- Share.Market

- 2 min read

- Published at : 02 Jan 2026 02:14 PM

- Modified at : 16 Jan 2026 01:51 AM

MCX’ shares appeared to “drop” 80% on Tuesday. However, this isn’t a crash. It’s a 1:5 stock split.

The company reduced its face value from ₹10 to ₹2, therefore, if one held 100 shares before the split, they will now hold 500 shares. While the number of shares has increased, their total investment will remain the same, as the price of each share has also reduced to ₹2,200.

The number of shares in one’s demat has multiplied by five, while the price has been divided by five. The total ownership in the company remains exactly the same.

Why did MCX’ shares undergo a split?

Following stellar Q1 FY26 results, MCX utilized the split to:

Boost Participation: Lowering the entry barrier by reducing the price per share encourages more retail investors to invest, who were previously priced out.

Enhance Liquidity: Higher volumes often lead to tighter bid-ask spreads, benefiting active traders.

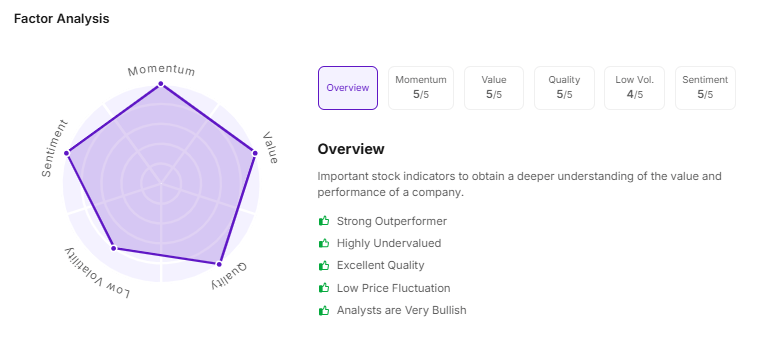

Let’s take a look at the company’s Factor Analysis:

For F&O Traders, the transition is value neutral: the lot size multiplies by five while the strike prices are divided by five.The real win here is liquidity — tighter spreads and easier entries/exits

| Variable | Adjustment Logic | Result |

| Strike Price | Old Price÷5 | Reduced by 80% |

| Market Lot | Old Lot×5 | Increased by 400% |

| Position Value | (P/5)×(L×5) | Remains Identical |