- Share.Market

- 6 min read

- Published at : 12 Aug 2025 12:06 PM

- Modified at : 12 Aug 2025 12:58 PM

The shares of InterGlobe Aviation, Pidilite Industries, Godrej Consumer Products, Hitachi Energy India, and Page Industries are set for their record date on Wednesday, August 13, 2025. To be eligible for the upcoming dividends, investors must have bought the shares before the ex-date and hold them at least till the record date.

InterGlobe Aviation Ltd. has announced a final dividend of ₹10 per equity share.

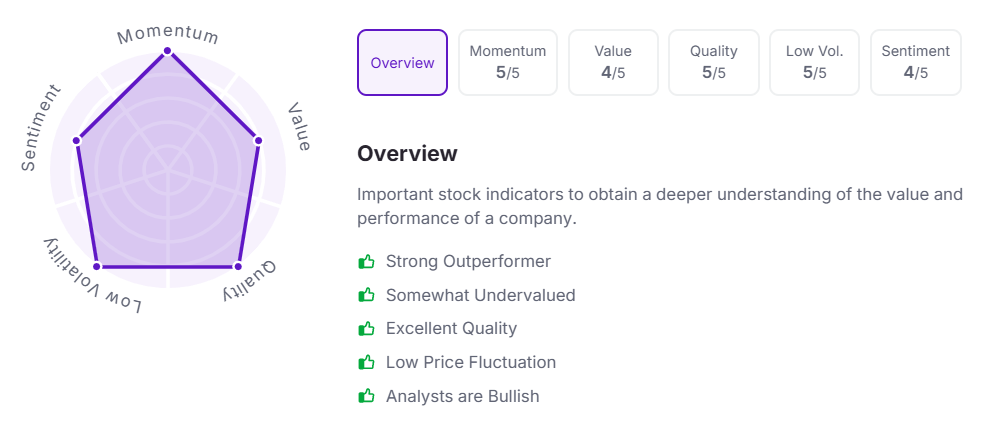

IndiGo, India’s largest passenger airline and one of the fastest-growing carriers globally, operates a fleet of over 400 aircraft, serving 130+ destinations, including 40+ international routes. In Q1FY26, the airline reported a 6.4% year-on-year growth in total income to ₹215,426 crores, driven by a 4.7% rise in revenue from operations and a 54.3% jump in other income.

Over the last three and five years, this stock has given multibagger returns of more than 190% and 525%, respectively.

Let’s take a look at its Factor Analysis scores:

Pidilite Industries Ltd. has announced a special dividend of ₹10 per equity share. It has a current dividend yield of 0.60% TTM.

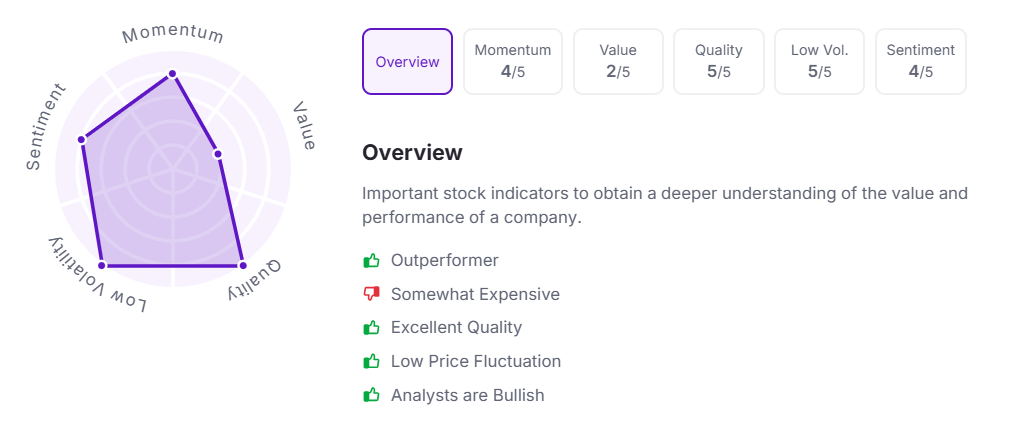

Pidilite Industries, a leading name in adhesives, waterproofing solutions, and construction chemicals, has built a strong presence in both domestic and international markets with a portfolio of over 25 brands and a network of 68 manufacturing units in India. For Q1FY26, the company reported revenue from operations of ₹3,753.10 crores, up from ₹3,395.35 crores in the year-ago quarter, while other income rose to ₹85.71 crores from ₹53.94 crores, taking total income to ₹3,838.81 crores compared to ₹3,449.29 crores a year earlier.

Over the last five years, this stock has given multibagger returns of more than 120%.

