- Share.Market

- 5 min read

- Published at : 07 Aug 2025 12:25 PM

- Modified at : 07 Aug 2025 12:25 PM

The shares of Indian Oil Corporation , ABB India Ltd, Hindalco Industries, and Mankind Pharma are set for their record date on Friday, August 8, 2025. To be eligible for the upcoming dividends, investors must have bought the shares before the ex-date and hold them at least till the record date.

Indian Oil Corporation Ltd. has announced a final dividend of ₹3 per equity share.

Indian Oil is India’s flagship integrated energy company, operating across refining, marketing, petrochemicals, and alternative energy. Known for its scale, innovation, and commitment to quality, it plays a pivotal role in meeting the nation’s energy needs. In its latest results, IndianOil reported total income of ₹2.25 lakh crore and a net profit of ₹7,419 crore, reflecting strong operational performance despite a challenging environment.

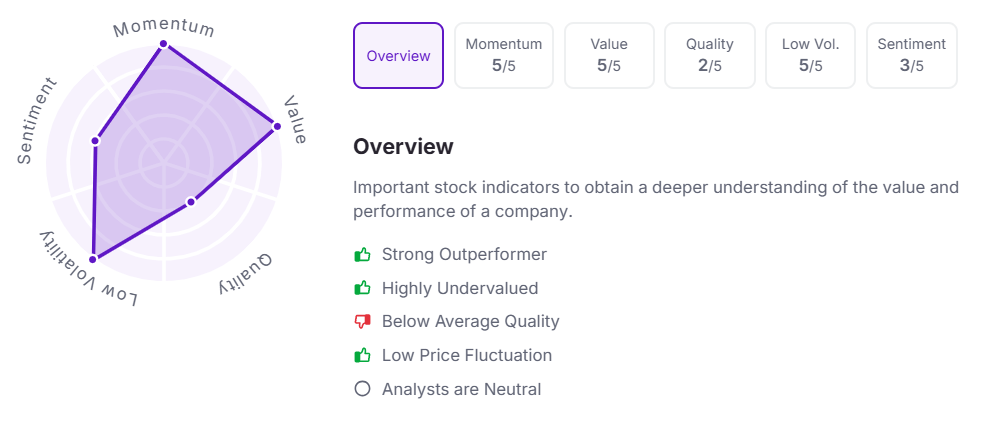

Let’s take a look at its Factor Analysis scores:

ABB India Ltd. has announced an interim dividend of ₹9.77 per equity share. Its current dividend yield is 0.90%.

ABB is a global leader in electrification and automation, driving sustainable industrial transformation through advanced engineering and digital technologies. With a legacy of over 140 years and around 110,000 employees, ABB enables resource-efficient operations across sectors. In Q2 2025, the company achieved record-high orders of $9.8 billion (up 16% YoY) and revenue of $8.9 billion (up 8% YoY), supported by broad-based demand and strong execution.

Over the last three years, this stock has delivered multibagger returns of more than 190%.

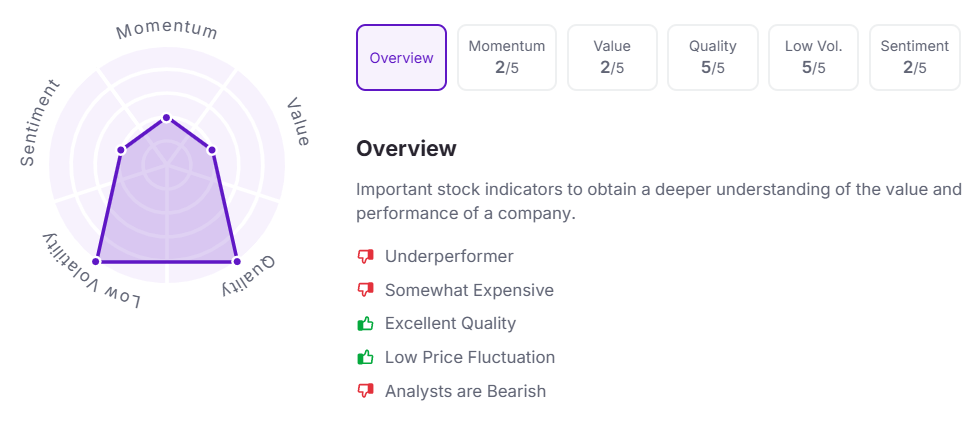

Let’s take a look at its Factor Analysis scores:

Hindalco Industries Ltd. has announced a final dividend of ₹5 per equity share. Its current dividend yield is 0.50%.

