- Share.Market

- 2 min read

- Published at : 16 Jan 2026 12:53 PM

- Modified at : 16 Jan 2026 02:07 PM

IT services behemoth Infosys’ share price surged nearly 6% on Friday, after the company reported better-than-expected revenue numbers amid a cautious demand environment, boosting investor confidence.

At 12:00 PM, the company’s shares were trading at ₹1,688.90 apiece, up 5.57%.

Q3FY26 (October- December Quarter) Results

Infosys’ revenue from operations grew 8.89% to ₹45,479 crore in the latest quarter, compared to ₹41,764 crore in the corresponding quarter of the previous year (Q3 FY25).

It’s net profit declined 2.2% to ₹6,654 crore, compared to ₹6,806 crore reported in Q3FY25.

Large deal wins stood at $4.8 billion during the quarter, a sharp jump from $3.1 billion in the previous quarter, including two mega deals, supporting medium-term revenue visibility. Around 57% of these deals were classified as net new, indicating fresh business additions.

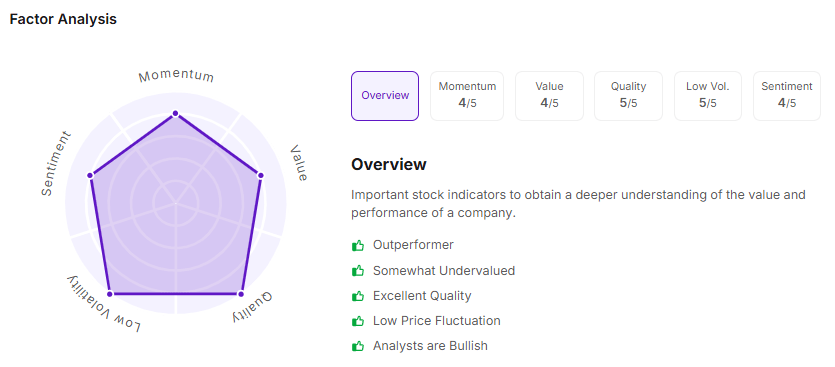

Factor Analysis of Infosys

Revenue Growth Guidance

Infosys raised its revenue growth guidance to 3-3.5% in constant currency terms, on the basis of improving demand visibility and strong execution.

The deal pipeline was supported by a large contract win from NHS UK. Strong deal activity is often seen as an early sign of demand recovery.

The company added 11,246 employees over the last two quarters, signalling confidence in future growth and execution.

Jump in ADRs

Infosys‘ American Depository Receipts jumped about 8% in two sessions signalling positive offshore investor response. This helped in lifting investor sentiment around the stock in Indian markets as well.