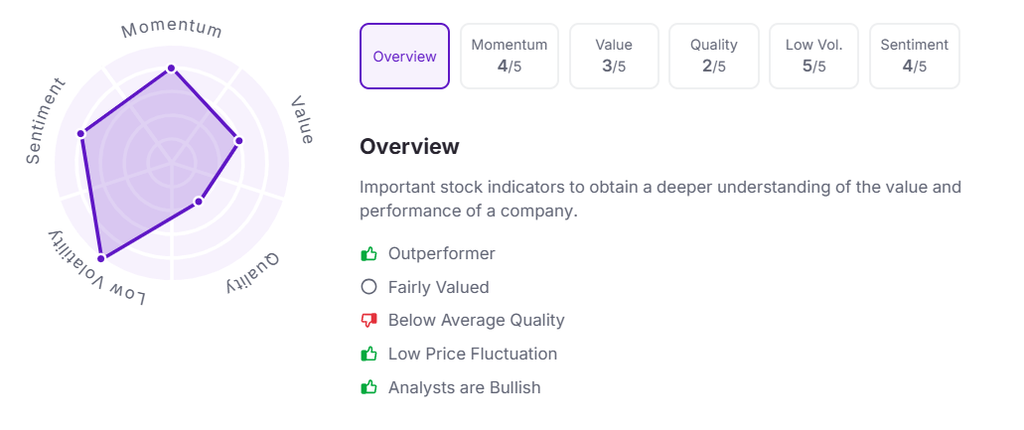

Let’s take a look at its Factor Analysis scores:

Note: The stock price mentioned is as of 2:40 pm.