Hindalco Industries, the metals flagship of the Aditya Birla Group, is a USD 28 billion global leader in aluminium and copper, with integrated operations across 10 countries and 52 manufacturing locations. Through its subsidiary Novelis, it leads the world in flat-rolled aluminium products.

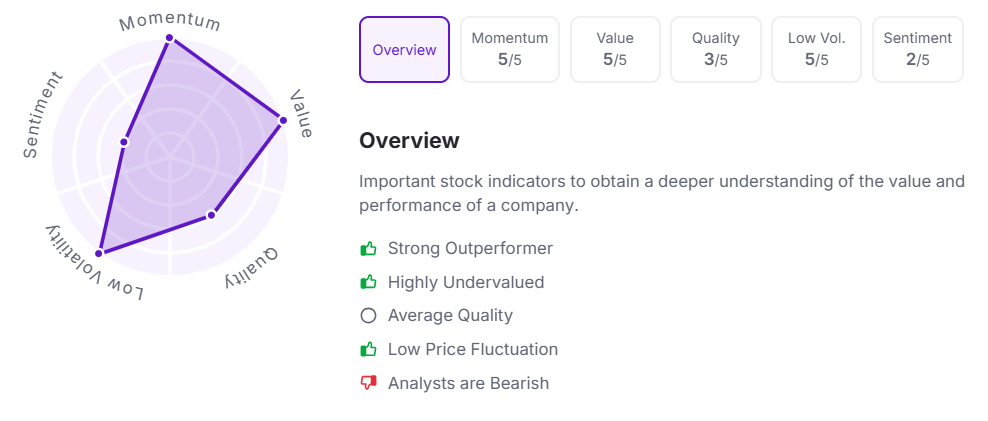

Let’s take a look at its Factor Analysis scores:

Mankind Pharma Ltd. has announced an interim dividend of ₹1 per equity share.

Mankind Pharma, India’s fourth-largest pharmaceutical company, continues to drive its mission of affordability, quality, and accessibility through strong in-house R&D and manufacturing. In Q1FY26, revenue rose 24.5% YoY to ₹3,570 crore, with EBITDA margin at 23.8%. Domestic revenue grew 18.9% on the back of steady base business and BSV consolidation, while exports surged 81.1%. The company outperformed the Indian pharma market (IPM) across chronic, respiratory, and anti-infective segments, maintaining its #1 prescription rank for the 8th straight year.

Over the last three years, this stock has delivered multibagger returns of more than 133%.

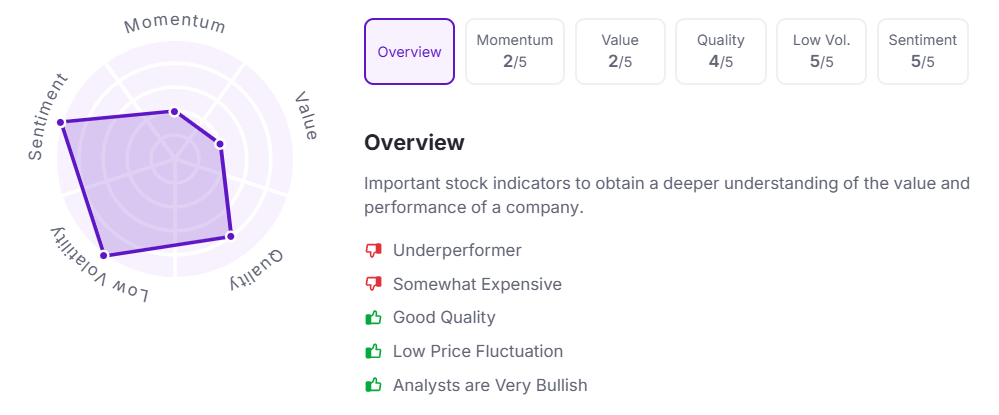

Let’s take a look at its Factor Analysis scores:

Note: The stock prices mentioned are as of 12:20 pm.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.