- Share.Market

- 2 min read

- Published at : 12 Aug 2025 01:09 PM

- Modified at : 12 Aug 2025 03:37 PM

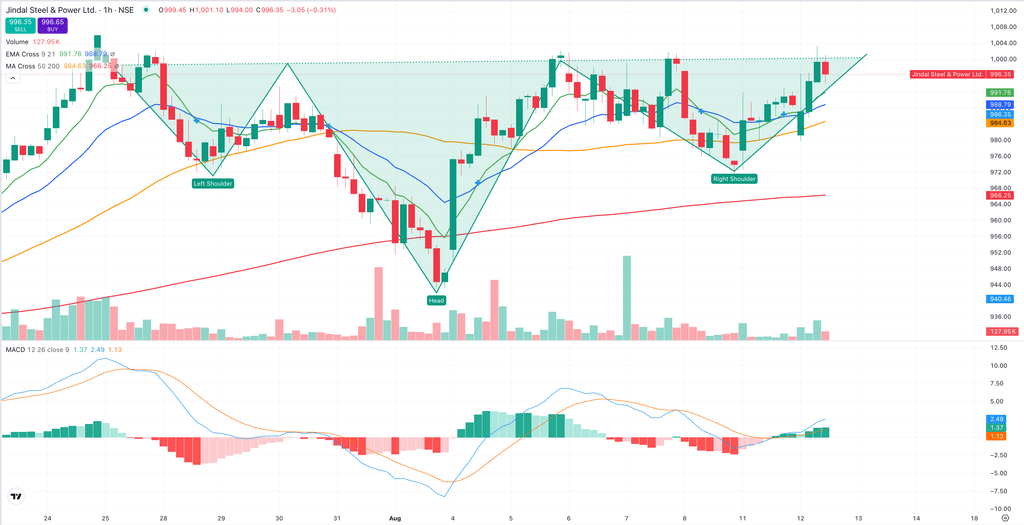

Jindal Steel & Power Ltd. (CMP: ₹994, SL: 915) is showing promising technical strength, with an Inverse Head and Shoulders formation emerging on the hourly chart — a widely tracked bullish reversal pattern. The setup, which often precedes an uptrend, is being reinforced by a rising MACD line, signaling improving upward momentum.

The immediate hurdle lies at ₹1,000, where a breakout supported by strong volumes could trigger further upside. On the downside, ₹970 serves as immediate support, with a stop loss pegged at ₹915 to safeguard against sharp reversals.

While price action has been firm, analysts note that volume contraction could delay a decisive move, making a volume surge a key confirmation signal. For active traders, sustained trade above ₹970 and a clear breach of ₹1000 could open the door for short-term gains.

Note: Charts and prices are as of 12:30 PM.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887 and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.