- Share.Market

- 3 min read

- Published at : 10 Jun 2025 12:11 PM

- Modified at : 04 Dec 2025 07:28 AM

Shares of Jindal Saw Ltd., surged after the company approved three major international investment proposals to expand its presence in the Middle East’s oil, gas, and infrastructure sectors. The stock reached an intraday high of ₹257.00.

Step-Down Subsidiary in UAE

The first major move involves the incorporation of a step-down subsidiary in the United Arab Emirates. Jindal Saw plans to invest up to USD 105 million to set up a 300,000 TPA seamless pipe manufacturing facility in Abu Dhabi. The plant will primarily cater to the oil and gas sector in the MENA region, aligning with the company’s strategy to strengthen its supply base closer to key global energy markets. The project is expected to be completed in about three years, subject to regulatory approvals.

Two Joint Ventures in Saudi Arabia

In a strategic expansion into Saudi Arabia, Jindal Saw’s wholly-owned subsidiary, Jindal Saw Holdings FZE (JSH), will enter into two joint venture agreements.

The first JV will be with BUHUR FOR INVESTMENT COMPANY LLC, to incorporate a new company in KSA that will set up a Helically Spiral Welded (HSAW) pipe manufacturing facility. The estimated investment is up to USD 10 million, with Jindal Saw holding a 51% stake in the venture. The facility is expected to be operational within two years.

The second JV is with RAX United Industrial Company to establish a ductile iron pipe project in KSA, with a capital outlay of up to USD 3 million and a similar 51% equity holding. This project is expected to come online within 12–18 months.

Strategic Rationale

All three projects are squarely within Jindal Saw’s core business of iron and steel pipe manufacturing and are intended to deepen its market penetration in the MENA region, which has seen steady infrastructure investments and energy sector expansion. These moves will enable the company to serve regional demand more efficiently and tap into large-scale pipeline projects linked to oil, gas, water, and sanitation infrastructure.

Over the last three years, this stock has given multibagger returns of more than 480%.

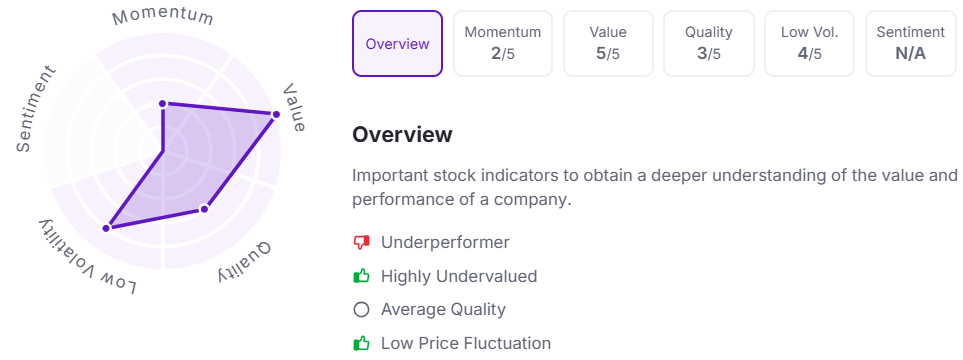

Let’s take a look at its Factor Analysis scores:

Note: The stock price mentioned is as of 12:10 PM.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.