- Share.Market

- 6 min read

- Published at : 29 May 2025 04:12 PM

- Modified at : 16 Jul 2025 07:51 PM

The shares of Angel One, Bajaj Finance, Caplin Point Laboratories, GlaxoSmithKline Pharmaceuticals, and Infosys are set for their record date on Friday, May 30, 2025. To be eligible for the upcoming dividends, investors must have bought the shares before the ex-date and hold them at least till the record date.

Angel One Ltd

Angel One Ltd., a full-service retail broker, has announced a final dividend of ₹26 per equity share. Its current dividend yield is 0.70%.

The company had previously announced interim dividends of ₹11 per equity share on 20 March 2025 and 21 January 2025.

Angel One began as a traditional stockbroking firm in 1996, driven by a strong focus on customer needs. Over time, the company embraced technology to enhance client experiences, eventually transforming into a digital-first platform in 2019. By offering end-to-end digital investment solutions through a single app, Angel One expanded its reach across India, including tier-2 and tier-3 cities.

Over the last three years, this stock has given multibagger returns of more than 125%.

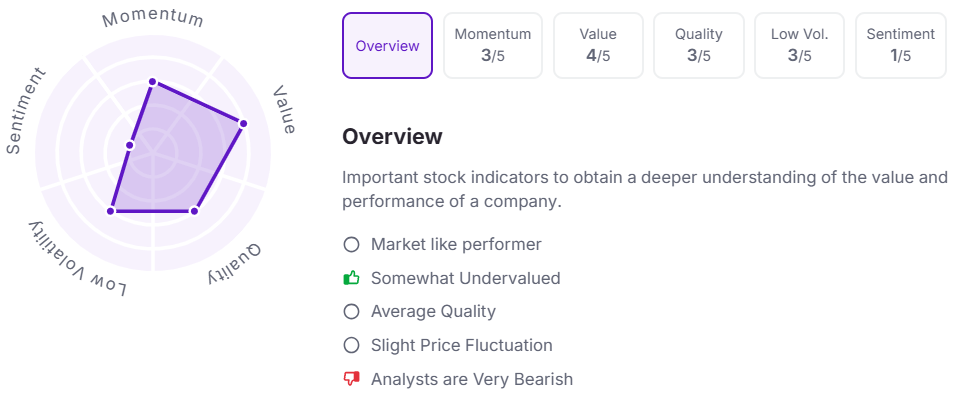

Let’s take a look at its Factor Analysis scores:

Bajaj Finance Ltd

Bajaj Finance Ltd., a leading NBFC, has announced a final dividend of ₹44 per equity share. Its current dividend yield is 0.50%.

The company had previously announced a special dividend of ₹12 per equity share on 09 May 2025 and a final dividend of ₹36 per equity share on 21 June 2024.

Bajaj Finance offers a broad range of financial products, including consumer, SME, rural, and commercial loans, deposits, and payments. Known for its innovation and omnichannel approach, Bajaj Finance is rapidly evolving into a digital-first, AI-powered financial powerhouse focused on delivering seamless customer experiences across India’s mass affluent and middle-class segments.

The company posted strong results for FY25, with AUM rising 26% year-on-year and profit after tax growing 16% to. It added 18.18 million new customers during the year and surpassed the 100 million customer milestone.

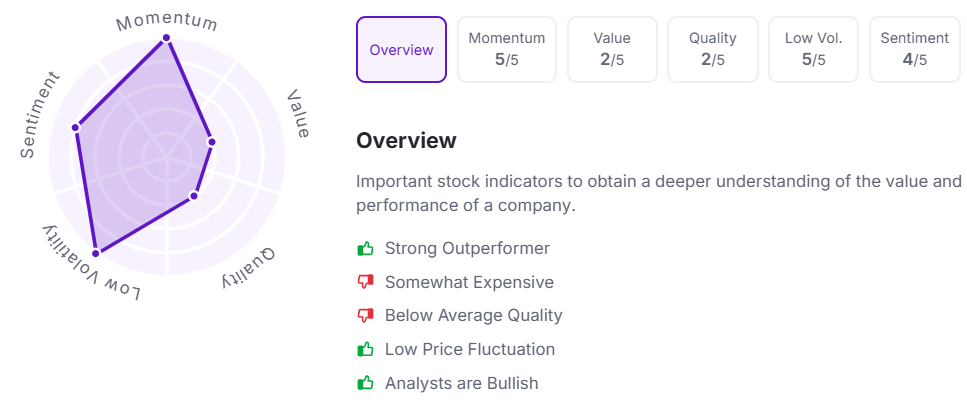

Let’s take a look at its Factor Analysis scores:

Caplin Point Laboratories Ltd

Caplin Point Laboratories Ltd., a pharmaceutical company, has announced a dividend of ₹3 per equity share. Its current dividend yield is 0.50%.

The company had previously announced a final dividend of ₹2.50 per equity share on 23 September 2024 and an interim dividend of ₹2.50 on 31 May 2024.

Caplin Point Laboratories is a mid-sized Indian pharmaceutical company with a unique presence across the pharma value chain. It operates in finished formulations, APIs, clinical research, and branded generics, with a strong market presence in Latin America, Francophone Africa, and the US. The company’s strategic focus on backward integration, R&D investment, and a balanced model of in-house and outsourced manufacturing has positioned it as a lean, debt-free, and cash-rich player.

