- Share.Market

- 3 min read

- Published at : 11 Jun 2025 03:09 PM

- Modified at : 16 Jul 2025 08:08 PM

Shares of Indian Renewable Energy Development Agency Ltd. surged over 2% after raising ₹2,005.90 crore through a Qualified Institutions Placement (QIP). The capital was mobilized by issuing 12.15 crore equity shares at ₹165.14 each, comprising a face value of ₹10 and a premium of ₹155.14 per share.

The issue price reflected a 5% discount to the floor price of ₹173.83 and saw strong interest from a broad spectrum of qualified institutional buyers (QIBs), including insurance firms, foreign portfolio investors (FPIs), and scheduled commercial banks. The QIP, launched on June 5 and closed on June 10, was oversubscribed with bids amounting to ₹2,005.90 crore, 1.34 times the base issue size of ₹1,500 crore.

In a meeting held on June 11, 2025, the Board approved the allotment of equity shares to eligible institutional investors. The funds raised will strengthen IREDA’s Tier-I capital and enhance its Capital Adequacy Ratio (CAR), enabling the company to significantly scale up its lending capacity to renewable energy and energy efficiency projects across the country.

Over the last three years, IREDA has given multibagger returns of more than 465%.

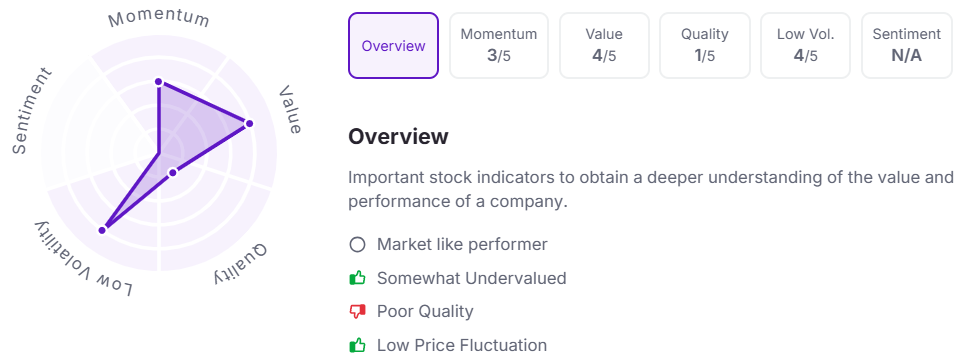

Let’s take a look at its factor analysis scores:

About IREDA

Indian Renewable Energy Development Agency Limited (IREDA) is a ‘Navratna’ Government of India Enterprise operating under the Ministry of New and Renewable Energy (MNRE). Established in 1987 as a Non-Banking Financial Institution (NBFI), IREDA is dedicated to promoting, developing, and financing projects in the renewable energy and energy efficiency sectors. With the guiding motto “Energy for Ever,” IREDA plays a pivotal role in accelerating India’s transition to clean and sustainable energy.

IREDA’s mission is to be a pioneering, participant-friendly institution that fosters self-sustaining investments in green energy technologies. The agency provides financial support for electricity generation through renewable sources and energy conservation initiatives, while also continuously improving its systems and customer services to remain competitive in a dynamic energy landscape.

Note: The stock price mentioned is as of 2:40 PM.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.