- Share.Market

- 5 min read

- Published at : 13 Nov 2025 12:25 PM

- Modified at : 15 Nov 2025 09:33 AM

The shares of Infosys, Oil and Natural Gas Corporation, National Aluminium Company, Bayer CropScience, and Nava are set for their record date on Friday, November 14, 2025. To be eligible for the upcoming buyback and dividends, investors must have bought the shares before the ex-date and hold them at least till the record date.

The IT company has announced a buyback of up to 10 crore equity shares (2.41% of total paid-up capital) at a fixed price of ₹1,800 per share.

The buyback price of ₹1,800 represents a 15.93% premium over the current trading price of ₹1,552.60 as of 1:03 pm.

Unlike previous buybacks, this will be executed via the tender offer route, where the company buys shares directly from shareholders, as new regulations prohibit open-market buybacks.

For the second quarter of Fiscal Year 2026, Infosys Ltd. reported Revenue from Operations of ₹44,490 crore, reflecting an increase of over 8.6% compared to Q2 FY25. The Profit After Tax (PAT) for the quarter was ₹7,375 crore , an increase of over 13.2% compared to Q2 FY25.

Over the last five years, this stock has given multibagger returns of more than 225%.

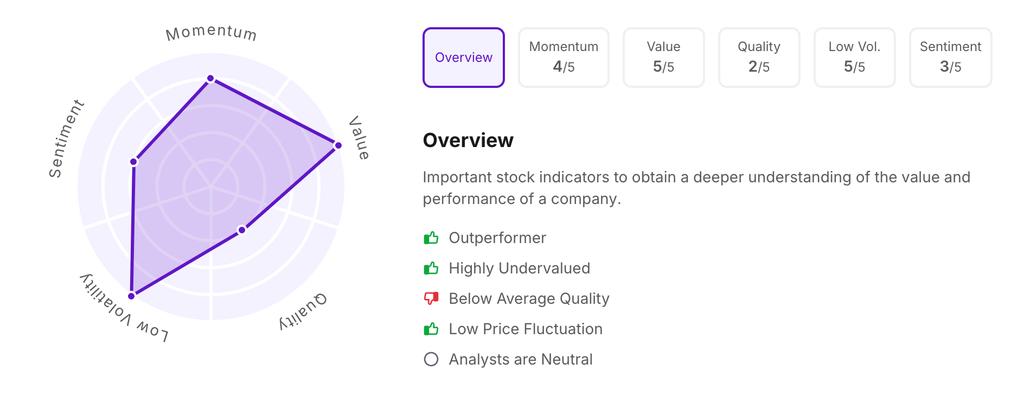

Let’s take a look at its Factor Analysis scores:

The maharatna oil and natural gas company has announced an interim dividend of ₹6 per equity share. It has a high dividend yield of 4.90% TTM.

For Q2 FY26, Oil And Natural Gas Corporation Ltd. reported Gross Revenues of ₹1,57,911 crore, falling 1% year-on-year. The company reported Profit After Tax of ₹12,615 crores, up 28.2% from Q2FY25.

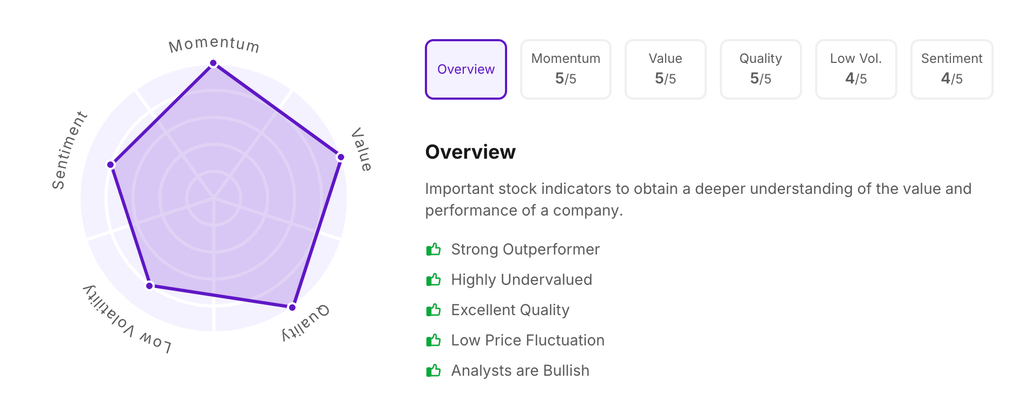

Let’s take a look at its Factor Analysis scores:

The leading aluminium producing company has announced an interim dividend of ₹4 per equity share. It has a high dividend yield of 3.90% TTM.

For the Q2FY26, National Aluminium Company Ltd. reported Total income at ₹4,292 crore, up 7%, and Profit after tax at ₹2,497 crore, down 50.15%. NALCO also achieved its best-ever half-year production in FY 2025–26 for Alumina Hydrate (11,53,000 MT), Calcined Alumina, and Aluminium Cast Metal (2,34,148 MT).

Over the last five years, this stock has given multibagger returns of more than 670%.

Let’s take a look at its Factor Analysis scores:

The shipping company has announced an interim dividend of ₹90 per equity share. It has a dividend yield of 2.70% TTM.

For the Q2FY26, Bayer Cropscience Ltd. reported Total income at ₹1,553.4 crore, down 10.6%, and Profit after tax at ₹152.7 crore, up 12%.

Over the last five years, this stock has given multibagger returns of more than 395%.

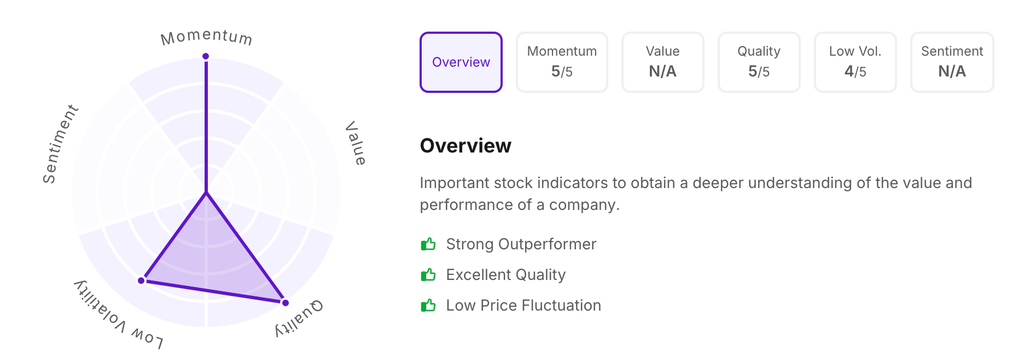

Let’s take a look at its Factor Analysis scores:

The shipping company has announced an interim dividend of ₹3 per equity share. It has a dividend yield of 1.10% TTM.

For the Q2FY26, NAVA Ltd. reported Revenue from Operations at ₹963.73 crore, up 7%, and Profit after tax at ₹177.49 crore, down 46.53%.

Over the last five years, this stock has given multibagger returns of more than 2,115%.

Let’s take a look at its Factor Analysis scores:

Note: The stock prices mentioned are as of 12:20 pm.