Let’s take a look at its Factor Analysis scores:

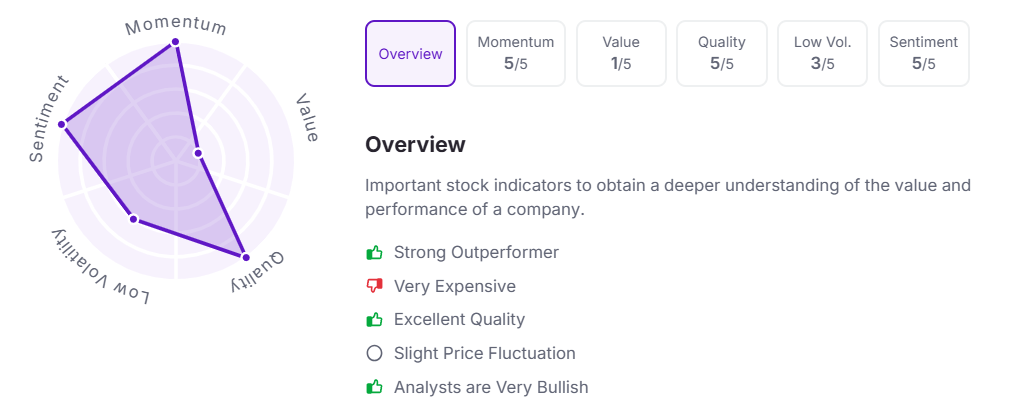

Godrej Consumer Products Ltd. has announced an interim dividend of ₹5 per equity share. It has a dividend yield of 1.70%.

Godrej Consumer Products Limited (GCPL), a leading emerging markets FMCG company with a strong presence in household insecticides, hair care, soaps, and air fresheners, serves over 1.4 billion consumers globally and operates across India, Indonesia, Africa, Latin America, and other regions. In Q1FY26, consolidated sales grew 10% year-on-year in INR terms, driven by an 8% underlying volume growth, with strong performance in Africa, USA, and the Middle East offsetting softness in Indonesia.

Let’s take a look at its Factor Analysis scores:

Hitachi Energy India Ltd. has announced a final dividend of ₹5 per equity share.

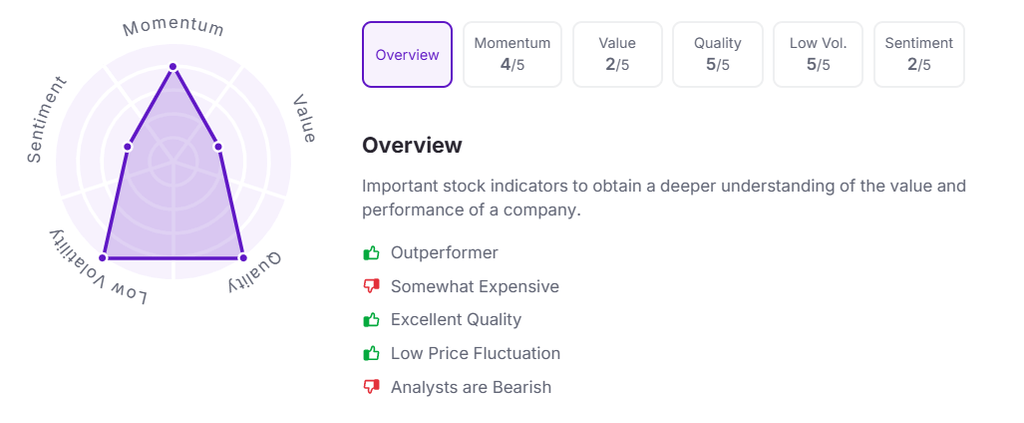

Hitachi Energy India Limited, the domestic arm of the global technology leader in electrification and power grid solutions, serves utilities, industry, transportation, and infrastructure sectors with advanced products and systems to support the energy transition. In Q1FY26, the company reported a sharp 365.4% year-on-year surge in orders to ₹11,339.2 crore, driven by large project wins, taking its order backlog to a record ₹29,125.3 crore.

Over the last three and five years, this stock has given multibagger returns of more than 545% and 2,160%, respectively.

Let’s take a look at its Factor Analysis scores:

Page Industries Ltd. has announced a final dividend of ₹5 per equity share.

Page Industries Limited, the exclusive licensee of Jockey and Speedo in India and several international markets, is a market leader in premium innerwear, leisurewear, and swimwear with an extensive retail and online presence across thousands of outlets and exclusive brand stores. In Q1FY26, the company reported revenue of ₹13,166 million, up 3.1% year-on-year, supported by a 1.9% growth in sales volumes to 58.6 million pieces. Profit after tax increased 21.5% to ₹2,008 million, aided by product innovation, process automation, and cost efficiency measures.

Over the last five years, this stock has given multibagger returns of more than 135%.

Let’s take a look at its Factor Analysis scores:

Note: The stock prices mentioned are as of 12:00 pm.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.