Caplin closed FY25 with consistent growth in revenue, profit, and cash flows, supported by a strong product pipeline and expanded global footprint. Growth was led by emerging markets, where branded generics and new launches in oncology, softgels, and injectables performed well. With robust profitability metrics and a cash surplus position, Caplin is positioning itself as a fully integrated global pharma player.

Over the last three years, this stock has given multibagger returns of more than 190%.

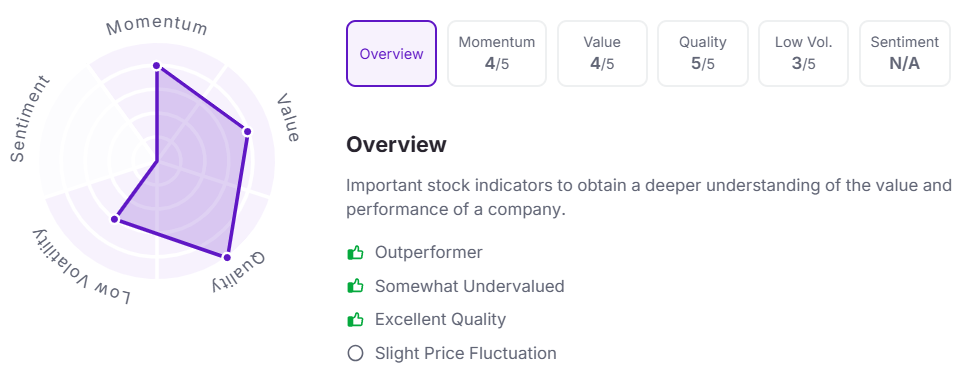

Let’s take a look at its Factor Analysis scores:

GlaxoSmithKline Pharmaceuticals Ltd

GlaxoSmithKline Pharmaceuticals Ltd., a British multinational pharmaceutical and biotechnology company, has announced a final dividend of ₹42 per equity share. Its current dividend yield is 1.30%.

The company had previously announced an interim dividend of ₹12 per equity share on 07 November 2024 and a final dividend of ₹32 per equity share on 31 May 2024.

GlaxoSmithKline Pharmaceuticals (GSK) is one of the country’s oldest and most established pharmaceutical companies, with a strong legacy in prescription medicines and vaccines. A subsidiary of global healthcare leader GSK plc, the Indian arm is focused on therapeutic areas such as respiratory, anti-infectives, dermatology, and oncology, alongside a growing portfolio of vaccines.

The company delivered steady performance in Q1CY25, supported by strong momentum in its priority brands and continued focus on operational efficiency. Respiratory portfolio and dermatology products showed healthy growth, while vaccines remained a key contributor with rising demand for travel and pediatric immunization.

Over the last three years, this stock has given multibagger returns of more than 110%.

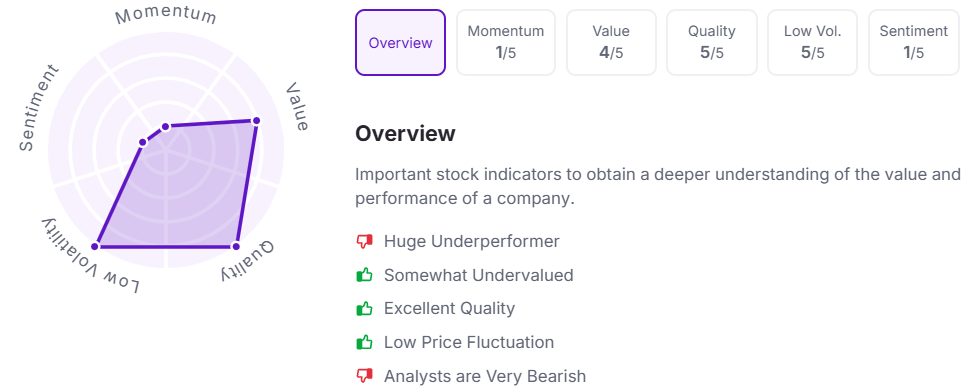

Let’s take a look at its Factor Analysis scores:

Infosys Ltd

Infosys Ltd., a global leader in digital services and consulting, has announced a final dividend of ₹22 per equity share. Its current dividend yield is 3.10%.

The company had previously announced an interim dividend of ₹21 per equity share on 29 October 2024, a final dividend of ₹20 per equity share on 31 May 2024, and a special dividend of ₹8 per equity share on 31 May 2024.

With over four decades of experience and more than 300,000 employees, Infosys leverages AI, cloud, and next-gen technologies to deliver agile, scalable, and efficient solutions across industries. Its services span across digital transformation, application development, IT infrastructure, data analytics, and enterprise consulting, serving some of the world’s largest businesses.

Infosys reported a resilient performance in FY25, achieving 4.2% revenue growth in constant currency and expanding its operating margin to 21.1%. Large deal wins stood at $11.6 billion for the year, with over half being net new. The company continued to strengthen its AI and cloud capabilities and expanded strategic collaborations with global clients across banking, manufacturing, aviation, and healthcare.

Let’s take a look at its Factor Analysis scores:

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.